Overview

This article is current at the time of posting.

In the months immediately following President Trump’s decision to suspend the imposition of “reciprocal tariffs” up to 50% on the United States’ major trading partners until July 9, 2025 (later extended to August 1, 2025), US importers and trading partners enjoyed some relative stability, as they were able to factor in a blanket 10% reciprocal tariff. However, as this deadline has neared, President Trump has sent letters to numerous US trading partners, threatening to reimpose higher reciprocal tariffs, sometimes at rates different from and higher than those originally announced on April 2, 2025 (i.e., "Liberation Day").

In the weeks leading up to this deadline, many US trading partners have been seeking to reach trade agreements with the United States to prevent the reimposition of these higher tariffs, but this process has proven to be difficult. Countries like China, United Kingdom, India, Malaysia and Vietnam and South Korea have all publicly discussed their negotiations with the United States, and a few – most notably China, the United Kingdom, and Vietnam – have announced that limited trade agreements or frameworks had been reached. But in the weeks following those announcements, the lack of formal documentation, and even suggestions of differences in understanding as to the deal reached, suggest that even these agreements may not be final.

This post provides an overview of recent announcements to President Trump's reciprocal tariff program, and the negotiations underway to mitigate the tariff impact.

Background

On April 2, 2025, President Trump issued an Executive Order invoking the International Emergency Economic Powers Act (IEEPA) to address persistent US trade deficits by imposing "reciprocal tariffs." This included a global 10% tariff on all imports, with higher country-specific tariffs ranging from 11-55% on imports from nearly 60 US trading partners with high trade in goods deficits with the United States. (Numerous products were exempted from these tariffs, though many of those were subject to tariffs or potential tariffs under other policies.) On April 9, 2025, President Trump delayed the implementation of the higher reciprocal tariffs until July 9, 2025 to allow time to address the national and economic security concerns of the United States.

These actions provoked widespread international criticism, successful legal challenges, and significant concerns from US industry groups over cost increases and supply chain disruptions.

Trade Deals Taking Shape

During the temporary pause of the reciprocal tariffs, the United States announced the contours of trade frameworks with the United Kingdom, China, and Vietnam. But in recent days, the validity of these agreements has come into question.

The United Kingdom

On May 8, 2025, the United States and the United Kingdom (UK) announced an "Economic Prosperity Deal" that seeks to reduce trade barriers between the trading partners. Among its provisions, the limited agreement reduces or eliminates tariffs on each other's exports of cars, steel, aluminum, jet engines, and other aerospace products. Further, the partners agreed to reduce non-tariff barriers and continue discussions on customs and procurement processes and digital trade matters (namely, the UK's digital services tax). On June 16, 2025, President Trump issued an Executive Order to operationalize aspects of the Economic Prosperity Deal. However, further progress has not been announced and long-standing trade and economic policy disagreements may inhibit negotiations from progressing further.

China

Following the initial announcement of reciprocal tariffs against China of 34% and a tit-for-tat exchange of tariff hikes, the US tariff rate on imports from China escalated to 125% – imposed in addition to 20% tariffs previously imposed over concerns over the movement of illegal aliens and illicit opioids. Following a tentative agreement, the United States lowered its tariff on imports from China to 10% until August 10, 2025.

On June 11, 2025, the United States and China announced the initial stages of an agreement to reduce trade and immigration tensions. The United States and China reportedly signed a trade agreement in late June, though the specific details have not been published. According to the parties, the agreement will allow US firms to obtain magnets and certain rare earth minerals from China that are critical for manufacturing and semiconductor production. The US also reportedly agreed to stop efforts to revoke visas of Chinese nationals on US college campuses, and discussions are reportedly ongoing to address additional matters such as export controls and China's economic policies.

Vietnam

On July 2, 2025, the United States and Vietnam announced that a trade agreement had been reached with Vietnam. However, no official documents have been issued by either party, and few concrete details have emerged. According to President Trump, the United States agreed to lower its threatened 46% reciprocal tariff rate to 20%. Imports "transshipped" through Vietnam will reportedly face a 40% tariff, though the precise definition of that term was not explained. In exchange, Trump said Vietnam agreed to completely remove tariffs on US imports.

However, recent reports indicate significant disagreements about the framework remain, and the deal has not been finalized. More critically, however, Vietnam has claimed in recent press reports that it understood that the United States had agreed to a 10% tariff on all imports from Vietnam. The lack of any official documentation and the public disagreement over the terms of the deal struck suggest that serious differences may remain between the countries.

Future Deals/Frameworks

Among the trading partners reportedly negotiating substantive trade frameworks with the United States are Canada, Mexico, the European Union, and India, though even fewer details on these negotiations have been made publicly available.

Tariffs Delayed and Additional Tariffs Threatened

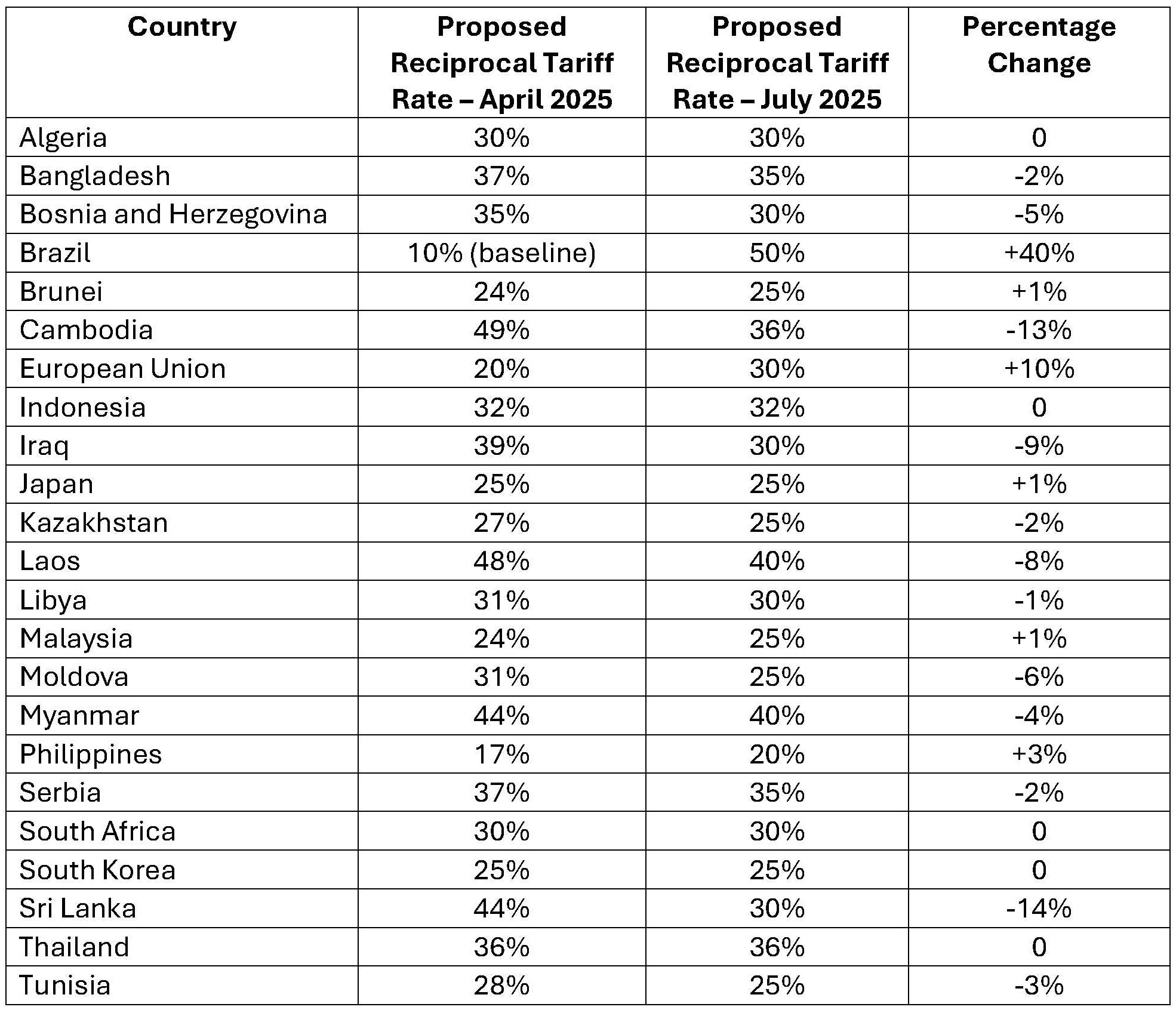

On July 7, 2025, the same day that the last extension of the 10% baseline reciprocal tariff was announced, President Trump began sending letters to US trading partners, threatening to impose reciprocal tariffs by August 1, 2025 in the absence of progress on trade negotiations with the United States. The following trading partners received such letters:

On July 10, 2025, President Trump said he plans to impose blanket levies of 15-20% on trading partners that have not received updated reciprocal tariff rates. Finally, President Trump has most recently threatened to increase tariffs on imports from Canada to 35% and on imports from Mexico to 30%. Initially, Canada and Mexico were not subject to reciprocal tariffs as they were subject to earlier tariff actions.

The reactions from US trading partners have been mixed, with some vowing to harden their negotiating positions and others praising the Administration for reducing their proposed reciprocal tariff rates and committing to continue negotiations on their respective "trade deals."

One complicating factor in the negotiations will be the ongoing, sector-specific Section 232 investigations into national security risks posed by imports which could lead to tariffs on products critical to many US trading partners, such as in the automotive, steel, semiconductor, and pharmaceutical industries. The tentative agreement with the UK provided some relief as to the Section 232 tariffs applied to imports of steel/aluminum and autos/auto parts. But it is unclear whether similar relief would be granted under other agreements, particularly as to countries that export these products in much greater volumes than the UK.

Further, litigation developments could inject significant uncertainty into ongoing and future tariff and trade deal negotiations. Decisions could provide justifications for the president's tariff actions, enabling the president to seek greater concessions from trading partners. On the other hand, courts could limit the president's authority to invoke IEEPA to impose tariffs and the president may turn to other tariff authorities to invoke tariffs and/or use as leverage for negotiating limited trade deals.

For more information on these actions, assistance with compliance, or questions on how the tariffs may impact your business, please contact a member of Steptoe's Trade Policy practice.