Overview

On June 3, 2025, President Trump issued a proclamation doubling the Section 232 tariffs on steel and aluminum, as well as covered derivative products, from 25% to 50%, effective June 4, 2025. President Trump had first announced this tariff increase on May 30, 2025, when speaking at a rally at US Steel. US Customs has also released guidance on steel and aluminum imports. Key points from the proclamation and related guidance are set forth below.

Rate Increase:

- The tariff rate applied to both steel and aluminum products (and designated derivatives) from all countries, except the United Kingdom, increased from 25% to 50%.

- As a result of the "US-UK Economic Prosperity Deal" announced on May 8, 2025, the duty on steel and aluminum imports from the UK will remain at 25% until July 9, 2025. At that point, the tariff level may be modified. The proclamation notes that the rate may be increased to 50% if the US decides that the UK is not abiding by the deal.

- The proclamation keeps in place certain exceptions regarding derivative steel and aluminum products where the primary aluminum or primary steel was smelted/cast or melted/poured in the United States.

- The 200% tariff on aluminum from Russia is still in effect.

- There is no exemption for goods on the water; all good entered for consumption or withdrawn from warehouse on or after June 4, 2025, are subject to the increased duties.

- Duty drawback continues not to be allowed for Section 232 tariffs.

Distinction Between Steel/Aluminum and Non-Steel/Aluminum Content:

The proclamation also adjusts the Section 232 tariff measures so that this 50% rate will be imposed on the value of the aluminum or steel content of a particular good. This approach had previously only been applied to certain derivative products, with the tariff assessed on the full value of the imported product.

- The steel and aluminum content will not be subject to the so-called "reciprocal tariffs," which have recently been subject to legal challenge.

- The non-steel/aluminum content will not be subject to the 50% tariff but will be subject to reciprocal tariff rates and other applicable duties.

- If the value of the steel/aluminum content is unknown, the 50% tariff applies to the entire entered value of the imported product.

- For derivative products subject to both the aluminum and steel tariffs, duties will be owed on both the value of the aluminum and steel content of that product.

Tariff Stacking Changes:

The proclamation amends Executive Order 14289 which prevented the cumulative "stacking" of certain tariff actions. Originally under that action, goods subject to the International Emergency Economic Powers Act (IEEPA) tariffs on Canadian and Mexican imports would not be subject to the Section 232 tariffs on steel and aluminum. This proclamation reverses that and first imposes the higher 50% steel and aluminum tariff on Canadian/Mexican imports, but exempts them from the IEEPA tariff.

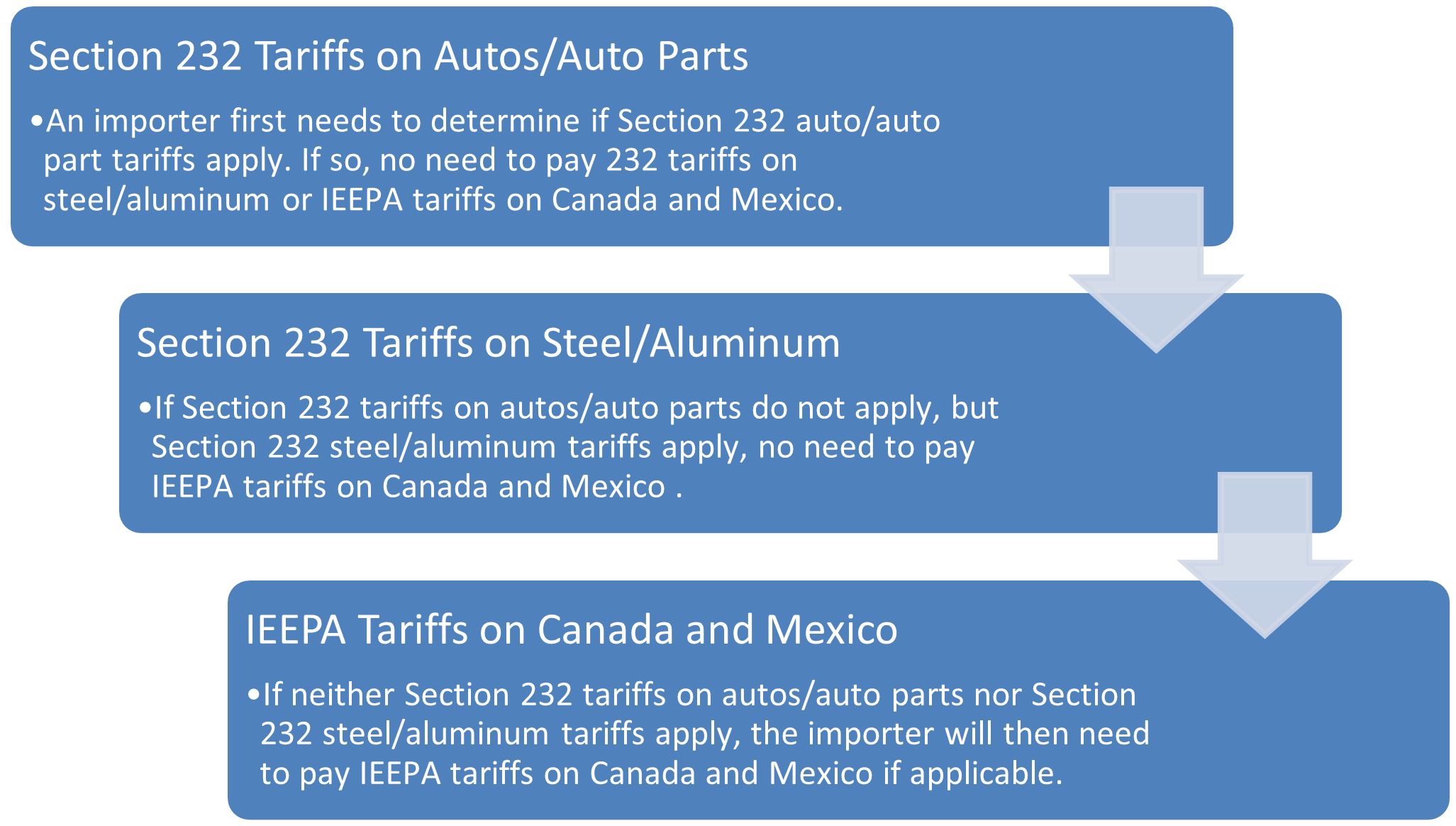

CBP has subsequently issued a bulletin, laying out the priority order of the various tariffs for goods that are subject to several tariff actions. As shown in the diagram below, the priority order is now: (1) Section 232 tariffs on automobiles/automobile parts; (2) Section 232 tariffs on aluminum and/or steel; and (3) IEEPA tariffs on Canadian and Mexican imports.

CBP notes that Executive Order 14289 has retroactive effect for goods entered on or after March 4, 2025, and importers can claim refunds if they have made excessive duty payment.

For more information on these Section 232 tariffs, or questions on how any potential trade action may impact your business, please contact a member of Steptoe's Trade Policy or Trade Remedies practices.