Overview

The One Big Beautiful Bill (OBBB), signed into law by President Trump on July 4, makes significant changes to the clean energy tax credits enacted under the Inflation Reduction Act (IRA) in 2022. Although the Senate-passed version of the OBBB did not go as far to repeal or modify the IRA’s credits as the initial House-passed version, the enacted legislation represents a dramatic roll back of the IRA's credits. This client alert discusses these significant changes and modifications, as well as the few exceptions to the roll back and the challenges facing the Department of Treasury (Treasury) and the Internal Revenue Service (IRS) in implementing the OBBB amendments.

The biggest roll backs were to the electric vehicles and residential energy efficiency credits, which all terminate before the end of this year. The other big roll backs were to the wind and solar tax credits. The OBBB terminates the section 45Y production tax credit (PTC) and section 48E investment tax credit (ITC) for wind and solar projects placed in service after December 31, 2027, though facilities that begin construction before July 4, 2026, may take the full amount of the credit for the original phase-out period. The OBBB also rolls back the section 45V clean hydrogen PTC by terminating the credit five years earlier than scheduled. In addition, the OBBB terminates the section 45X advanced manufacturing PTC for wind components sold after December 31, 2027, and denies the 45Y PTC and 48E ITC for wind and solar leasing to residential customers immediately.

The few exceptions to the general roll back were the section 45Z clean fuel credit, the section 45Q carbon sequestration credit, the section 45X advanced manufacturing PTC (for non-wind components), and the section 45U nuclear credit. The 45Z credit was extended by two years, and the small agri-biodiesel producer credit was extended until December 31, 2026, and granted transferability. Carbon capture under section 45Q also came out ahead under the OBBB, with increased credit values for carbon utilization and enhanced oil recovery to provide parity for all end uses of carbon allowed under the statute. Despite the roll back discussed above for wind energy components, the section 45X credit was expanded to provide a new tax credit for metallurgical coal production through December 31, 2029. Finally, the section 45U nuclear credit remained unscathed, and the OBBB added an energy community bonus credit for nuclear communities under the PTC.

The OBBB also includes detailed new FEOC restrictions that will apply to the IRA's clean energy credits. These FEOC restrictions are designed to prevent any entity that is deemed to be controlled or influenced by a covered nation (including China, Russia, Iran, and North Korea) from claiming the credits and are expected to cause significant changes to the clean energy supply chain. Finally, the OBBB retains the IRA’s transferability provisions to allow taxpayers to continue to monetize these credits but prohibits the transfer of credits to a prohibited foreign entity.

Now that the OBBB is signed into law, the focus will turn to Treasury and the IRS to issue guidance and regulations to implement the legislation. Treasury and the IRS face a couple of significant implementation challenges.

First, on July 7, President Trump issued an Executive Order (EO) instructing the Secretary of the Treasury, within 45 days, to take action to "strictly enforce the termination of the clean electricity production and investment tax credits under sections 45Y and 48E of the Internal Revenue Code for wind and solar facilities," including by adopting policies to ensure that the "beginning of construction" requirement is not circumvented. This EO is creating uncertainty beyond solar and wind facilities, because energy credit eligibility has been tied to when a project "begins construction" for multiple credit extensions and for multiple energy credits for over a decade, so the Executive Order threatens to upend long-standing IRS guidance.

Second, the EO also directs the Secretary to take action to implement the enhanced FEOC restrictions within 45 days, which is an extremely short time to implement such complex rules. As such, we expect this guidance to be preliminary.

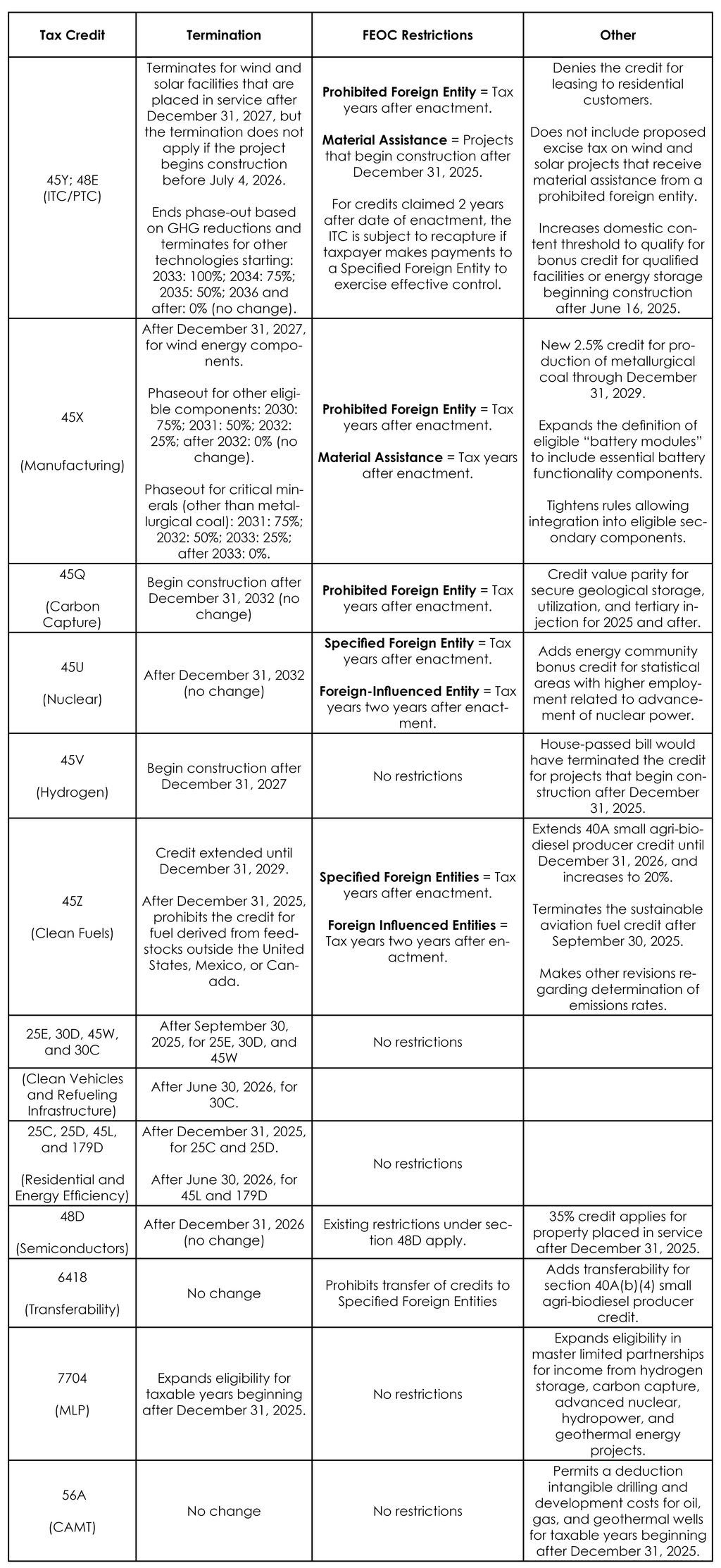

This client alert summarizes the OBBB's key changes to the clean energy tax credits. A chart outlining the changes is included at the beginning of the alert for easy reference. A detailed description of the OBBB's changes for each credit follows the chart. For a full summary of the OBBB, please see our previous client alert.

- Summary Chart

- FEOC Restrictions

- Section 45Y Clean Electricity PTC and Section 48E Clean Electricity ITC

- Begin Construction Guidance and President Trump's Executive Order

- Section 45X – Advanced Manufacturing PTC

- Section 45Q – Carbon Oxide Sequestration Credit

- Section 45U – Zero-Emission Nuclear Power PTC

- Section 45V – Clean Hydrogen Credit

- Section 45Z – Clean Fuel Production Credit

- Section 40A – Biodiesel and Renewable Diesel Used as Fuel

- Section 48C – Advanced Energy Project Credit

- Sections 25E, 30D, 45W, and 30C – Clean Vehicle and Refueling Infrastructure Credits

- Sections 25C, 25D, and 45L, and 179D – Residential Clean Energy Credits and Commercial Building Deduction

- Section 48D – Advanced Manufacturing Investment Tax Credit

- Section 6418 – Transferability of Certain Credits

- Section 7704 – Expansion of Master Limited Partnerships (MLP)

- Section 56A – Corporate Alternative Minimum Tax (CAMT) – Intangible Drilling and Development Costs

Summary Chart

FEOC Restrictions

Originally introduced during the Biden Administration for the sections 30D and 48D credits, the OBBB imposes new FEOC restrictions on all the IRA’s clean energy credits (except the section 45V hydrogen PTC) and includes additional restrictions for the section 45Y PTC, section 48 ITC, and section 45X advanced manufacturing PTC for facilities that receive “material assistance” from prohibited foreign entities.

The OBBB imposes new FEOC restrictions limiting the ability of projects to claim tax credits if a “Prohibited Foreign Entity” from a covered nation is involved, including China, Iran, North Korea, or Russia.

The OBBB's FEOC restrictions fall into three categories: (1) ownership and control; (2) "effective control;" and (3) "material assistance" in the form of providing components/materials. The determination of FEOC status generally occurs on the last day of each taxable year, but for the first taxable year after enactment, determination is made as of the first date of such taxable year (except for a "Foreign Controlled Entity" as defined below).

Ownership and Control Restrictions

The OBBB prohibits claiming tax credits if the taxpayer is a Prohibited Foreign Entity, which is defined to mean either a "Specified Foreign Entity" or a "Foreign-Influenced Entity."

A Specified Foreign Entity is defined as (1) entities included in a statutory list of "foreign entities of concern," which includes entities involved in the proliferation of weapons and terrorism; (2) Chinese military companies; (3) entities listed under the Uyghur Forced Labor Prevention Act; or (4) entities on the battery supply chain blacklist under the National Defense Authorization Act for FY 2024. A Specified Foreign Entity also includes a Foreign-Controlled Entity, which is an entity owned or 50% controlled[1] by the government of a covered nation (including subnational governments, agencies, or instrumentalities); a citizen or resident of a covered nation (that is not also a US citizen or resident); or an entity organized or having a principal place of business in a covered nation.

An entity is a Foreign-Influenced Entity if (1) a Specified Foreign Entity has direct authority to appoint board members or officers; (2) a single Specified Foreign Entity owns more than 25% of the entity; (3) one or more Specified Foreign Entities owns an aggregate of 40% of the entity; or (4) at least 15% of the entity’s debt is held by Specified Foreign Entities (in the aggregate).

There are special rules for publicly traded entities. Specifically, the Foreign Controlled Entity prong of Specified Foreign Entity applies only with regard to owners that are required to report their beneficial ownership under Rule 13d-3 of the Securities and Exchange Act of 1934 (or an equivalent foreign rule), which is typically a 5% stockholder. In addition, the ownership prongs of Foreign-Influenced Entity do not apply to publicly traded entities or their 80% controlled subsidiaries. Instead, such ownership prongs apply only with regard to owners that are required to report their beneficial ownership as described above. Finally, the debt prong of Foreign-Influenced Entity applies only to publicly traded debt. For this purpose, exchanges or markets in covered nations are excluded from the definition of publicly traded.

For purposes of determining whether an entity is a Prohibited Foreign Entity, Specified Foreign Entity, or Foreign-Influenced Entity, the attribution rules of section 318(a)(2) apply to determine ownership of stock in a corporation. This means that stock that is owned by a partnership, estate, or trust generally is treated as proportionately owned by its partners or beneficiaries (or grantor in the case of a grantor trust), and stock that is owned by another corporation is treated as proportionately owned by any 50% or greater stockholders.[2] Because the statute only incorporates section 318(a)(2), it is not clear whether section 318(a)(5)(A) applies. Section 318(a)(5)(A) treats stock that is constructively owned by reason of section 318(a)(1)-(4) as actually owned, which allows for attribution of ownership up a chain of entities to the ultimate beneficial owner. If that section is found not to apply so that attribution is limited to direct ownership, the FEOC restrictions could have limited applicability in larger corporate structures. We note that the House-passed version of the OBBB incorporated all of section 318, except for section 318(a)(3) (which provides rules for owner to entity attribution).

Effective Control

For sections 45X, 45Y, and 48E credits, an entity will also be a Foreign-Influenced Entity if, during the prior taxable year, the entity made payments to a Specified Foreign Entity pursuant to contract, agreement, or other arrangement that entitles such Specified Foreign Entity (or a related entity) to exercise effective control over a project, production of components, or extraction, processing, or recycling of critical minerals.

The OBBB directs the Secretary of Treasury to issue guidance to carry out the effective control provision, but pending such guidance, the statute provides that effective control is established through: (1) unrestricted contractual rights to: determine the quantity or timing of production, who may purchase or use output, restrict access to critical data, or control the operation or maintenance of equipment; or (2) a licensing or related agreement that specifies the right to control sources of components, subcomponents, or critical minerals, limits the use of intellectual property, or if the agreement does not provide the licensee with sufficient technical information or know-how to produce the components without involvement of the counterparty or specified foreign entity.[3] The statute essentially provides that, pending issuance of guidance by the Secretary, there is per se “effective control” if there is a long-term license (longer than 10 years), long-term service arrangement (longer than 2 years), or for any license or related agreement entered into (or modified) after the date of enactment.

Material Assistance

The OBBB applies additional and more onerous FEOC restrictions to the section 45Y PTC, the section 48E ITC, and the section 45X advanced manufacturing PTC, denying eligibility for these credits to facilities or components that receive "material assistance" from a Prohibited Foreign Entity.

An entity receives material assistance if the material assistance cost ratio is less than the applicable threshold listed in statute. The threshold amounts listed in the statute vary based on the technology.

The material assistance cost ratio percentage is determined using the following formula: (Total Costs – Costs Attributed to a Prohibited Foreign Entity / Total Costs). The cost-ratio percentage effectively considers the project's non-FEOC costs compared to a project's total costs. If the non-FEOC costs exceed the threshold, the project did not receive material assistance from a FEOC.

The material assistance provisions are likely to be applied like the existing domestic content bonus provisions as the OBBB directs the Secretary of the Treasury to issue safe harbor tables similar to the domestic content bonus under Notice 2025-08, but pending such guidance (and for facilities the construction of which begins on or before the date that is 60 days after the date of issuance of such guidance), taxpayers can rely on the tables in Notice 2025-08. In addition to reliance on Notice 2025-08, taxpayers can rely on supplier certifications to meet the requirement for determining material assistance.

Taxpayers may also exclude costs of components or materials that are acquired pursuant to a binding contract entered into prior to June 16, 2025, and placed in service or sold prior to January 1, 2030 (or in the case of a wind or solar facility before January 1, 2028; or in the case of a component or material sold or used in an eligible component before January 1, 2027).

In the case of a deficiency related to the material assistance requirement, the OBBB extends the statute of limitations to six years and reduces the threshold for the substantial understatement penalty. The statute also adds a penalty for substantial misstatements on supplier certifications.

To meet the new material assistance requirements and retain eligibility for the credits, energy project developers may substitute some higher cost components that are not produced by a Prohibited Foreign Entity. However, any benefits for non-FEOC manufactures may be limited. The material assistance requirements apply for projects that begin construction after 2026, and the wind and solar ITC and PTC terminate if the project is not placed in service by the end of 2027.

Section 45Y Clean Electricity PTC and Section 48E Clean Electricity ITC

Section 45Y provides a PTC for electricity generated by zero‑emitting facilities for ten years after they are placed in service. Section 48E provides an ITC for expenditures on zero‑emission electricity or standalone energy‑storage facilities. Projects that began construction before 2025 are generally unaffected by the OBBB.

One bright spot for solar and wind was that the OBBB did not include the new excise tax on wind and solar projects that receive material assistance from a prohibited foreign entity, which was proposed in an earlier version of the Senate bill.

Phase-Out for Wind and Solar Facilities

The OBBB terminates the ITC and PTC for wind and solar facilities that are placed in service after December 31, 2027. However, due to a last-minute amendment in the Senate, this termination does not apply to solar and wind facilities that begin construction within 12 months after the date of enactment (before July 4, 2026). If a project begins construction before the 12-month deadline, the phase-outs applicable to other eligible technologies would apply.

For all other eligible technologies, the OBBB retained the phase-out along the following schedule: 2033: 100% of the credit; 2034: 75% of the credit; 2035: 50% of the credit; 2036 and after: 0%. However, the OBBB eliminated the extended eligibility period under prior law, which would have continued eligibility for the technology-neutral credits until the US green-house gas emission rates from energy production is equal to or less than 25% of the corresponding emissions rate for 2022.

The OBBB denies the credit for wind and solar leasing to residential customers, effective upon the date of enactment.

Domestic Content Bonus

The OBBB increases the domestic content threshold for qualified facilities that begin construction after June 16, 2025, to claim the domestic content bonus credit in addition to the base ITC or PTC. The domestic content threshold phases up from 40% for projects that begin construction prior to June 16, 2025, to 55% for projects that begin construction after December 31, 2026.

Begin Construction Guidance and President Trump’s Executive Order

Current Begin Construction Guidance

The key factor for most clean energy tax credits will be the date they begin construction, as this will determine eligibility for the credit and compliance with FEOC rules.

In 2013, Treasury and the IRS issued Notice 2013-29, the first piece of guidance on how to determine when construction has begun on a qualified facility for claiming the PTC and ITC. This long-standing guidance provides safe harbors that project developers have relied on for years to establish tax credit eligibility without needing to prove that they have undertaken substantial physical construction early on.

The existing Treasury and IRS guidance provides two methods for establishing that construction of a facility has begun: (1) the Physical Work Test, or (2) the 5% Safe Harbor. Under the Physical Work Test, the construction of a project is considered to have begun when "physical work of a significant nature" is undertaken. This may include on-site physical work related to the construction of a project or off-site physical work with respect to property that is integral to the operation of a project. Under the 5% Safe Harbor, the construction of a project is considered to have begun when the taxpayer pays or incurs 5% of the total cost of property included in a project that is integral to the production of electricity.

Under both methods, the taxpayer also must make continuous efforts toward completion of the project from and after the date construction is considered to begin under the Physical Work Test or 5% Safe Harbor. The guidance provides a safe harbor under which a taxpayer is deemed to make continuous efforts toward completion of a project if the project is placed in service by the end of the fourth calendar year following the year in which the Physical Work Test or 5% Safe Harbor was satisfied.[4]

Since 2013, these safe harbors have been reaffirmed in multiple IRS notices for multiple types of energy tax credits and continued to apply after the IRA was enacted. The only differences in any of the notices relate to examples of activities and costs needed to satisfy these tests and the length of the continuous efforts safe harbor.[5]

President Trump's Executive Order

On July 7, President Trump issued an EO directing the Secretary of the Treasury to issue, within 45 days, "new and revised guidance" for solar and wind projects for the beginning of construction.

The EO directs the Secretary of the Treasury to issue new and revised guidance as the Secretary deems appropriate and consistent with applicable law to prevent "the artificial acceleration or manipulation of eligibility and by restricting the use of broad safe harbors unless a substantial portion of a subject facility has been built."

The EO creates significant legal uncertainty regarding how to apply the begin construction standard for the period prior to the OBBB and for non-wind/solar credits. For example, Treasury and the IRS could modify or eliminate the 5% Safe Harbor or require more substantial construction to satisfy either test. It is not clear whether such guidance would apply only to wind and solar credits, or whether it would broadly modify the begin construction guidance. We believe that either approach would risk challenges by stakeholders.

First, if Treasury and the IRS issue a different standard for wind and solar than for other credits, the guidance could be challenged under Loper Bright Enterprises v. Raimondo.[6] Second, if Treasury and the IRS apply the guidance retroactively to other begin construction guidance, the guidance could be challenged as violating the Administrative Procedures Act (APA) and/or section 7805(b) regarding retroactive guidance. Third, if the guidance is issued without notice and comment, this similarly could be challenged as an APA violation.

The OBBB incorporates by reference the IRS’s prior begin construction guidance, specifically citing Notice 2013-29 and Notice 2018-59 (as well as any guidance clarifying, modifying, or updating either notice),[7] but it does so in the FEOC provisions in new section 7701(a)(51) and (a)(52). These paragraphs themselves do not refer to the beginning of construction, but the material assistance limitations apply with respect to the sections 45Y and 48E credits for facilities that begin construction after December 31, 2025. Thus, it is not clear how these cross references are intended to apply—it seems odd that Congress would expressly incorporate the IRS's begin construction guidance for purposes of determining whether the material assistance provisions apply, but then modify or limit the IRS’s begin construction guidance for other purposes under sections 45Y and 48E.

Treasury and the IRS will need to balance all of these competing legal arguments. A more limited approach that Treasury could take is to adopt an anti-avoidance rule to prevent developers from meeting the begin construction standard by simply contracting for equipment without starting any physical work or from stockpiling certain equipment, without otherwise modifying the interpretation of the begin construction language in the statute. Any rule adopted by Treasury and the IRS should provide sufficient certainty so that developers have clear guidance on what requirements must be met to secure tax credit eligibility. Otherwise, they may not be able to secure project financing.

Section 45X – Advanced Manufacturing PTC

Section 45X sets the credit values for eligible solar, wind, battery components, and critical minerals that are manufactured and sold to an unrelated person in a taxable year. The OBBB generally maintains eligible components, credit values, and timelines of the original statute, except as discussed below. In addition, the OBBB maintains the election to allow taxpayers to treat the sale of components to a related person as being made to an unrelated person.

Phase-Out for Wind Energy Components and Critical Minerals

The OBBB terminates the credit for wind energy components sold after December 31, 2027, and terminates the credit for critical minerals sold after December 31, 2033, with the phase down occurring in 2031 through 2033. Previously, the credit for wind components phased out after 2032 and the credit for critical minerals was permanent.

The OBBB maintains the existing phase down for other eligible components, with a phasedown starting in 2030 at 75% of the credit; 2031: 50% of the credit; 2032: 25% of the credit; after 2032: 0%.

New Eligibility for Metallurgical Coal and Certain Battery Components

The OBBB provides a new credit for metallurgical coal equal to 2.5% of the costs incurred by the taxpayer to produce the coal and is available through December 31, 2029.

Under the OBBB, "metallurgical coal" is defined as "coal which is suitable for use in the production of steel (within the meaning of the notice published by the Department of Energy entitled 'Critical Material List; Addition of Metallurgical Coal Used for Steelmaking' (90 Fed. Reg. 22711 (May 29, 2025)), regardless whether such production occurs inside or outside of the United States." The additional metallurgical coal aligns with the Trump Administration's support for increased domestic mineral production and increased domestic coal production, particularly to benefit domestic steel manufacturing.

The OBBB also expands the definition of eligible "battery modules" to include essential battery functionality components, such as current-collector assemblies and voltage-sense harnesses.

Sale of Integrated Components

The OBBB tightens the rule permitting integration into an eligible component that is sold to an unrelated party. Under the new rule, the eligible component (the primary component) may be integrated into a secondary component produced at the same facility, and at least 65% of the total direct materials cost must be attributable to the primary component.

Thus, if a taxpayer is vertically integrated, its ability to integrate a primary component into a secondary component is limited by a "same facility" requirement and a 65% primary content floor. But if the taxpayer that produces the primary component is related to the producer of the secondary component, it could still elect to treat the sale as being to an unrelated party without such limitations. As a result, the amendment made by the OBBB creates a disincentive to vertically integrate within a single entity.

Section 45Q – Carbon Oxide Sequestration Credit

The OBBB provides parity for credit values for captured carbon oxide that is disposed of in secure geological storage, utilized, or used as a tertiary injectant. As a result, all end uses of carbon oxide will quality for the higher $17 (or $85 if the prevailing wage and apprenticeship requirements are met) per metric ton credit. The same is true for direct air capture projects at $36 (or $180 if the prevailing wage and apprenticeship requirements are met) per metric ton. Carbon capture projects already placed in service before July 4, 2025, would not be able to claim the higher 45Q credit amounts for these uses.

Section 45U – Zero-Emission Nuclear Power PTC

The OBBB maintains the section 45U credit but, as discussed above, applies FEOC restrictions.

The OBBB also extends the energy communities bonus to apply to communities with advanced nuclear facilities. Specifically, the OBBB adds to the definition of energy community a statistical area with greater than a certain threshold of employment related to the advancement of nuclear power. This amendment does not apply for purposes of the section 48E ITC.

Section 45V – Clean Hydrogen Credit

The OBBB terminates the section 45V credit for projects that begin construction after December 31, 2027. This December 31, 2027 termination date is later than the December 31, 2025 termination date included in initial House-passed version of the OBBB.

Unlike other credits enacted in the IRA, the OBBB does not apply the FEOC restrictions to the section 45V credit.

Section 45Z – Clean Fuel Production Credit

Certain transportation fuel sold before 2028 is eligible for a credit equal to the applicable amount multiplied by an emissions factor. Sustainable aviation fuel is allowed a credit at an enhanced rate. The OBBB makes several changes to the clean fuels credit.

Extension of Credit and Modification of Requirements

The OBBB extends the period the credit can be claimed for transportation fuel by two years, until December 31, 2029. The OBBB also disallows a double credit by excluding from the definition of creditable fuel that which is produced from a fuel for which a section 45Z credit was already claimed.

After December 31, 2025, the OBBB prohibits the credit for fuel derived from feedstocks that are produced or grown outside the United States, Mexico, or Canada.

The OBBB prohibits negative emissions rates, except in the case of animal-manure-based fuels, and excludes indirect land use changes for the purposes of lifecycle greenhouse gas emissions. It directs the Secretary of the Treasury to provide an emissions rate for specific animal manure feedstock. The Secretary is also authorized to provide rules addressing certain related-party sales.

Sustainable Aviation Fuel

The OBBB eliminates the enhanced credit amounts for sustainable aviation fuel after December 31, 2025. The OBBB also terminates the excise tax credit for sustainable aviation fuel credit under section 6426(k) after September 30, 2025, and disallows the credit for any fuel for which a section 45Z credit was claimed.

Section 40A – Biodiesel and Renewable Diesel Used as Fuel

The OBBB extends the small agri-biodiesel producer credit from December 31, 2024 until December 31, 2026, and increases it from 10 cents to 20 cents per gallon. The OBBB also provides that this credit is in addition to any credit under section 45Z.

Similar to section 45Z, eligible small agri-biodiesel producers must exclusively derive the fuel from feedstock produced or grown in the United States, Mexico, or Canada.

The OBBB also allows transferability for the section 40A small argi-biodiesel producer credit.

Section 48C – Advanced Energy Project Credit

The section 48C credit is an allocated credit, meaning the taxpayer must apply and the IRS must approve and award an allocation to the taxpayer before it may be claimed on the taxpayer’s return. The IRA allocated $10 billion in section 48C credits to be awarded by the IRS.

The Biden Administration issued the full $10 billion in credits, but taxpayers who received the allocation must meet certification and placed in service requirements to claim the credit. If the deadlines are not met, the taxpayers forfeit the credits. In the previous section 48C allocation rounds, the IRS has reissued the forfeited credits.

The OBBB restricts funds returned from forfeited section 48C credits from being later reissued.

Sections 25E, 30D, 45W, and 30C – Clean Vehicle and Refueling Infrastructure Credits

The OBBB terminates the credits for new clean vehicles under section 30D, used clean vehicles under section 25E, and commercial clean vehicles under section 45W for vehicles acquired after September 30, 2025.

The OBBB also terminates the credits for electric vehicle charging and alternative fuel refueling equipment under section 30C for property placed in service after June 30, 2026.

Sections 25C, 25D, and 45L, and 179D – Residential Clean Energy Credits and Commercial Building Deduction

The OBBB terminates the section 25C credit for energy efficient home improvements with respect to property placed in service after December 31, 2022, and the section 25D credit for residential clean energy property with respect to any expenditures made after December 31, 2025.

The OBBB terminates the section 45L new energy efficient homes credit and the section 179D energy efficient commercial building deduction with respect to homes acquired or property the construction of which begins after June 30, 2026.

Section 48D – Advanced Manufacturing Investment Tax Credit

The OBBB increases the CHIPS Act’s section 48D credit for semiconductor and semiconductor equipment manufacturing facilities to 35% (previously 25%) for property that is placed in service after December 31, 2025.

The OBBB did not change the termination date, so the credit will expire at the end of 2026. As a result, this change is likely to only benefit existing projects that are already planned and under construction.

Section 6418 – Transferability of Certain Credits

The OBBB generally retains transferability for the lives of the eligible credits. Although the OBBB preserved transferability, the early termination of several of the IRA’s tax credits, including the section 45Y PTC and section 48 ITC, limits the benefits of retaining transferability.

The OBBB amended the existing transferability provisions to prohibit the transfer of credits to Specified Foreign Entities, which will require additional due diligence by buyers of credits. In addition, the OBBB added transferability for the section 40A(b)(4) small agri-biodiesel producer credit.

Section 7704 – Expansion of Master Limited Partnerships (MLPs)

MLPs offer investors treatment as a partnership for federal income tax purposes (and no corporate level taxation) if at least 90% percent the MLP’s gross income for every taxable year consists of "qualifying income." Qualifying income has been limited to income from oil and gas exploration, development, mining, production, processing, and refining.

The OBBB expands the definition of qualifying income to include transportation or storage of liquified hydrogen or compressed hydrogen; carbon capture facilities; the production of electricity from advanced nuclear, hydropower, and geothermal facilities.

Section 56A – Corporate Alternative Minimum Tax (CAMT) – Intangible Drilling and Development Costs

Section 56A defines adjusted financial statement income for purposes of the 15% CAMT. The computation starts with financial statement income and is adjusted as provided in section 56A. The OBBB permits a deduction for intangible drilling and development costs for oil, gas, and geothermal wells for purposes of the CAMT for taxable years beginning after December 31, 2025.

[1] For this purpose, control generally is defined by such persons or entities beneficially owning (1) more than 50% of the vote or value of a corporation, (2) more than 50% of the capital or profits interest of a partnership, or (3) more than 50% of the beneficial interests of other entities.

[2] For purposes of determining whether the 50% ownership threshold is met, all of the stock owned actually and constructively by the person concerned must be aggregated. Treas. Reg. § 1.318-1(b)(3).

[3] There is an exception for licensing or related agreements that are part of a bona fide purchase or sale of intellectual property.

[4] The four-year safe harbor was introduced by Notice 2017-4; the notices prior to that had provided specific dates by which the facility had to be placed in service to satisfy the continuous efforts safe harbor.

[5] See, e.g., Notice 2013-60; Notice 2014-46, Notice 2015-25, Notice 2016-31, Notice 2017-4, Notice 2018-59, Notice 2019-43, Notice 2020-12 (begin construction guidance for section 45Q), Notice 2020-41, Notice 2021-5, Notice 2021-41, and Notice 2022-61 (affirming that existing begin construction guidance applies to the IRA’s prevailing wage and apprenticeship rules).

[6] 630 U.S. 369 (2024).

[7] OBBB, § 70512(c) (adding new section 7701(a)(51) defining prohibited foreign entity).