Overview

Law360, New York (July 20, 2017, 12:28 PM EDT) -- Inter partes review is increasingly becoming the method of choice for challenging patents directed to blockbuster biopharmaceuticals and methods of their manufacture. Examples include challenges to patents relating to aging biologics such as Rituxan[1] and Humira,[2] next-generation biologics such as Kadcyla,[3] and methods of manufacturing biologics.[4]

IPRs provide a number of distinct advantages over litigating biologics cases in district court, including lower cost, lower burden of proof, and faster time to final judgment, as well as the enhanced technical expertise of the administrative patent judges.[5] And for biosimilar applicants in particular, the relative simplicity and speed of IPRs can be an attractive means to avoiding the complexity of litigation under the Biologics Price Competition and Innovation Act, including the high volume of patents often in play and the corresponding two waves of litigation provided for by the act.[6] For these reasons, IPR challenges, either as stand-alone actions or as adjuncts to district court litigation, are becoming increasingly common with respect to high-value biologics.

This article examines statistical trends in the roughly 100 biologics-related IPR petitions filed from the inception of the IPR procedure on Sept. 16, 2012, to April 12, 2017. We focus on both the types of patents being challenged and the success rates of those challenges, including institution and ultimate outcome at trial. We also look behind the numbers and provide the possible underlying bases for these statistical trends.

Current Trends in Biologics-Related IPRs

Timing and Volume of Filings

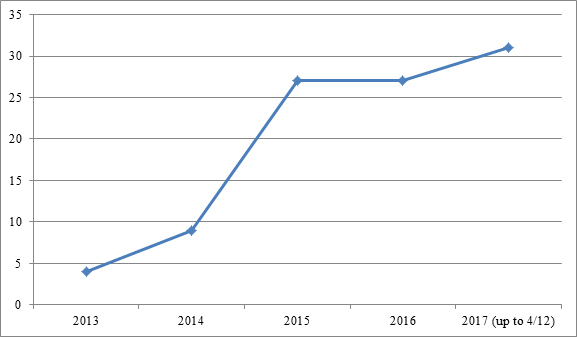

As of April 12, 2017, we identified 98 biologics-related IPRs filed since Sept. 16, 2012,[7] the effective date of the statutory provision creating the IPR procedure.[8] The numbers reveal that the biopharmaceutical industry was initially slow to embrace IPRs, with only 13 petitions filed in 2013 and 2014 combined. Those numbers climbed to just over 25 in both 2015 and 2016, and have steeply risen to 31 in just the first few months of 2017. Those data are depicted in Figure 1:

| Figure 1: Number of biologics-related petitions filed between Sept. 16, 2012, and April 12, 2017. |

|

As an initial matter, it should be noted that while the number of biogics-related IPR petitions filed continues to rise, that number is dwarfed by the number of petitions filed in other technologies. By volume, the vast majority of IPR petitions continues to be filed in the electronics and software arts.[9] This differential may largely be explained by two factors. First, the software and electronics industries commonly employ IPRs to combat litigation brought by nonpracticing entities, a problem rarely faced in the biopharmaceutical industry.[10] Second, unlike the patents typically challenged in the software and electronics sectors, two key grounds of attack on biopharmaceutical patents are for lack of written description and lack of enablement, grounds of invalidity that may not be asserted in an IPR.[11]

With respect to the biologics-related IPR petitions that have been filed to date, several factors may account for the trends observed above. Looking first at the small number of initial filings in the 2013-2014 time frame, they may be explained in part by the pharmaceutical industry’s historical reluctance to embrace post-grant procedures as a means to challenge patents,[12] coupled with a lack of familiarity with the new procedure.[13] At the same time, many biosimilar programs were still in their infancy, and the need to clear a path through the patent thicket was not immediate or desirable, since those same patents would potentially block more advanced competitors. Over the last two years, however, a number of companies have sufficiently advanced their biosimilar programs to the point where IPR-based challenges have become a key component to enabling them to market their products. Such companies include, for example, Mylan Pharmaceuticals Inc. (Herceptin biosimilar),[14] Amgen Inc. (Humira biosimilar),[15] and Celltrion Inc. (Rituxan biosimilar).[16]

Types of Patents Challenged

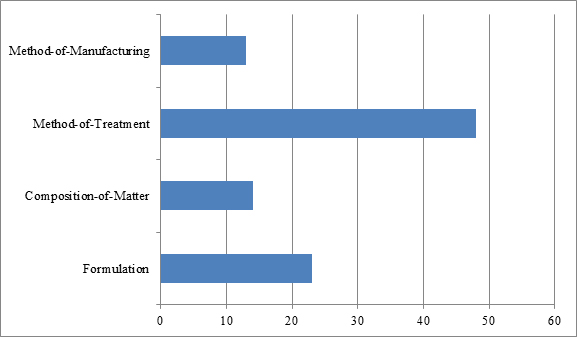

The types of biologics patents that have been challenged in IPR proceedings fall into four general categories: composition-of-matter patents, formulation patents, method-of-manufacturing patents, and method-of-treatment patents.[17] As depicted in Figure 2, of the 98 petitions analyzed, most involved challenges to method-of-treatment patents (48) and formulation patents (23). The predominance of such challenges may likely be explained in two ways. First, method-of-treatment and formulation patents are often perceived as vulnerable to obviousness attacks, particularly in view of composition-of-matter-related prior art. Second, such patents are commonly directed to, for example, indications and dosage regimens set forth in the label for the reference product, and they thus can constitute key patents for blocking biosimilar entry.

By contrast, the least challenged patents were composition-of-matter and method-of-manufacturing patents, which were implicated in only 14 and 13 of the 98 identified petitions, respectively. The infrequency of challenges to composition-of-matter patents may be accounted for in part by difficulties in finding invalidating prior art, which may often occur with patents narrowly claiming antibodies by their amino acid sequences. And to the extent the composition-of-matter patents claim the biologic in broad functional language, e.g., “an antibody or antigen binding fragment which specifically binds to human Siglec-15 (SEQ ID NO.:2) or murine Siglec-15 (SEQ ID NO.:108),”[18] such patents are often most vulnerable to written description or enablement attacks as opposed to prior art challenges, which grounds, as noted above, may not be raised in an IPR proceeding.

As for method-of-manufacturing patents, the infrequency of challenges to those types of patents may likewise be accounted for, at least in part, by difficulties in finding prior art, and in this instance prior art disclosing all the steps of highly specialized manufacturing processes. Exemplary challenges include patents directed to methods of purifying antibodies at low temperature or pH,[19] methods of refolding a protein,[20] methods for increasing the yield of a folded polypeptide,[21] and methods of producing antibody compositions using fucosyltransferase knock-out host cells.[22] Notably, of the 13 challenges to this type of patent, six related to Cabilly II, which is directed to the basic process for producing antibodies in host cells.[23] The number of challenges to this patent is not surprising given that its broad scope potentially implicates any biopharmaceutical development program using host cells to make therapeutic antibodies.[24] The challengers to Cabilly II may have been seeking to reduce their existing or future royalty rates for this patent or, alternatively, may have been seeking to clear the landscape of this patent altogether prior to launch.[25]

| Figure 2: Types of patents challenged in biologics-related IPR petitions between Sept. 16, 2012, and April 12, 2017. |

|

Institution and Final Decisions in Biologics-Related IPRs

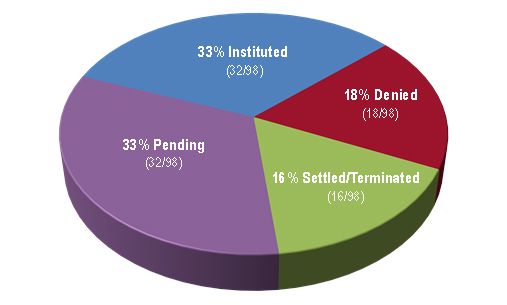

While the Patent Trial and Appeal Board has developed a reputation of being hostile to patent owners,[26] this reputation appears unwarranted in the context of biologics-related IPRs. From the standpoint of institution generally, the numbers reflect that the PTAB appears to have taken a somewhat more balanced approach in instituting biologics-related IPRs.

As of April 12, 2017, Figure 3 indicates that the PTAB had granted 33 percent of biologics-related petitions and denied 18 percent, with 16 percent settling/terminating prior to decision on institution and the remaining 33 percent awaiting decision.

| Figure 3: Disposition of petitions at the institution stage as of April 12, 2017. |

|

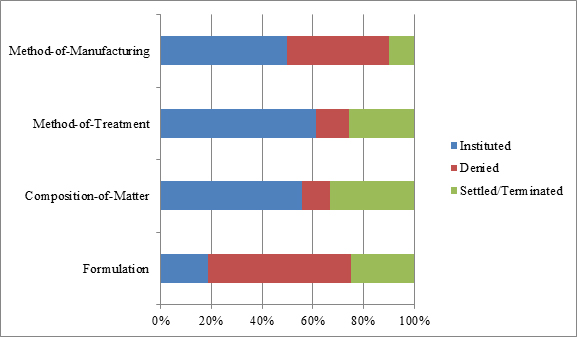

Looking specifically at decisions to institute by patent type, and removing the petitions that were still pending, the data set forth in Figure 4 indicate that the PTAB instituted 50 percent or more of the petitions challenging method-of-treatment (19/31), method-of-manufacturing (5/10), and composition-of-matter patents (5/9). But the number for composition-of-matter patent challenges should be viewed cautiously given the small data pool, and the fact that three of those petitions involved challenges to patents covering the same product, Byetta.[27] Interestingly, the PTAB instituted only 19 percent of the petitions challenging formulation patents (3/16), despite the conventional wisdom that formulation patents are particularly vulnerable to obviousness attacks. These data therefore underscore the importance of formulation patents as a complement to composition-of-matter and method-of-treatment patents in the life-cycle management of biologics-related products. Lastly, it should be noted that 24 percent (16/66) of cases resolved prior to institution, with 15 percent (10/66) of them resolving by way of settlement.[28]

| Figure 4: Types of patents challenged and percent disposition at the institution stage as of April 12, 2017. |

|

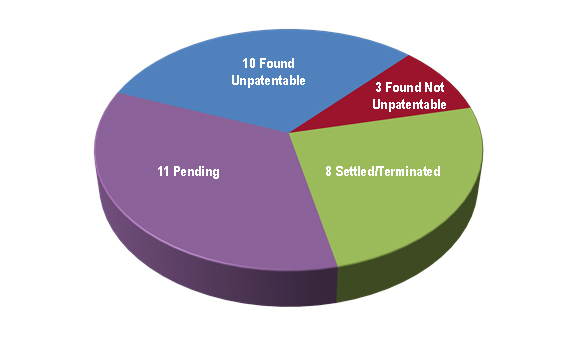

As for the 32 IPRs that progressed passed the institution stage, Figure 5 reveals that 13 were resolved by a final decision on the merits, eight were settled/terminated, and eleven were awaiting decision. Removing the petitions that were still pending, we find that petitioners in the biologics space have seen considerable success in the limited number of cases decided on the merits, with nearly 50 percent of cases resolving in favor of the challenger (10/21), about 15 percent resolving in favor of the patentee (3/21), and roughly 35 percent settling or otherwise terminating prior to final decision (8/21).[29]

| Figure 5: Disposition of cases post-institution as of April 12, 2017. |

|

Again, those data should be viewed with caution given the limited number of final decisions on the merits. In fact, as shown in the table below, six of the challenges related to three patents covering Copaxone®,[30] three related to patents covering Lumizyme,[31] and the other related to a patent covering antibodies against Siglec-15.[32]

Conclusion

The data thus far reveal that the number of challenges to biologics-related patents have increased dramatically since the inception of the IPR procedure, going from a mere four in all of 2013 to 31 in just the first quarter of 2017. During this time frame, biologics-related IPRs have broken down into four categories, including challenges to method-of-treatment patents (49 percent), composition-of-matter patents (14 percent), formulation patents (24 percent), and method-of-manufacturing patents (13 percent). In those categories, the PTAB instituted only 19 percent of challenges to formulation patents, while instituting 50 percent or more of challenges to composition-of-matter patents, method-of-treatment patents, and method-of-manufacturing patents. And of the 13 instituted IPRs that reached a final written decision, approximately three-quarters of the decisions held all of the reviewed claims unpatentable. Lastly, it should be noted that about 30 percent of IPRs settled at some point during the proceedings.

The preliminary data suggest that IPRs are a potent weapon for biopharmaceutical companies in challenging biologics-related patents, and it follows that the number of biologics-related IPRs has continued to increase since 2012. Given these statistics and the advantages IPRs possess over district court litigation, coupled with the steadily growing number of abbreviated biologics license applications filed with the US Food and Drug Administration, we can expect the number of biologics-related challenges via IPR to continue to rise in years to come.

________________________________________

John Josef Molenda, Ph.D., is a partner in the New York office of Steptoe & Johnson LLP, a co-chair of the firm’s healthcare and life sciences industry practice, and head of the intellectual property practice for the New York office.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of the firm, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[1] E.g., Boehringer Ingelheim Int’l GmbH v. Genentech, Inc., IPR2015-00415; Boehringer Ingelheim Int’l GmbH v. Genentech, Inc., IPR2015-00417; Boehringer Ingelheim Int’l GmbH v. Biogen, Inc., IPR2015-00418; Celltrion, Inc. v. Genentech, Inc., IPR2015-01733; Celltrion, Inc. v. Genentech, Inc., IPR2015-01744; Celltrion, Inc. v. Biogen, Inc., IPR2016-01614; Celltrion, Inc. v. Genentech, Inc., IPR2016-01667; Pfizer, Inc. v. Genentech, Inc., IPR2017-01115; Pfizer, Inc. v. Biogen, Inc., IPR2017-01166.

[2] E.g., Amgen, Inc. v. AbbVie Biotech. Ltd., IPR2015-01514; Amgen, Inc. v. AbbVie Biotech. Ltd., IPR2015-01517; Coherus BioScis. Inc. v. AbbVie Biotech. Ltd., IPR2016-00172; Coherus BioScis. Inc. v. AbbVie Biotech. Ltd., IPR2016-00188; Coherus BioScis. Inc. v. AbbVie Biotech. Ltd., IPR2016-00189; Coherus BioScis. Inc. v. AbbVie Biotech. Ltd., IPR2016-01018; Boehringer Ingelheim Int’l GmbH v. AbbVie Biotech. Ltd., IPR2016-00408; Boehringer Ingelheim Int’l GmbH v. AbbVie Biotech. Ltd., IPR2016-00409.

[3] Phigenix, Inc. v. ImmunoGen, Inc., IPR2014-00676; Phigenix, Inc. v. Genentech, Inc., IPR2014-00842.

[4] E.g., sanofi-aventis U.S. LLC v. Genentech, Inc., IPR2015-01624 (challenging U.S. Patent No. 6,331,415 (“Cabilly II”) directed to methods of manufacturing antibodies); Coalition for Affordable Drugs V LLC v. Hoffmann-La Roche Inc., IPR2015-01792 (challenging claims of U.S. Patent No. 8,163,522 directed to polynucleotides encoding the extracellular region of an insoluble human TNF receptor); Hospira, Inc. v. Genentech, Inc., IPR2016-01837 (challenging claims of U.S. Patent No. 7,807,799 directed to methods of purifying antibodies at low temperature or pH).

[5] See, e.g., D. Cavanaugh et al., A Practical Guide to Inter Partes Review: Strategic Considerations for Pursuing Inter Partes Review in a Litigation Context, WilmerHale Webinar, http://www.wilmerhale.com/uploadedfiles/wilmerhale_shared_content/wilmerhale_files/events/wilmerhale-webinar-ipr1-20jun13.pdf (last visited Apr. 25, 2017).

[6] For example, AbbVie alleged that Amgen’s abbreviated Biologics License Application (“aBLA”) for Amgen’s biosimilar of Humira® infringed sixty-one patents, with ten of those patents being litigated in the first wave of litigation and fifty-one of those patents to be litigated in the second wave of litigation. Complaint at 1, 3-5, 6-7, 13-16, AbbVie Inc. v. Amgen Inc., C.A. No. 16-666-SLR (D. Del. Aug. 4, 2016), ECF No. 1.

[7] The IPRs discussed herein include those challenging patents directed to therapeutic biologics and related platform technology. Such IPRs were identified via word searches using Docket Navigator.

[8] Leahy-Smith America Invents Act of 2011, Pub. L. No. 112-29, § 319(c)(2)(A), 125 Stat. 284, 304 (2011) (providing that the sections pertaining to inter partes review “shall take effect upon the expiration of the 1-year period beginning on the date of the enactment of this Act”).

[9] See Matt Cutler, 3 Years of IPR: A Look at the Stats, Law360 (Oct. 9, 2015), http://www.law360.com/articles/699867/3-years-of-ipr-a-look-at-the-stats (last visited Apr. 25, 2017) (reporting that as of September 2015, 61% (2,073) of the 3,408 petitions filed challenged electronics/computer patents).

[10] See Review of Recent Judicial Decisions on Patent Law, Hearing before the Subcommittee on Intellectual Property, Competition, and the Internet of the Committee of the Judiciary, House of Representatives, 112th Cong., 1st Sess., at 10 (2011) (statement of Dan L. Burk, Professor of Law, University of California, Irvine) (“As you are aware, Mr. Chairman, much of the push toward patent reform legislation has been driven by the activity of ‘non-practicing entities’ or NPEs, whom some have dubbed ‘patent trolls.’”); H.R. Rep. No. 112-98, at 48 (2011), reprinted in 2011 U.S.C.C.A.N. 67, 78 (referring to the AIA post-grant review proceedings as “quick and cost effective alternatives to litigation”).

[11] 35 U.S.C. § 311(b).

[12] For example, it has been relatively uncommon for the biopharmaceutical industry to challenge patents through traditional reexamination. This may be explained at least in part by the fact that reexamination proceedings, unlike IPRs, cannot be terminated via settlement, an important strategic consideration in Hatch-Waxman litigation. See, e.g., W.J. Cass et al., Should We Settle? Considerations for Generic Companies before Settling Hatch-Waxman Litigation, Cantor Colburn (Sept. 2011), http://www.cantorcolburn.com/media/news/40_201110_Sept%202011%20Shoudl%20We%20Settle%20-%20Hatch-Waxman%20Litigation.pdf (last visited Apr. 25, 2017) (noting that “settling a Paragraph IV litigation can be a more profitable option for a generic company than litigating the case to its end”).

[13] Armstrong Teasdale LLP, Biotechnology/Pharma Patents: Immune to Post Grant Challenges?, Nat’l L. Rev. (Aug. 13, 2014), http://www.natlawreview.com/article/biotechnologypharma-patents-immune-to-post-grant-challenges (last visited Apr. 25, 2017) (noting that potential petitioners in the biotechnology/pharmaceutical field may not be willing to invest expense into post grant challenges without more certainty regarding the outcomes).

[14] See, e.g., Mylan Website, Mylan and Biocon Announce U.S. FDA Submission for Proposed Biosimilar Trastuzumab, Mylan Press Releases (Nov. 8, 2016), http://newsroom.mylan.com/2016-11-08-Mylan-and-Biocon-Announce-U-S-FDA-Submission-for-Proposed-Biosimilar-Trastuzumab (last visited Apr. 25, 2017) (announcing submission of Biologics License Application for MYL-1401O, a proposed Herceptin® biosimilar); see also Mylan Pharm. Inc. v. Genentech, Inc., IPR2016-01693 (challenging claims of U.S. Patent No. 6,407,213 directed to humanized antibodies and humanized antibody variable domains; proceeding terminated prior to institution pursuant to parties’ Joint Motion to Terminate, following settlement); Mylan Pharm. Inc. v. Genentech, Inc., IPR2016-01694 (challenging claims of U.S. Patent No. 6,407,213 on different grounds; proceeding terminated prior to institution pursuant to parties’ Joint Motion to Terminate, following settlement); Mylan Website, Mylan Announces Global Settlement and License Agreements with Genentech and Roche on Herceptin®, Mylan Press Releases (Mar. 13, 2017), http://newsroom.mylan.com/2017-03-13-Mylan-Announces-Global-Settlement-and-License-Agreements-with-Genentech-and-Roche-on-Herceptin-R (last visited Apr. 25, 2017) (announcing global settlement in relation to patents for Herceptin®, which provides Mylan with global licenses for its Herceptin® biosimilar product).

[15] See, e.g., Amgen Website, FDA Accepts Amgen’s Biosimilar Biologics License Application for ABP 501, Amgen News Releases (Jan. 25, 2016), https://www.amgen.com/media/news-releases/2016/01/fda-accepts-amgens-biosimilar-biologics-license-application-for-abp-501/ (last visited Apr. 25, 2017) (announcing that the FDA has accepted for review Amgen’s Biologics License Application for ABP 501, a biosimilar of Humira®); see also Amgen Inc. v. AbbVie Biotech. Ltd., IPR2015-01514 (challenging claims of U.S. Patent No. 8,916,157 directed to formulations of human antibodies for treating TNF-α associated disorders); Amgen Inc. v. AbbVie Biotech. Ltd., IPR2015-01517 (challenging claims of U.S. Patent No. 8,916,158 directed to formulations of human antibodies for treating TNF-α associated disorders).

[16] See, e.g., Teva Website, Teva and Celltrion Announce Exclusive Biosimilar Commercial Partnership, Teva Latest News (Oct. 6, 2016), http://www.tevapharm.com/news/teva_and_celltrion_announce_exclusive_biosimilar_commercial_partnership_10_16.aspx (last visited Apr. 25, 2017) (announcing that Teva and Celltrion entered into an exclusive partnership to commercialize, inter alia, Celltrion’s Rituxan® biosimilar in the U.S. and Canada); see also, e.g., Celltrion, Inc. v. Biogen Inc., IPR2017-01093 (challenging Claim 1 of U.S. Patent No. 8,329,172 directed to a method of treating low grade B-cell non-Hodgkin’s lymphoma with, inter alia, rituximab maintenance therapy); Celltrion, Inc. v. Biogen Inc., IPR2017-01094 (challenging claims of U.S. Patent No. 8,557,244 directed to methods of treating diffuse large cell lymphoma with, inter alia, an unlabeled chimeric anti-CD20 antibody); Celltrion, Inc. v. Biogen Inc., IPR2017-01095 (challenging claims of U.S. Patent No. 9,296,821directed to methods of treating low grade or follicular non-Hodgkin’s lymphoma with, inter alia, rituximab).

[17] For simplicity, the patents discussed herein are characterized based on the predominant claim type, although some of the challenged patents contain more than one claim type.

[18] Daiichi Sankyo Co. v. Alethia Biotherapeutics Inc., IPR2015-00291 (challenging claims of U.S. Patent No. 8,168,181).

[19] Hospira, Inc. v. Genentech, Inc., IPR2016-01837 (challenging claims of U.S. Patent No. 7,807,799).

[20] Apotex Inc. v. Amgen Inc., IPR2016-01542 (challenging claims of U.S. Patent No. 8,952,138).

[21] Bioeq IP AG v. Genentech, Inc., IPR2016-01608 (challenging claims of U.S. Patent No. 6,716,602).

[22] E.g., Aragen Biosci., Inc. v. Kyowa Hakko Kirin Co., IPR2017-01252 (challenging claims of U.S. Patent No. 6,946,292).

[23] Sanofi-aventis U.S. LLC v. Genentech, Inc., IPR2015-01624; Genzyme Corp. v. Genentech, Inc., IPR2016-00383; Genzyme Corp. v. Genentech, Inc., IPR2016-00460; Mylan Pharm. Inc. v. Genentech, Inc., IPR2016-00710; Merck Sharp & Dohme Corp. v. Genentech, Inc., IPR2016-01373; Merck Sharp & Dohme Corp. v. Genentech, Inc., IPR2017-00047.

[24] See E. Waltz, Industry Waits for Fallout from Cabilly, 25 Nature Biotech. 699, 699 (2007).

[25] See id.

[26] In the first year after IPRs became available, the Board decided to institute trials more than 85 percent of the time. R. Davis, Inter Partes Review Becoming Friendlier to Patent Owners, Law360 (Mar. 1, 2017), https://www.law360.com/ip/articles/894916/inter-partes-reviews-becoming-friendlier-to-patent-owners?nl_pk=1c80c418-4720-4c67-a09f-c2ba3f3a8737&utm_source=newsletter&utm_medium=email&utm_campaign=ip (last visited Apr. 25, 2017). And according to a 2014 study, among IPRs that reached a final decision on the merits, all instituted claims were invalidated or disclaimed more than 77 percent of the time. B.J. Love et al., Inter Partes Review: An Early Look at the Numbers, 81 U. Chi. L. Rev. Dialogue 93, 94, 102 (2014). For this reason, former Chief Judge Rader went so far as to refer to the PTAB as “death squads, killing property rights.” See T. Dutra, Rader Regrets CLS Bank Impasse, Comments on Latest Patent Reform Bill, Bloomberg BNA (Oct. 29, 2013), https://www.bna.com/rader-regrets-cls-n17179879684/ (last visited Apr. 25, 2017).

[27] Sanofi-aventis U.S. LLC v. AstraZeneca Pharm. LP, IPR2016-00353 (challenging claims of U.S. Patent No. 7,691,963); sanofi-aventis U.S. LLC v. AstraZeneca Pharm. LP, IPR2016-00354 (challenging claims of U.S. Patent No. 8,445,647); sanofi-aventis U.S. LLC v. AstraZeneca Pharm. LP, IPR2016-00355 (challenging claims of U.S. Patent No. 8,951,962).

[28] See Laboratorios Silanes, SA de CV v. BTG Int’l Inc., IPR2014-01269; Novo Nordisk Inc. v. Nektar Therapeutics, IPR2016-01384; Pfizer Inc. v. Intellect Neurosciences, Inc., IPR2015-00293; Mylan Pharm. Inc. v. Genentech, Inc., IPR2016-01693; Mylan Pharm. Inc. v. Genentech, Inc., IPR2016-01694; Merck Sharp & Dohme Corp. v. Ono Pharm. Co., IPR2016-01217; Merck Sharp & Dohme Corp. v. Ono Pharm. Co., IPR2016-01218; Merck Sharp & Dohme Corp. v. Ono Pharm. Co., IPR2016-01219; Merck Sharp & Dohme Corp. v. Ono Pharm. Co., IPR2016-01221; Roche Diagnostics Operations, Inc. v. Abbott Labs., IPR2016-00233.

[29] See Sanofi-aventis U.S. LLC v. AstraZeneca Pharm. LP, IPR2016-00353; sanofi-aventis U.S. LLC v. AstraZeneca Pharm. LP, IPR2016-00354; sanofi-aventis U.S. LLC v. AstraZeneca Pharm. LP, IPR2016-00355; sanofi-aventis U.S. LLC v. Genentech, Inc., IPR2015-01624; Genzyme Corp. v. Genentech, Inc., IPR2016-00460 (joined with IPR2015-01624, and later terminated pursuant to settlement agreement); Mylan Pharm. Inc. v. Genentech, Inc., IPR2016-00710 (Merck (IPR2017-00047) joined IPR2016-00710; IPR2016-00710 later terminated with respect to Mylan pursuant to a settlement agreement between Mylan and Genentech; IPR2016-00710 continues with Merck as petitioner).

[30] Mylan Pharm. Inc. v. Yeda Research & Dev. Co., IPR2015-00643 (challenging claims of U.S. Patent No. 8,232,250); Mylan Pharm. Inc. v. Yeda Research & Dev. Co., IPR2015-00644 (challenging claims of U.S. Patent No. 8,399,413); Mylan Pharm. Inc. v. Yeda Research & Dev. Co., IPR2015-00830 (challenging claims of U.S. Patent No. 8,969,302); Amneal Pharm. LLC v. Yeda Research & Dev. Co., IPR2015-01976 (challenging claims of U.S. Patent No. 8,232,250; joined with IPR2015-00643); Amneal Pharm. LLC v. Yeda Research & Dev. Co., IPR2015-01980 (challenging claims of U.S. Patent No. 8,399,413; joined with IPR2015-00644); Amneal Pharm. LLC v. Yeda Research & Dev. Co., IPR2015-01981 (challenging claims of U.S. Patent No. 8,969,302; joined with IPR2015-00830).

[31] BioMarin Pharm. Inc. v. Genzyme Therapeutic Prods. Ltd., IPR2013-00534 (challenging sole claim of U.S. Patent No. 7,351,410); BioMarin Pharm. Inc. v. Duke Univ., IPR2013-00535 (challenging claims of U.S. Patent No. 7,056,712); BioMarin Pharm. Inc. v. Genzyme Therapeutic Prods. Ltd., IPR2013-00537 (challenging claims of U.S. Patent No. 7,655,226).

[32] Daiichi Sankyo Co. v. Alethia Biotherapeutics, Inc., IPR2015-00291 (challenging claims of U.S. Patent No. 8,168,181).

All Content © 2003-2017, Portfolio Media, Inc.