Overview

For additional guidance, please refer to Steptoe's COVID-19 Resource Center.

At least 42 states (plus DC, Guam, and Puerto Rico) have ordered "non-essential businesses" to close their doors in an unprecedent effort to stop the spread of the novel Coronavirus (COVID-19).[1] While the safety measures are understandable, employers have been required to shut down, or significantly slowdown, their operations, resulting in varying measures to manage employee resources from reduction of employees' hours and furloughs to lay-offs. Consequently, over 17 million people filed unemployment claims in the last four weeks, largely as a result of closures of non-essential businesses, such as restaurants, retail, and certain manufacturing industries.[2] The number of unemployment claims continues to grow.

Many employers are looking for help from the $2.2 trillion stimulus package (the Coronavirus Aid, Relief, and Economic Security (the CARES Act)) to provide necessary financial aid, including directly to employees in the form of increased unemployment insurance benefits, during the COVID-19 pandemic. As employers are trying to keep their businesses afloat, including making plans to bring back employees after the pandemic is over, knowing that their employees would receive adequate unemployment insurance benefits is a top consideration and can help put decision-makers and employees at ease. However, the practical implications of the increased unemployment insurance benefits under the CARES Act are still developing and will heavily depend on implementation by the individual states.

This alert seeks to provide some general practical guidance of how the unemployment insurance benefits under the CARES Act will interplay with the unemployment laws of two major states, California and New York, as well as the District of Columbia. It is not intended to provide any legal advice regarding specific issues, and we encourage employers to contact Steptoe's employment team directly for any additional questions about unemployment insurance benefits.

What Unemployment Insurance Benefits Does the CARES Act Really Provide and What Do States Have to Do with It?

By now, everyone has likely heard that the CARES Act will increase unemployment insurance benefits for eligible individuals by providing an additional $600 per week on top of state unemployment benefits. But a closer examination of the CARES Act is necessary to fully understand the practical consequences of laying off, furloughing, or reducing employee hours during the pandemic. Employers should focus on several key factors in weighing the availability of unemployment benefits in its employment decisions.

First, the additional benefits will not be available to your employees unless the state in which they apply for unemployment insurance benefits has entered into an agreement with US Department of Labor (DOL). Specifically, each state must enter into an agreement under section 2104(a) of the CARES Act with the DOL to activate the additional $600/week Federal Pandemic Unemployment Compensation (FPUC). However, at this time, there is not a consolidated listing of which states have entered into the required agreement to begin receiving the additional funds. States are starting to provide this information by indicating that claimants are entitled to the additional $600 in FAQ sections or press releases on their respective unemployment agency websites, such as California, New York, and the District of Columbia.[3] However, for now, employers will have to monitor each state in which their employees work to determine if their employees would receive the additional federal unemployment benefits.

Second, embedded within the text of the CARES Act is the shifting of responsibility to the states to administer the federal $600 weekly payment. Indeed, states must show that they "have an adequate system for administering such assistance through existing state agencies"[4] to receive the additional funding. This will present some additional challenges, as further discussed below, as each state has their own filing procedures, rules, and capacity to handle the increased volume of claims. This will also mean that impacted employees likely will not start receiving unemployment benefits at the same time.

Third, and most significantly, the additional benefits are available only to individuals who are eligible for state unemployment insurance benefits. States are required to administer the additional unemployment benefits, including making determinations about eligibility for and the amount of state benefits that the claimant will receive in accordance with state law where the individual filed a claim. In other words, a claimant must qualify for unemployment under state laws to be eligible for the additional $600 weekly federal payment. This raises questions about the availability of unemployment benefits for periods of partial unemployment or reduced hours under state unemployment laws, although the FPUC should be available for these situations.[5] This also means that employees making the same salaries or hourly compensation while employed will likely receive different unemployment amounts depending on the state where they were employed. In addition, individuals may be subject to differing job search and training requirements depending on the state in which they apply for unemployment insurance benefits.

Fourth, employees with reduced hours may receive unemployment insurance benefits, including the full $600 weekly federal payment. While many states clearly have stated on their websites and in their FAQs that individuals with reduced working hours may be eligible for partial unemployment insurance benefits, as with full unemployment insurance benefits, eligibility for partial benefits will depend on the claimant's ability to meet state-specific requirements.

What is the Estimated Amount of Pandemic Unemployment Benefits?

Each state has its own method for determining eligibility for unemployment insurance benefits and a claimant's weekly unemployment benefit amount based on the claimant's earnings over a 12 to 18-month period. Some states provide a calculator or table to help individuals estimate their weekly benefits, such as California, New York, and Illinois, while other jurisdictions, including the District of Columbia, do not. Moreover, some States include an additional benefit for a spouse or dependent minor child, such as Illinois. The maximum weekly benefit amount can be as low as $235[6] in Mississippi or has high as $823 per week in Massachusetts.[7]

The California weekly benefit amount ranges from $50 to $450 a week.[8] Depending on the claimant's annual income, as calculated based on a formula using quarterly earnings, the weekly benefit amount would be 60% or 70% of weekly earnings, with a maximum benefit of $450, according to the Employment Development Department of the State of California (EDD) website. EDD website provides a calculator to estimate weekly unemployment benefits used to arrive at the estimated benefits. California residents may also be eligible for benefits under the state's disability insurance or paid family leave insurance programs, which are beyond the scope of this article, if they are unable to work because of COVID-19 or are caring for certain family members as a result of COVID-19.

New York increased its maximum weekly benefit rate to $504 each week in October 2019.[9] The minimum benefit rate ranges over certain periods during the year, and is currently set at $182 for April 1, 2020 to June 30, 2020. New York likewise has a calculator for claimants to estimate their weekly benefit on the New York State Department of Labor website.

The District of Columbia weekly unemployment benefits are determined by taking the claimant’s weekly highest quarter of wages in the determined base period and dividing it by 26 with a maximum weekly benefit of $444.[10]

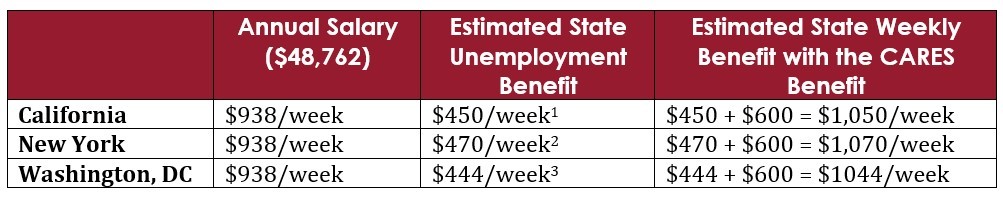

The below charts provide an estimate of the weekly unemployment insurance benefits available to eligible furloughed or laid-off employees in California, DC and New York. The charts provide these estimates for two compensation scenarios: (1) an employee compensated at the average US yearly salary of $48,762 or $938/week;[11] and (2) an employee compensated at minimum wage in the three jurisdictions, previously working full-time (40 hours per week).

Scenario 1 (Full-time Employee Earning $48,762 Annually):

1. https://www.edd.ca.gov/unemployment/ui-calculator.htm

1. https://www.edd.ca.gov/unemployment/ui-calculator.htm

2. https://labor.ny.gov/benefit-rate-calculator/

3. https://fileunemployment.org/washington-dc/dc-calculator/

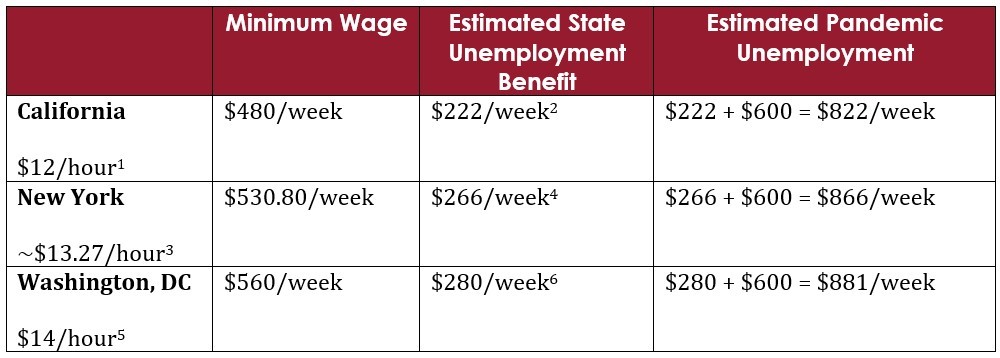

Scenario 2 (Full-time Employee Earning Minimum Wage): 1. https://www.dir.ca.gov/dlse/faq_minimumwage.htm. Effective January 1, 2020, the minimum wage for employers with less than 25 employees was increased to $12/hour and $13/hour for employers with 26 or more employees. The above calculation uses the lower minimum wage amount.

1. https://www.dir.ca.gov/dlse/faq_minimumwage.htm. Effective January 1, 2020, the minimum wage for employers with less than 25 employees was increased to $12/hour and $13/hour for employers with 26 or more employees. The above calculation uses the lower minimum wage amount.

2. https://www.edd.ca.gov/unemployment/ui-calculator.htm

3. https://www.labor.ny.gov/workerprotection/laborstandards/workprot/minwage.shtm. New York has varying minimum wage amounts throughout the state based on location and employer size ranging from $11.80/hour $15/hour. The calculation is based on the average of the minimum wage amounts available throughout the state. Consult with the county website to ensure proper calculation of the minimum wage.

4. https://labor.ny.gov/benefit-rate-calculator/

5. https://does.dc.gov/service/office-wage-hour-compliance-0. The minimum wage in DC increases to $15/hour on July 1, 2020.

6. https://fileunemployment.org/washington-dc/dc-calculator/. This calculator is provided by a third-party and may not include updates from the District of Columbia, and is used solely for informational purposes.

Eligibility for Employees with Reduced Hours

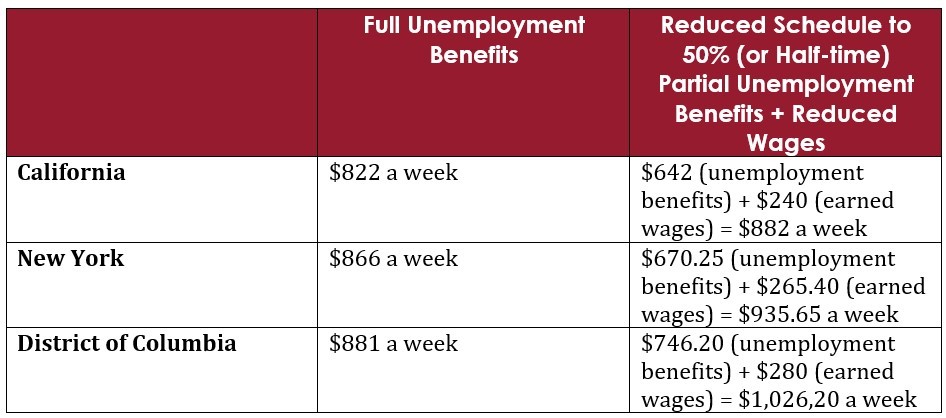

An understanding of the state-specific requirements becomes critical in determining whether employees would be eligible for unemployment insurance benefits in the event of a reduction in working hours. Notably, depending on the reduction in working hours and the applicable state formula, the employee may be eligible for minimal benefits or none at all. Of course, as discussed above, if the employee is eligible for any unemployment benefits, the employee will receive the additional federal benefit.

Under current California law, an individual is considered unemployed if his or her wages, "when reduced by $25 dollars or 25 percent of the payable wages, whichever is greater, do not equal or exceed the weekly benefit amount."[12] If the deduction of 25% of the individual's wages results in the individual still earning more or the same as the weekly unemployment benefit amount, then the individual will not qualify for unemployment benefits. For instance:

A 50% reduction in working hours for a full-time employee making minimum wage would result in weekly earnings (from the employer) of $240. The weekly anticipated unemployment benefit would be $222, see above. A 25% reduction of the $240 wages earned leaves the employee with $180 in earned wages, or $42 less than the weekly benefit amount. In this scenario, the employee should be deemed partially unemployed and receive approximately $42 week in California unemployment insurance benefits, which should in turn also would trigger eligibility for the additional $600 weekly for a total unemployment benefit of $642 a week plus their weekly earnings.

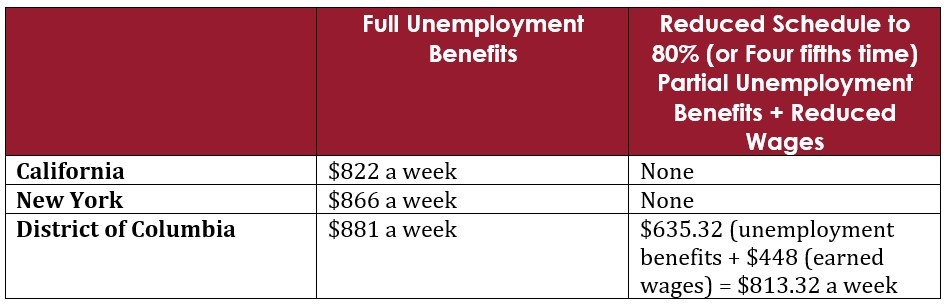

*If this same employee’s working hours were reduced by 20%, instead of 50%, the employee would not be eligible for unemployment insurance benefits or the additional federal benefit. This is because the employee's wages after a 25% reduction would result in $288 in weekly warnings, which exceeds the employee's estimated weekly unemployment insurance weekly benefit of $222.

In New York, claimants can receive partial unemployment benefits only if they work three days or less and do not earn more than the maximum benefit rate of $504 a week. New York provides a schedule of partial unemployment benefits depending on the number of working days per week as follows: "1 day of work = 3/4 of your full weekly benefit rate; 2 days of work = 1/2 of your full weekly benefit rate; 3 days of work = 1/4 of your full weekly benefit rate; and 4 days of work = No benefits due."[13] Additionally, claimants are required to report a full day of work, even if they worked less than an hour. Therefore:

If a minimum wage full time employee's hours are reduced to 20 hours, the employee would have to report three days of work (assuming eight hour shifts), and would see a decrease in their weekly unemployment benefit from $281 to $70.25 (or 1/4 of the weekly benefit rate).[14] As long as the employee qualifies for partial unemployment, he or she should still receive the $600 additional federal payment.[15] In this scenario, the employee should receive a total of $670.25 in unemployment benefits plus their earnings.

*If the employee’s schedule were reduced by 20%, the employee would continue to work four days a week and would not be eligible for unemployment insurance benefits or the additional federal benefit.

The District of Columbia's April 8th report made clear that "part-time workers are eligible for partial benefits, which are calculated by taking into consideration" recent wages and would be entitled to the $600 weekly federal unemployment payment.[16] According to the District of Columbia's unemployment handbook, partial unemployment benefits are calculated by adding $50 to the weekly benefit amount and then subtracting 66% of gross wages earned in a week, which determines reduced weekly benefit amount.[17] As an example:

A minimum wage earner reduced to 20 hours would earn $280 in weekly wages from the employer. The weekly unemployment insurance benefit amount should remain at $280 using prior quarter wages. Adding $50 to the $280 weekly benefit results in $331, which then must be deducted by 66% of the gross weekly wages (or by $184.80 in this example) to arrive at a reduced weekly benefit of $146.20. Again, in this example, the claimant should be entitled to receive a reduced weekly benefit from the District of Columbia, which still qualifies the individual to the additional $600 federal unemployment payment for a total of $746.20 plus their weekly earnings.

*If the employee’s working schedule is reduced by 20%, the employee also would be entitled to partial unemployment benefits in DC. In this example, the employee employee's weekly earnings would be reduced from $560 to $448. Adding $50 to the $280 weekly benefit results in $331, which then must be deducted by 66% of the gross earned weekly wages (or by $294.68 in this example) to arrive at a reduced weekly benefit of $35.32. The employee should be entitled to receive a reduced weekly benefit from the District of Columbia, which still qualifies the employee to the additional $600 federal unemployment payment for a total of $635.32 plus their weekly earnings.

Scenario 1 (Full-time Employee Earning Minimum Wage with Reduced Working Hours of 50%):

Scenario 2 (Full-time Employee Earning Minimum Wage with Reduced Working Hours of 20%):

Other Unemployment Insurance Benefits Considerations For Employers When Making Layoff, Furlough, or Schedule Reduction Decisions

As stated above, in order to qualify for the $600 additional federal unemployment insurance benefits payment, the individual must first qualify for state unemployment. Each state has its own set of unemployment rules related to eligibility (including partial unemployment or reduced hours), weekly certification requirements, and capacity to process claims. Moreover, states are continually making changes to their rules and are waiting for further guidance from the Federal Department of Labor on additional measures in order to receive the additional federal funding.

In addition, news headlines highlight the challenges of claimants in making unemployment claims. Claimants have reported website crashes, long call wait times, and multiple attempts in filing claims across the country. While most states have confirmed that they are waiving the seven-day waiting period as required under the CARES Act, it is not always clear whether states are also waiving other weekly certification requirements, such as job search requirements. For instance, the District of Columbia has stated that as of March 15, 2020, its job search requirements are waived during the pandemic.[18] Other states, such as a California and New York, have not yet addressed whether they will waive the job search requirements.

*********

In sum, employers looking to state unemployment insurance benefits and CARES Act benefits to provide a potential income supplement for furloughed or reduced hours employees should carefully consider state unemployment rules, particularly, in the instance of hours reductions. Steptoe's cross-disciplinary team of lawyers can help with these employment law issues and the countless legal and policy issues that companies are now navigating.

[1] https://www.businessinsider.com/us-map-stay-at-home-orders-lockdowns-2020-3

[2] https://www.washingtonpost.com/business/2020/04/09/66-million-americans-filed-unemployed-last-week-bringing-pandemic-total-over-17-million/

[3] https://labor.ny.gov/ui/pdfs/ui-covid-faq.pdf; https://www.edd.ca.gov/About_EDD/pdf/news-20-09.pdf; https://does.dc.gov/sites/default/files/dc/sites/does/publication/attachments/DOES_CARES%20Act%20FAQs.pdf

[4] Section 2102(f) of the CARES Act.

[5] The Department of Labor guidance states that: “FPUC is payable for ‘weeks of unemployment] beginning on or after the date on which the state enters into an agreement with the Department.” https://wdr.doleta.gov/directives/attach/UIPL/UIPL_15-20.pdf. The C.A.R.E.S Act defines “weeks of unemployment” as “a week of total, part-total, or partial unemployment as defined in the applicable state law, which shall be applied in the same manner to the same extent to claims filed under the requirements of the CARES Act.” (CITE)

[6] https://mdes.ms.gov/unemployment-claims/benefit-information/benefit-eligibility-requirements/

[7] https://www.mass.gov/info-details/how-your-unemployment-benefits-are-determined

[8] https://www.edd.ca.gov/Unemployment/Eligibility.htm

[9] https://www.labor.ny.gov/formsdocs/factsheets/pdfs/p832.pdf

[10] https://does.dcnetworks.org/claimantservices/MWBA%20FAQs_Effective.pdf

[11] https://www.thestreet.com/personal-finance/average-income-in-us-14852178

[12] https://www.edd.ca.gov/uibdg/Total_and_Partial_Unemployment_TPU_5.htm

[13] https://www.labor.ny.gov/formsdocs/ui/TC318.3e.pdf

[14] The employee would receive half of their weekly benefit, or $140.50, if he or she worked two 10-hour shifts.

[15] https://labor.ny.gov/ui/pdfs/ui-covid-faq.pdf

[16] https://does.dc.gov/sites/default/files/dc/sites/does/publication/attachments/DOES_CARES%20Act%20FAQs.pdf

[17] https://does.dc.gov/sites/default/files/dc/sites/does/publication/attachments/9.12.19%20UI%20Claimant%27s%20Rights%20and%20Responsibilities.pdf

[18] https://does.dcnetworks.org/claimantservices/Logon.aspx