2024 FCPA Year In Review and 2025 Outlook

The 2024 FCPA docket reflected continued steady enforcement against both companies and individuals, with the Department of Justice bringing eight corporate enforcement cases and a dozen cases against individuals, and the SEC charging six companies and two individuals. The range of industries involved in these matters was diverse, and included software, energy commodities trading, manufacturing, defense, telecommunications, online gaming, consulting, and aviation companies. As in past years, the caseload reflected a heavy proportion of non-U.S. companies caught up in these matters.

The DOJ was active in pursuing prosecutions of executives and other individuals, and indeed litigated four such cases in 2024, obtaining convictions in all. In 2025, despite the Trump Administration’s "pause" on new FCPA matters and directive to the Attorney General to review DOJ policy in this area, there are several cases scheduled for trial after being reviewed under the President’s Executive Order regarding the FCPA. See Perspective on the Executive Order on FCPA Enforcement, https://www.steptoe.com/en/news-publications/perspective-on-the-executive-order-on-fcpa-enforcement.html.

In 2024, the number of cases involving formal declinations under the DOJ’s Corporate Enforcement Policy remained low – indeed, there was only one. The Department had, however, been continuing to make strong efforts to demonstrate how it credited disclosure, cooperation, and remediation under the CEP. We will continue to monitor the approach by the current Department of Justice.

It also remains to be seen how often and in what types of cases the DOJ – and SEC – will decide to bring either corporate or individual matters under this administration. For example, the FCPA was amply enforced against non-US companies during the first Trump Administration, and it would not be surprising to see that pattern repeat itself. Overall, however, we anticipate enforcement in this area will be less predictable and potentially less transparent, both factors that mean that all companies that confront corruption risk in conducting business in the global marketplace cannot let down their guard.

Below, we break down the 2024 docket and key trends over the past decade in FCPA enforcement, including overall and by region, and we provide summaries of last year’s cases to help in understanding the types of conduct, business dealings, and geographies where these matters have arisen.

Number of Reported Cases

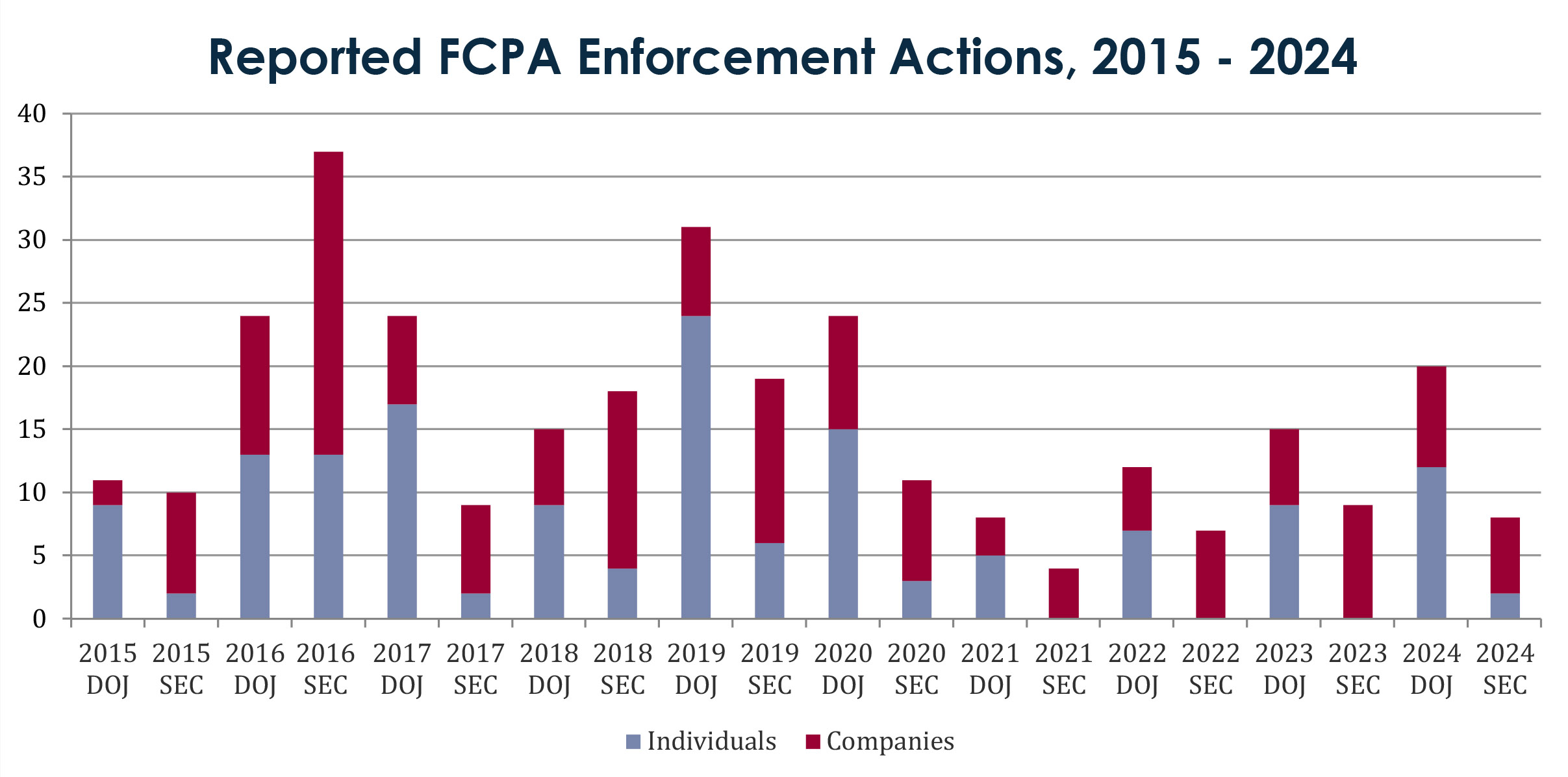

The total number of FCPA enforcement actions brought by the DOJ and/or SEC in 2024 increased from prior years to a total of 28 actions against either corporate entities or individuals. By comparison, in 2023 and 2022, there were 24 and 19 actions respectively. Companies in a variety of industries were the focus of the cases brought in 2024, including those in software, energy commodity trading, manufacturing, defense, telecommunications, online sports lottery, consulting, and aviation.

In 2024, the DOJ’s docket included eight corporate enforcement matters and 12 cases brought against individuals, while the SEC's docket of nine enforcement matters consisted of six corporate cases and two against individuals.

Breakdown of cases by agency and enforcement target (individuals vs. companies) over the last 10 years.

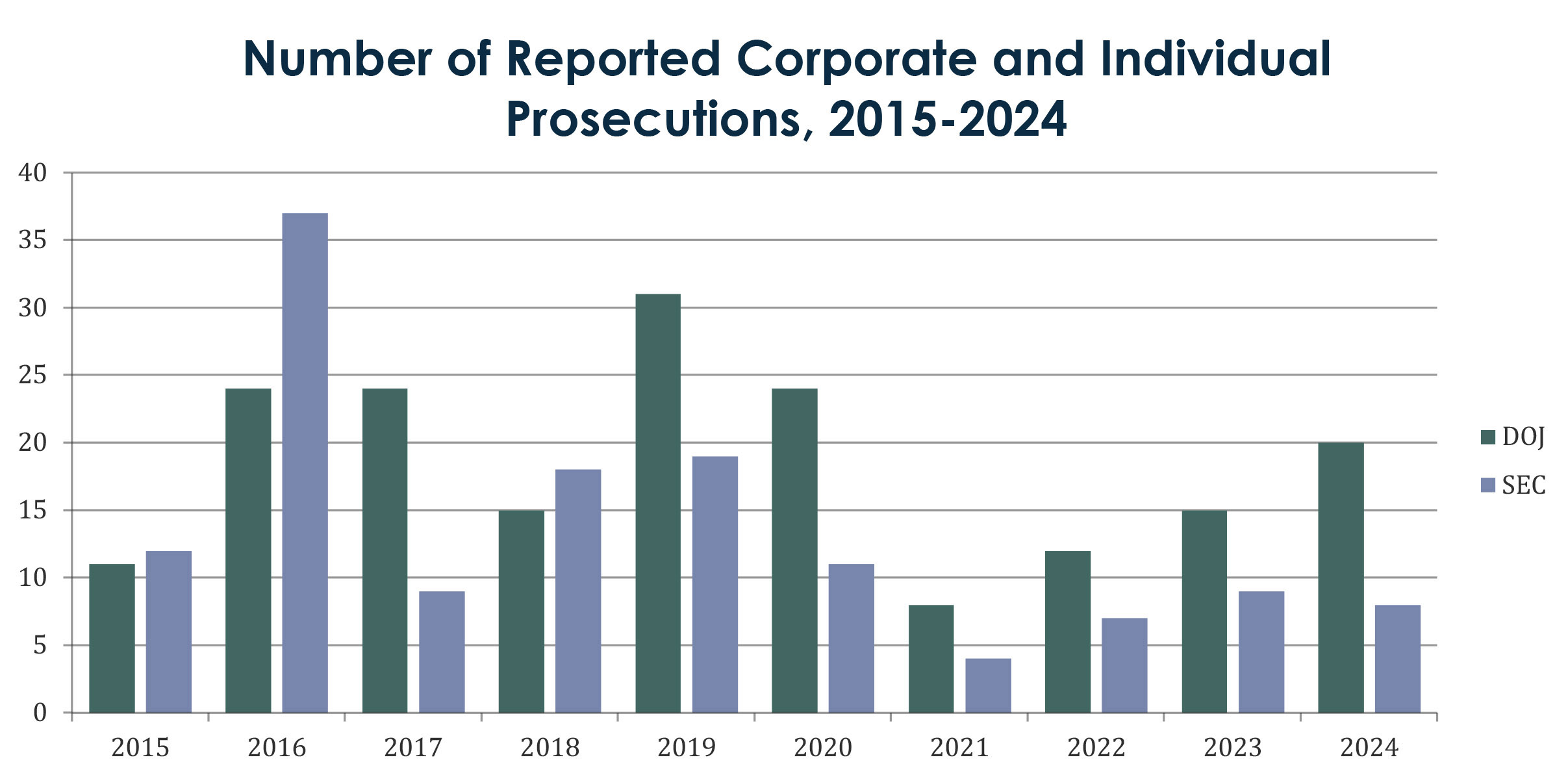

Total number of cases prosecuted by the DOJ and SEC over the past 10 years.

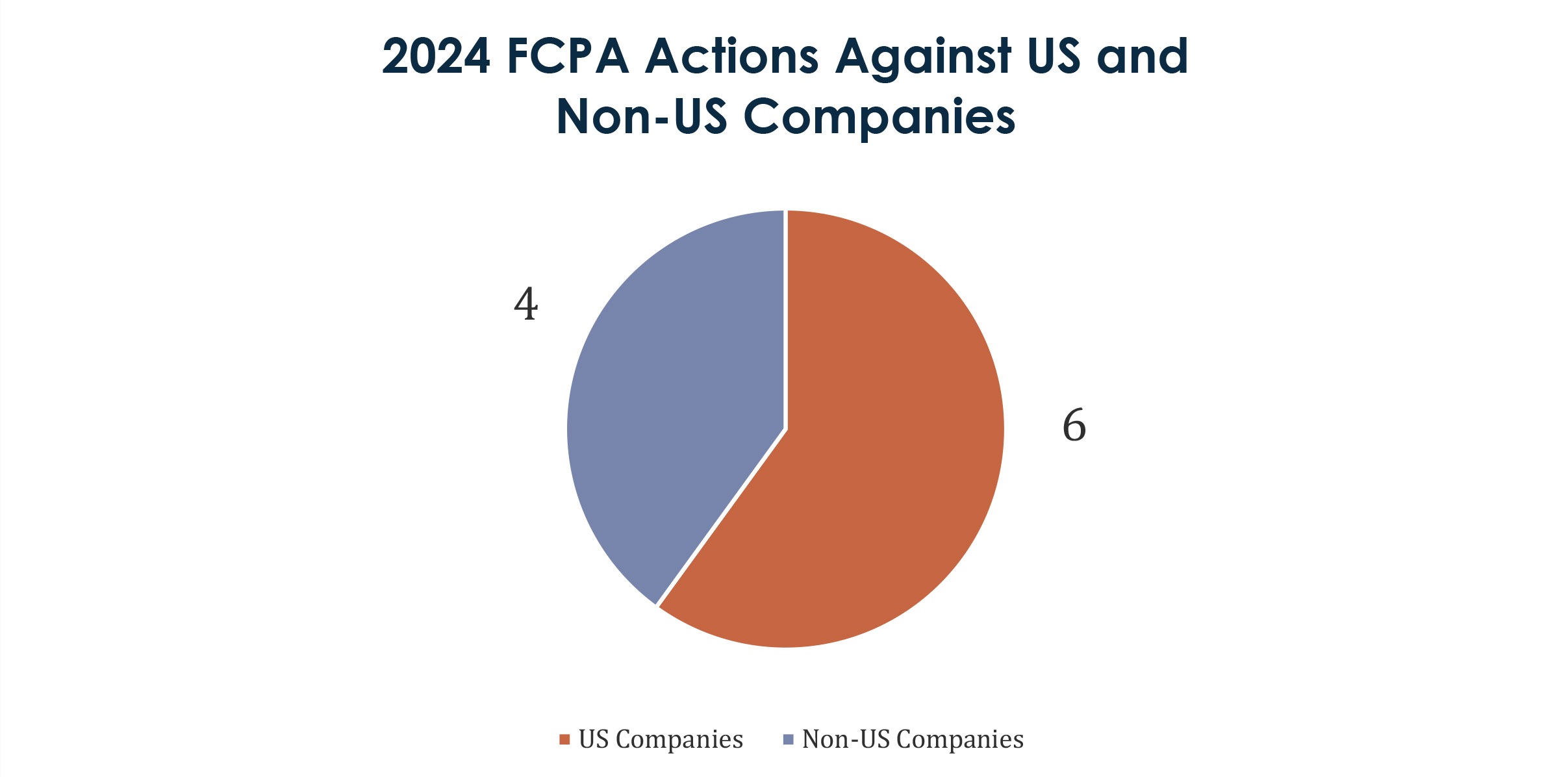

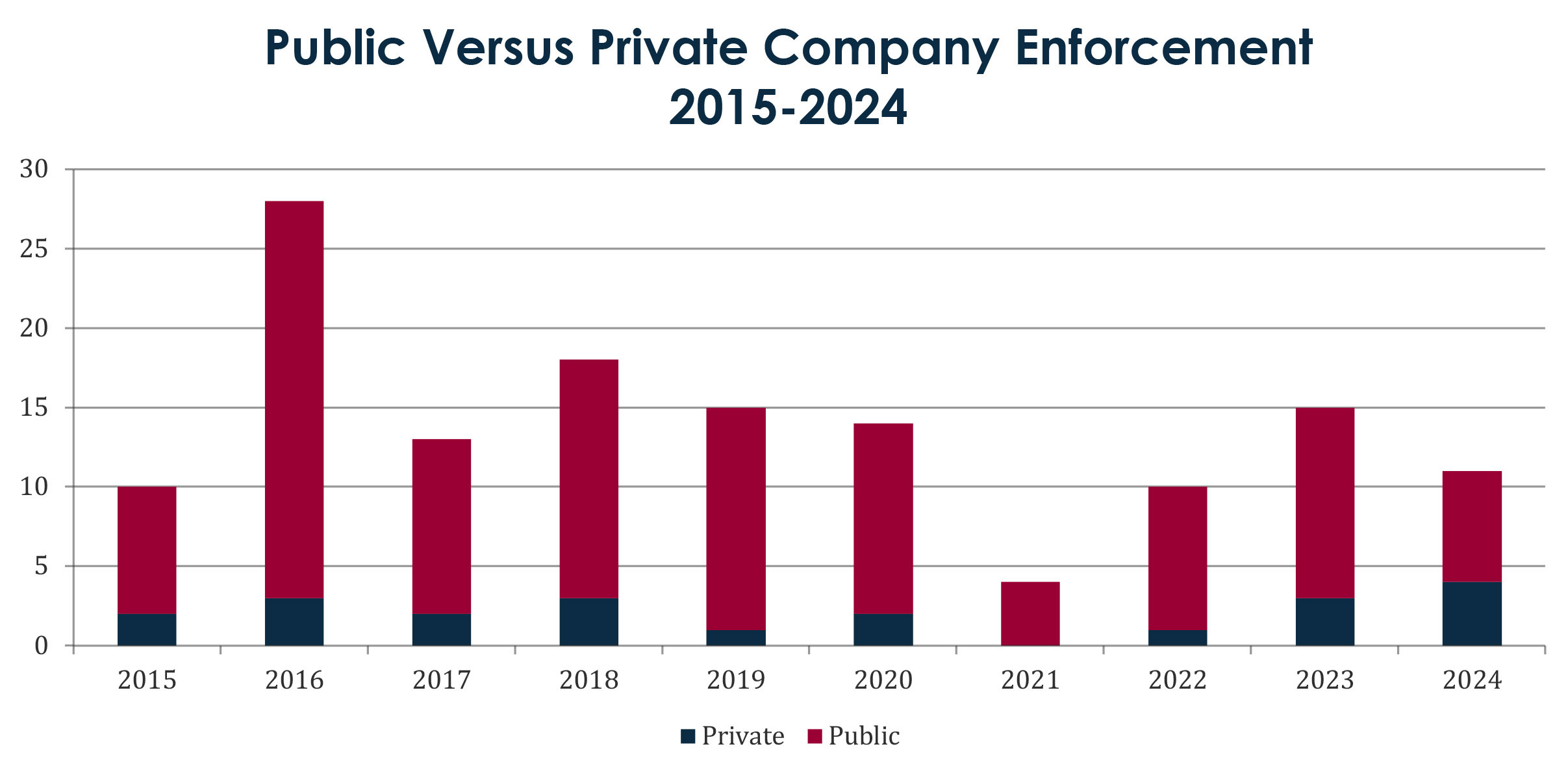

II. US vs. Foreign Companies

Of the ten companies charged in 2024 by either the DOJ or SEC, four were domestic, and five were foreign. This is more balanced compared with, in 2023, the authorities' charges against five US and eight foreign entities. Cumulatively, over the past ten years, the docket has been roughly split between US and foreign companies.

Proportion between US and foreign companies charged by the DOJ, the SEC, or both over the past 10 years.

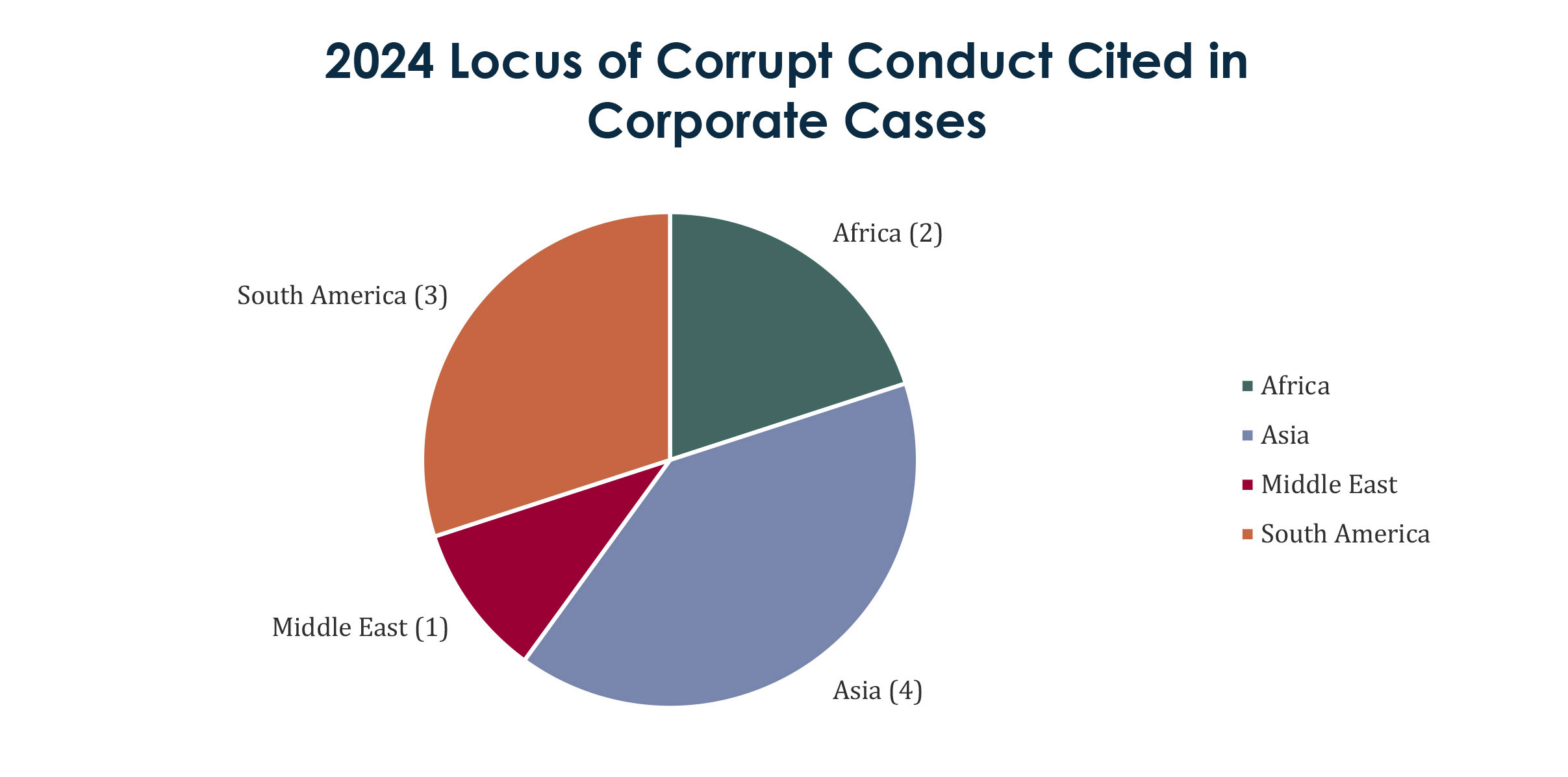

III. Geography of Conduct

Consistent with prior years, conduct alleged to violate the FCPA-related occurred in a diverse range of jurisdictions, with a larger percentage arising in Asia, followed by South America within LATAM, and Africa.1

Geographic location of conduct charged by the DOJ, the SEC, or both in 2024.

1 The enforcement against SAP SE involved conduct that occurred broadly throughout Africa and Asia. Some of the conduct occurred in Azerbaijan, which straddles the geographic border between Europe and Asia. Due solely to the geographic location, our calculations include Azerbaijan as being in Asia for the purposes of this analysis.

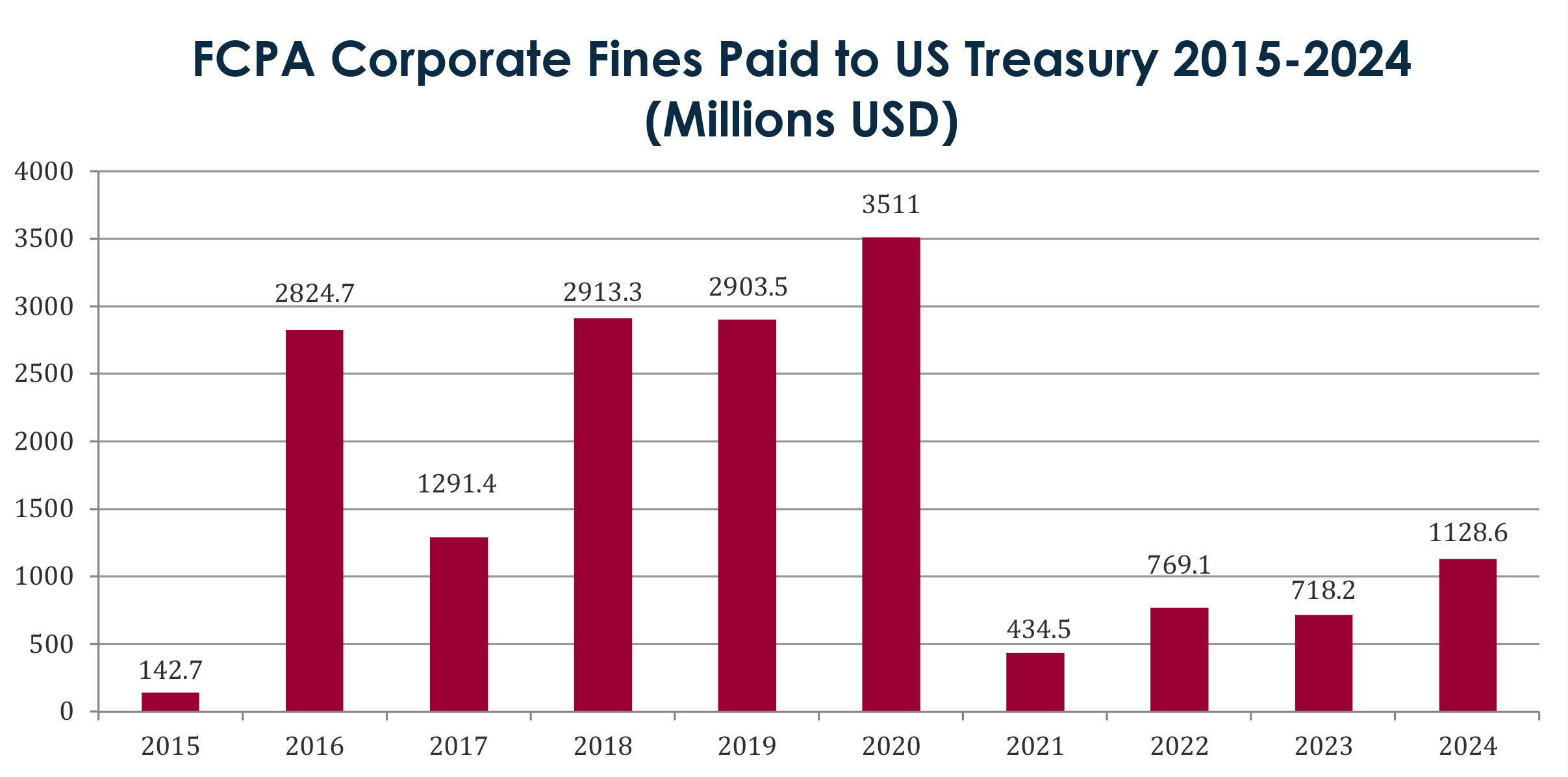

IV. Corporate Fines

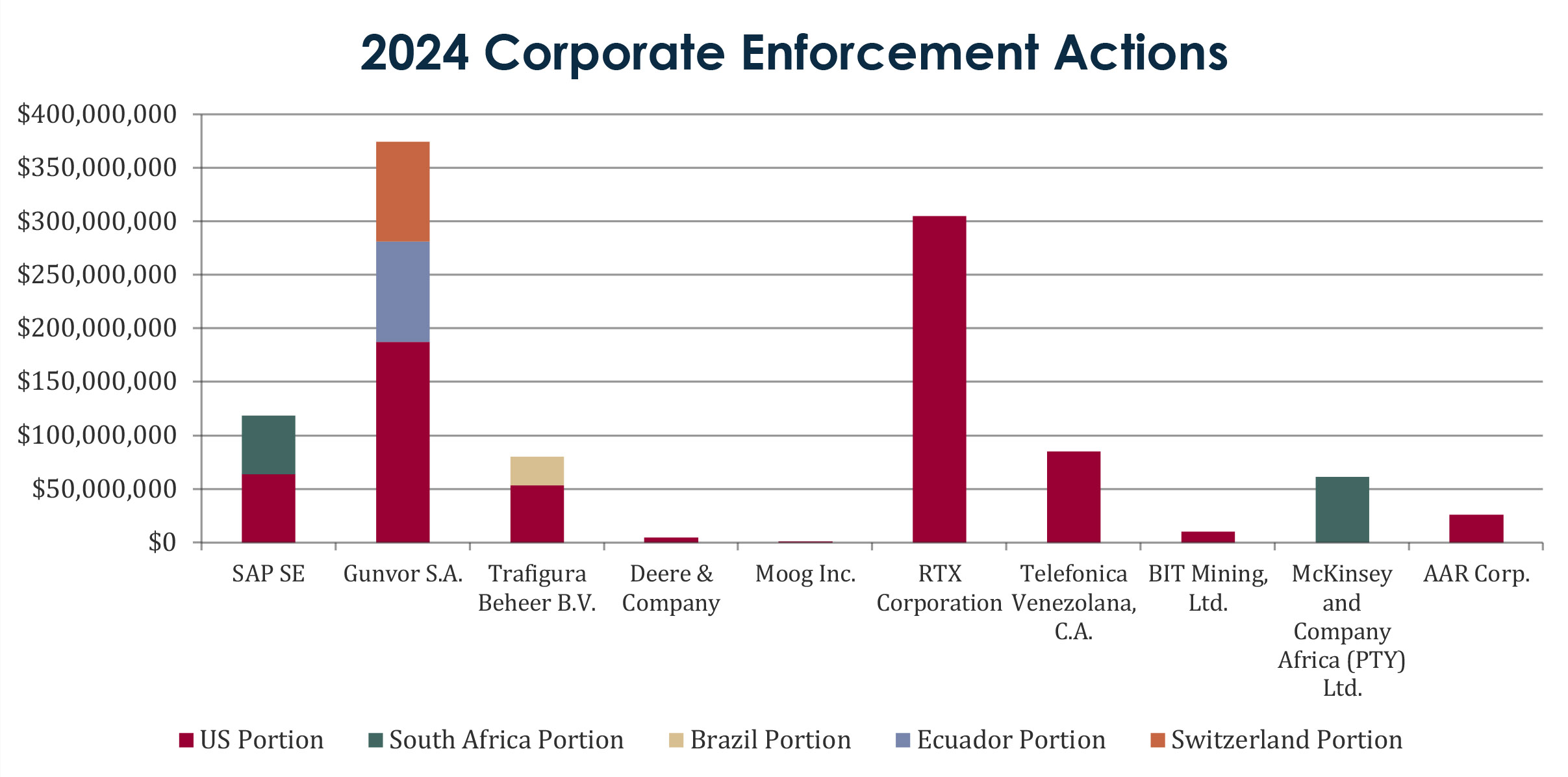

The aggregate dollar value of monetary sanctions imposed by the DOJ and SEC for FCPA-related offenses in 2024 was approximately US$1.12 billion.2 This is a substantial increase from the previous three years. Additionally, 2024 saw an increase in the number of concurrent prosecutions, with the US Government crediting fines paid to four different jurisdictions (Switzerland, Ecuador, Brazil, and South Africa). It is noteworthy that the Swiss-based commodities trading company Gunvor S.A. entered into a US$661 million settlement to resolve a DOJ investigation, US$187.2 of which was shared with Switzerland and Ecuador.

Total corporate fines over the past 10 years.

2As part of its settlement, RTX Corp. agreed to pay US$21,904,850 to resolve ITAR-related misconduct. This amount is included in the aggregate monetary sanctions because the ITAR and FCPA cases were resolved in the same agreement.

Total fines from each enforcement and corresponding beneficiaries in 2024.

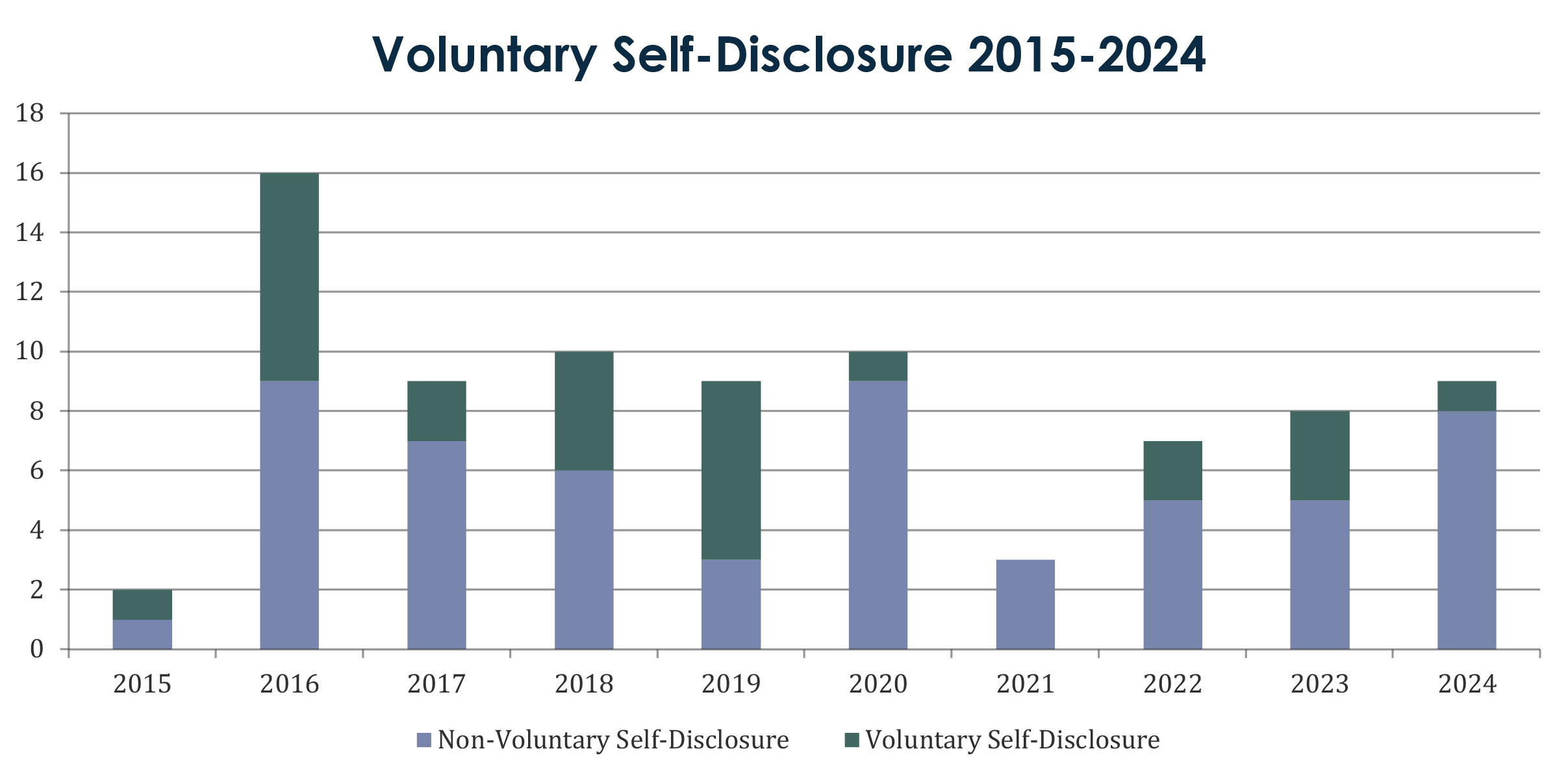

V. Voluntary Disclosure

The DOJ established the Corporate Enforcement Policy (CEP) in 2016 as a pilot program for FCPA cases. Revised over the years, it affords various levels of "credit" for companies that voluntarily disclose, cooperate, and successfully remediate FCPA matters. The SEC also takes these factors into account when determining whether to bring an enforcement action against a company and how much to penalize an entity, although its approach is not as clearly defined as the CEP.

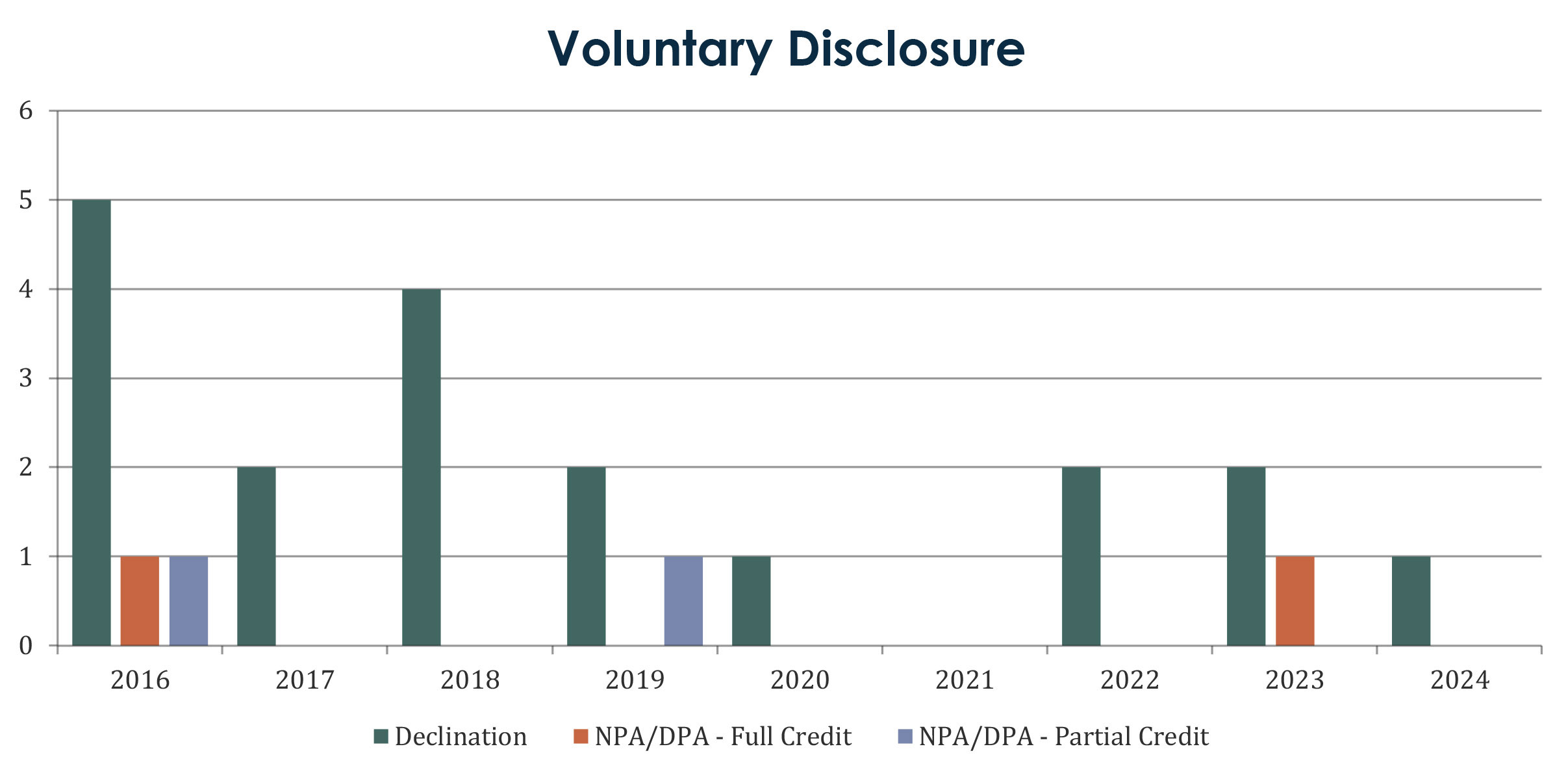

Under the CEP, where the DOJ determines that a company has voluntarily disclosed the conduct and fully cooperated and remediated, there is a presumption that the DOJ will decline to bring an enforcement action. This is known as a formal declination, documented with a letter issued by the DOJ and made available on its website. No criminal fine or other sanction is imposed in these cases other than a requirement that the company forfeits any ill-gotten gains.

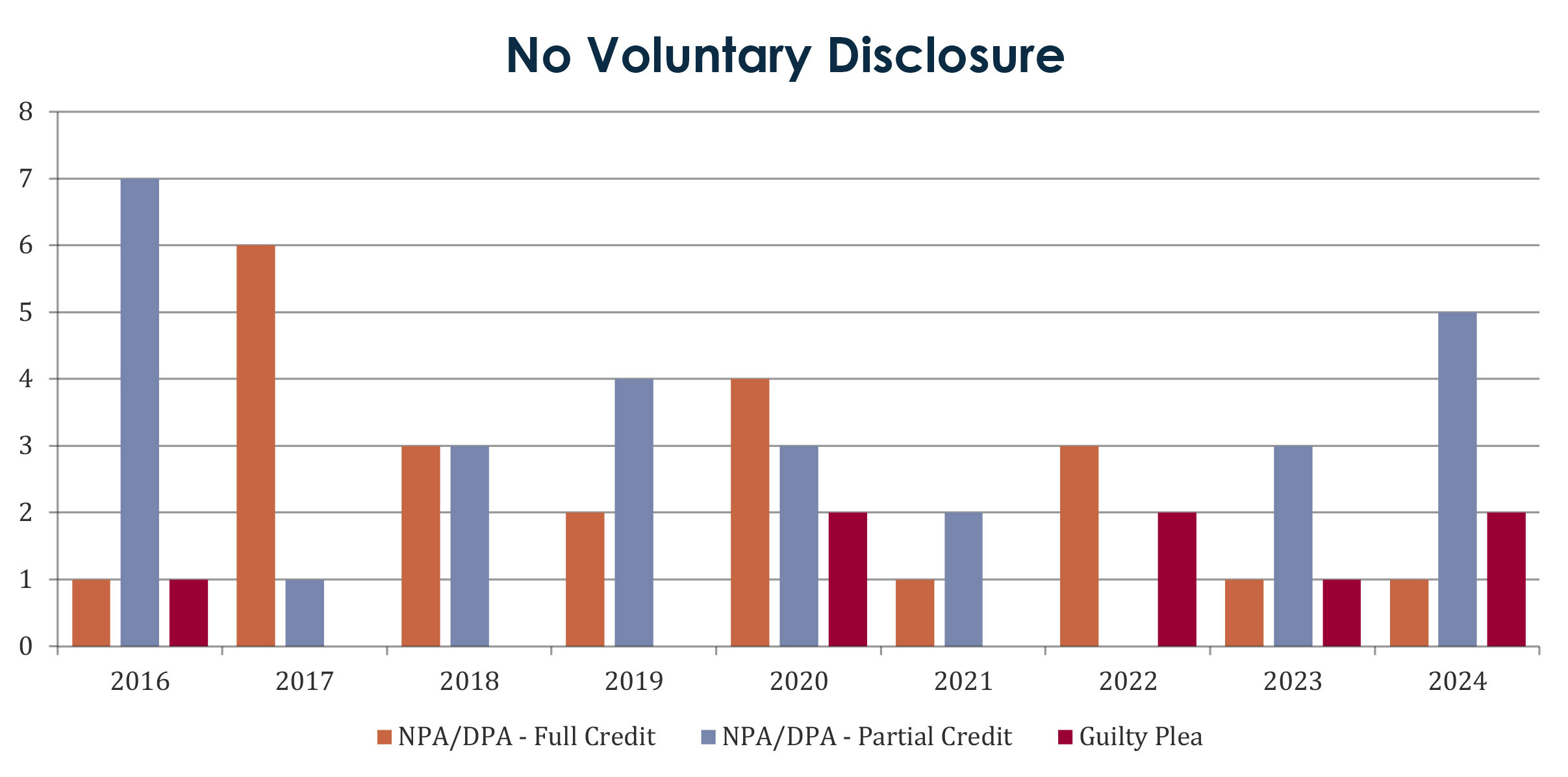

Companies that do not voluntarily disclose, or that disclose but are not deemed eligible for a declination due to other circumstances, can still receive certain leniency with respect to the fines imposed and other sanctions and requirements. Updates to the CEP in January 2023 allow the department to grant up to a 50% reduction off the low end of the US Sentencing Guidelines fine range in actions where companies did not voluntarily disclose but still fully cooperate and appropriately and timely remediate, and up to a 75% reduction where there has been a voluntary disclosure.

The 2024 docket included one formal declination for Boston Consulting Group, which made a voluntary disclosure. None of the enforcement actions brought against other companies involved voluntary disclosure, nor did any of those companies receive full credit for cooperation, although they all received some level of credit.

Only one company received a declination under the CEP in 2024

Types of resolutions in voluntary disclosure cases.

Types of resolutions in no voluntary disclosure cases.

Historically, publicly held companies ("issuers") have comprised the majority of the FCPA docket,

and this remained the case in 2024.

The Top Europe, Middle East, and Africa FCPA Actions of 2024

FCPA enforcement in the EMEA region continued in 2024, with three of the six Securities & Exchange Commission (SEC) corporate enforcement actions and four of the eight US Department of Justice (DOJ) corporate actions touching the region. There were, in total, five corporate resolutions related to conduct in EMEA or involving companies headquartered in EMEA: three resulted in DPAs with a requirement of three years of annual self-reporting on compliance program enhancements; one resulted in an NPA; and one resulted in a declination. The only company not headquartered in the US is SAP SE, which is based in Germany. Historically, there have been more corporate resolutions against companies headquartered outside the United States.

Continued focus on South Africa

Three of the five matters involving conduct or companies headquartered in EMEA in 2024 included conduct in South Africa. Moreover, two of those corporate resolutions were coordinated with the South African authorities (SAP and McKinsey) following the first coordinated resolution in 2023 involving ABB. In its Press Release, the DOJ stated that the McKinsey resolution was evidence that the International Corporate Anti-Bribery (ICAB) initiative, announced in November 2023, was bearing fruit. The ICAB is a formalization of a years-long effort to cooperate and coordinate with authorities abroad to enhance their anti-corruption laws and enforcement.

South Africa has been making strides to combat corruption in recent years. This includes the creation of the Zondo Commission to investigate alleged “state capture" during the presidency of Jacob Zuma and the enactment of the new offense for failure to prevent corruption, aimed at simplifying the prosecution of companies for corruption. A defense is available for a company with "adequate procedures" in place at the time of the corrupt conduct, mirroring the concept from the United Kingdom Bribery Act. Further legislative enhancements were introduced in 2024, including the creation of a new anti-corruption commission.

While much of the investigative focus has been on Eskom, the government-owned energy company, the investigations have not been limited to energy and infrastructure firms (such as SAP and ABB) but have also expanded to professional services firms, including McKinsey, and, reportedly, law firms.

Much of the conduct at issue in the resolutions reached this year, with conduct in South Africa, is dated—stating that it was in 2012 and mostly running through 2016. This demonstrates that corruption conduct can have long-lasting consequences for companies with long-running investigations and subsequent remedial measures.

It is unclear whether coordination will continue with the South African authorities, and we note that President Trump’s February 7, 2025 Executive Order ("Addressing Egregious Actions of the Republic of South Africa") is likely to strain relations, but could also prompt the South African authorities to continue to focus on their own anti-corruption efforts against American companies.

Corporate Enforcement

1. McKinsey and Company Africa (PTY) Ltd.

On December 5, 2024, the DOJ announced that McKinsey and Company Africa, a wholly owned and controlled subsidiary of US-headquartered consulting firm McKinsey & Company Inc., will pay over US$122 million, pursuant to a three-year deferred prosecution agreement (DPA), to resolve an investigation by the DOJ into a scheme to pay bribes to government officials in South Africa between 2012 and 2016.

Takeaways: The DPA cites a few compliance failures, including not completing the due diligence on a third party prior to commencing work, continuing to use the third party after it had been rejected in the due diligence process, and allowing a foreign official to recommend the third-party to rely upon for local source requirements. McKinsey received credit for cooperation and remediation, although not for voluntary self-disclosure. Despite receiving credit for remediation, McKinsey is still required to provide annual reporting on its ongoing remediation efforts for three years. Remediation efforts included some more expansive efforts than the standard examples cited in corporate resolutions, including ceasing all work with state-owned enterprises while McKinsey conducted its internal investigation, enhanced review for all sole-source work for public sector clients, and reporting to the DOJ on a partner's deletion of relevant emails and disclosing the individual’s personal email and bank account information to enable the DOJ to obtain relevant evidence.

2. SAP SE

SAP SE, the global software company headquartered in Germany, agreed to pay over US$220 million to settle FCPA violations with the SEC and DOJ, pursuant to a three-year DPA. From 2013 to 2022, SAP employed third-party intermediaries and consultants to pay bribes to government officials to obtain business in South Africa, Malawi, Kenya, Tanzania, Ghana, Indonesia, and Azerbaijan. The bribery included cash payments, political contributions, luxury goods, and shopping trips for government officials and their families. In South Africa, various benefits were provided to Eskom and the Department of Water and Sanitation, as well as foreign officials at the municipal level. SAP, like McKinsey, is subject to a requirement of three years of self-reporting on its compliance program despite the robust remediation measures taken prior to resolution.

Takeaway: The South African conduct came to the DOJ's attention following investigative reporting in South Africa, exemplifying how local attention to corrupt conduct can have wide-reaching consequences. SAP undertook extensive remedial measures, including eliminating its third-party sales commission model globally and prohibiting all sales commissions for public sector contracts in high-risk markets—many sectors rely on third-party sales models, and this remedial measure makes it appear that commonly used sales models are inherently risky.

3. Raytheon Company

The Raytheon Company, a subsidiary of Virginia-based defense contractor RTX, entered into a US$950 million global settlement with multiple DOJ divisions and the SEC to resolve, among other matters, charges brought under the FCPA, the Arms Export Controls Act (AECA), and the International Traffic in Arms Regulations (ITAR).

The FCPA conduct relates to a scheme to bribe a high-level official at the Qatar Emiri Air Force to obtain contract awards between 2012 and 2016 in connection with a Qatari program to update the country's air defense systems. Raytheon agreed to a three-year DPA, a US$230.4 million fine to resolve the FCPA DOJ investigation, and a civil penalty of US$75 million for the SEC's parallel FCPA investigation (US$22.5 million of which will be credited against the criminal monetary penalty).

Takeaway: The company did not receive full credit for cooperation because the DOJ took the view that the company's early cooperation efforts were insufficient, stating that the company was slow at times to respond to the government’s requests and did not provide relevant information in its possession.

4. AAR Corp.

On December 19, 2024, the DOJ and SEC announced that AAR, an Illinois-based aviation services company, would pay over US$55 million to settle FCPA allegations, pursuant to an 18-month non-prosecution agreement ("NPA"). The conduct related to efforts to secure contracts with two state-owned airlines: South African Airways and Nepal Airlines.

Takeaway: AAR might have otherwise received a declination, but the DOJ determined that the company’s disclosure to the DOJ did not satisfy the Criminal Division's policy on self-disclosure as several English-language articles citing irregularities with the contracts in both Nepal and South Africa preceded the company’s disclosure to the DOJ. AAR did receive credit for its self-reporting under the "cooperation" prong of the corporate enforcement policy. It is also noteworthy that this case was investigated by the Homeland Security Investigations New York Field Office, demonstrating that HSI was actively involved in pursuing foreign corrupt conduct.

5. BCG Consulting

The Boston Consulting Group obtained a formal declination in connection with an alleged scheme between 2011-2017 to bribe government officials in Angola in order to obtain contracts. The company had paid an agent in Angola approximately US$4.3 million in commissions to help obtain business with the Angolan Ministry of Economy and the National Bank of Angola. Certain BCG employees in Portugal were aware that the agent had close ties to Angolan Government officials and members of the ruling political party and agreed to pay the agent 20 to 35 percent of the value of any government contracts procured and sent the funds to the agent's three different offshore entities.

Takeaway: BCG obtained a formal declination from the DOJ by making a timely and voluntary disclosure, engaging in full cooperation and remediation (including termination of the personnel involved), improving the compliance program, and disgorging profits of approximately US$14.424 million.

The Top Latin America FCPA Actions of 2024

The United States Department of Justice (DOJ) actively enforced the FCPA in Latin America in 2024, with three of the DOJ's eight corporate enforcement actions being linked to the region. In addition, the DOJ brought two enforcement actions against individuals for their conduct while working for a company that previously faced DOJ and Securities & Exchange Commission (SEC) enforcement actions. Last year was a quiet year for the SEC in Latin America, bringing no new cases related to the region.

The DOJ's FCPA enforcement actions highlight corporations' need for strong compliance programs and a robust corporate culture that opposes unethical practices.

Corporate Enforcement

1. Gunvor S.A. (Ecuador)

On March 1, 2024, Gunvor S.A. (Gunvor), a privately held Swiss commodity trading company, pleaded guilty to one count of conspiracy to violate the FCPA and agreed to pay a criminal fine of US$374.5 million and a forfeiture order of US$287.1 million. Between 2012 and 2020, Gunvor paid Ecuadorean government officials in a scheme related to an oil-backed loans program of the Empresa Publica de Hidrocarburos del Ecuador (Petroecuador). Gunvor entered into agreements with state-owned entities that allowed it to obtain and profit from oil products through a process that was otherwise not available to private entities. Jurisdiction under the FCPA’s anti-bribery provision was obtained over Gunvor based on meetings by employees involved in the scheme that took place in Miami, Florida. Four individuals, two former Gunvor consultants, one former Gunvor employee, and a former Petroecuador official, were previously convicted in connection with the scheme.

Takeaway: The DOJ's prosecution of Gunvor, as well as the individuals connected to the scheme, demonstrates the DOJ's increased emphasis in recent years on prosecuting individuals implicated in FCPA matters, including where the company has entered into a negotiated resolution.

2. Trafigura Beheer B.V. (Brazil)

On March 29, 2024, Trafigura Beheer B.V. (Trafigura), a Dutch-registered commodity trading company with its principal place of business in Switzerland, pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and agreed to pay a criminal fine of US$80,488,040 and forfeiture of US$46,510,257. Trafigura conspired to pay bribes to officials of Petróleo Brasileiro S.A. (Petrobras), a Brazilian state-owned and state-controlled oil company, between approximately 2003 and 2014 in order to obtain and retain business. Bribe payments were made through shell companies and by funneling payments through intermediaries who used offshore bank accounts to deliver cash to officials in Brazil. The criminal fine calculated under the US Sentencing Guidelines reflects a 10% reduction off the fifth percentile of the applicable guidelines' fine range. The DOJ criticized Trafigura for what the Department characterized as cooperation that was initially too slow and incomplete, including, allegedly, a failure to adequately preserve documents and taking positions that were inconsistent with cooperation as well as, at the resolution stage, with reaching a settlement. For these reasons, as well as two prior enforcement matters involving different conduct and statutes – one with the US government and one with the government of the Netherlands – the DOJ required a guilty plea and agreed to only a modest discount off the Sentencing Guidelines fine.

Takeaway: The settlement reflects the Department’s efforts under its Corporate Enforcement Policy to calibrate the type of resolution and the fine amount to how robustly a company cooperates and remediates the conduct as well as to whether a company has a prior history of corporate misconduct reflected in other enforcement matters.

3. Telefónica Venezolana, C.A. (Venezuela)

On November 8, 2024, Telefónica Venezolana C.A. (Telefónica Venezolana), a Venezuela-based subsidiary of Telefónica S.A. (Telefónica), a publicly traded global telecommunications operator based in Spain, entered into a deferred prosecution agreement with the Department of Justice and agreed to pay a criminal fine of US$85.2 million. Telefónica Venezolana bribed Venezuelan government officials to receive preferential access to US dollars in a government-sponsored currency auction, which took place in or around 2014, and allowed Telefónica Venezolana to purchase equipment for its telecommunications network. Jurisdiction under the FCPA’s anti-bribery provision was asserted based on an allegation that relevant USD transactions went through correspondent bank accounts located in the United States and an allegation that the company’s executive and another involved party "exchanged drafts of a consultancy agreement" "using their personal, US-based email accounts."

Takeaway: This case appears to involve an aggressive exercise of jurisdiction with respect to a foreign issuer. Here, jurisdiction was asserted based on the fact that relevant payments were in USD and therefore went through US correspondent bank accounts, plus a communication using a US-based email account. This case is an important reminder for companies whose shares trade on a US stock exchange of just how attenuated a "touch" with the US is required, from the perspective of US regulators, for FCPA jurisdiction to be established.

4. Mauricio Gomez Baez (Mexico, Brazil, and Argentina)

In February 2024, Mauricio Gomez Baez, a Mexican citizen and former Senior Vice President of Stericycle LATAM, pleaded guilty to conspiracy to violate the FCPA anti-bribery provision. On June 21, 2024, Baez was sentenced to 7 months imprisonment. Baez conspired to bribe Mexican, Brazilian and Argentinian officials from at least 2011 to 2016 to obtain and retain contracts and other business advantages. In 2022, Baez’s former employer, Stericycle, entered into a three-year deferred prosecution agreement with the DOJ and a settlement with the SEC in connection with the same conduct.

5. Abraham Cigarroa Cervantes (Mexico, Brazil, and Argentina)

Also in connection with the Stericyle matter, on March 19, 2024, Abraham Cigarroa Cervantes, a Mexican citizen who served as Finance Director at Stericycle LATAM, was indicted for allegedly conspiring to bribe Mexican, Brazilian, and Argentinian officials, from around December 2011 to at least April 2016, to obtain and retain contracts and secure other business advantages for Stericycle and to maintain false books and records, including falsified Sarbanes-Oxley certifications, to conceal the corrupt payments. The case is ongoing.

Also worth noting with respect to LATAM-related enforcement were several cases brought against individuals charged under US anti-money laundering laws for facilitating bribery schemes, as well as against a former government official for accepting bribes.

Raul Gorrin Belisario (Venezuela): Gorrin, a citizen of Venezuela, allegedly conspired with others to launder the proceeds of an illegal bribery scheme, between 2014 and 2018, using the US financial system as well as various bank accounts located abroad. According to an indictment filed in October 2024 in the Southern District of Florida, Gorrin and his co-conspirators had the purpose of enriching themselves by laundering the proceeds of a corrupt foreign loan and bribery scheme relating to contracts entered into with Petróleos de Venezuela S.A., Venezuela's state-owned and controlled oil entity. The case is ongoing.

Carlos Ramon Polit Faggioni (Ecuador): Polit, a citizen of Ecuador, in his position as Comptroller General of Ecuador, allegedly solicited and received over US$10 million in bribe payments, between 2010 to 2015, from Odebrecht S.A., the Brazil-based construction conglomerate. Additionally, in or around 2015, Polit received a bribe from an Ecuadorian businessman in exchange for assisting with obtaining certain contracts with Ecuador's state-owned insurance company. From around 2010 and continuing until at least 2017, at the direction of Polit, another member of the conspiracy caused proceeds of Polit’s bribery scheme to "disappear" by using Florida companies registered in the names of friends and associates. In April 2024, a federal jury in Miami, Florida convicted Polit of conspiracy to commit money laundering, concealment of money laundering, and of engaging in transactions in criminally derived property. In October 2024, Polit was sentenced to 10 years in prison and ordered to forfeit US$16.5 million.

John Christopher Polit (Ecuador): In November 2024, John Polit pleaded guilty to conspiracy to commit money laundering, and agreed to forfeit US$16.5 million. He is scheduled to be sentenced in April 2025. Between approximately 2010 and 2018, John Polit, a citizen of the United States, laundered, through the US financial system and into various investments in South Florida, the bribe proceeds that the Brazil-based construction conglomerate Odebrecht S.A. paid for the benefit of his father, Carlos Ramon Polit Faggioni, the former Comptroller General of Ecuador.

Luis Fernando Vuteff (Venezuela): In May 2024, Vuteff entered into a plea agreement with the DOJ, where the DOJ agreed to dismiss a prior 2022 indictment. Vuteff, a citizen of Argentina, was retained to launder the proceeds of a foreign currency exchange scheme that took place in Venezuela, including the coordination of the transfer of funds to benefit former Venezuelan government officials. The scheme was conducted through loan contracts with Venezuela's state-owned and state-controlled oil company, Petróleos de Venezuela, S.A., that were obtained via bribes and kickbacks. The scheme exploited the difference between the fixed foreign exchange rate, which accorded Venezuelan bolivars an artificially high value compared to the open foreign currency exchange market. In December 2024, Vuteff was sentenced to 30 months imprisonment and forfeiture of approximately US$4.1 million.

The Top Asia Pacific FCPA Actions of 2024

The FCPA spotlight on the Asia Pacific region did not dim in 2024, as five of the six Securities & Exchange Commission (SEC) corporate enforcement actions and three of the eight US Department of Justice (DOJ) corporate actions were also linked to the region. APAC also featured in three separate DOJ matters brought against individuals, and in a rare individual enforcement action by the SEC. In fact, the largest enforcement action in 2024 involved an Asia-Pacific country, resulting in a US$220 million settlement with the DOJ and SEC. By region, the majority of ongoing investigations at the close of 2024 cited misconduct in Asia.

The FCPA enforcement actions against corporations underscore the critical need for strong compliance programs, diligent vetting of third-party relationships, and a robust corporate culture that opposes unethical practices.

Corporate Enforcement

1. SAP SE

On January 10, 2024, SAP agreed to pay over US$220 million to settle FCPA violations with the SEC and DOJ, pursuant to a three-year deferred prosecution agreement (DPA). From 2013 to 2022, SAP employed third-party intermediaries and consultants to pay bribes to government officials to obtain business in South Africa, Malawi, Kenya, Tanzania, Ghana, Indonesia, and Azerbaijan. The bribery included cash payments, political contributions, luxury goods, and shopping trips for government officials and their families.

Takeaway: ICYMI, vetting third parties and monitoring third-party messaging applications are important. SAP's subsidiary in Indonesia worked with a reseller "known for a pattern of corrupt business dealings" and subsidiary employees discussed the bribery schemes with the reseller using WhatsApp. DOJ granted a 40% penalty reduction for SAP's prompt cooperation and remediation but also discussed SAP's 2016 non-prosecution agreement and 2021 settlement with DOJ, Commerce and Treasury for export violations.

2. AAR Corp.

On December 19, 2024, the DOJ and SEC announced that AAR, an Illinois-based aviation services company, would pay over US$55 million to settle FCPA allegations, pursuant to an 18-month NPA. Two AAR executives, from a subsidiary and a joint venture, were accused of conspiring to bribe officials in order to secure contracts with two state-owned airlines: Nepal Airlines and South African Airways.

Takeaway: In a November 22 blog post, the DOJ clarified that to qualify for voluntary self-disclosure credit, a company must disclose original information that the Department is unaware of. Here, media reports had already brought attention to alleged misconduct in Nepal and South Africa, and an independent source had informed the DOJ about the activities in Nepal just 12 days before AAR's self-disclosure.

3. Deere & Company

On September 10, 2024, Deere, a global manufacturer of agricultural machinery and heavy equipment, agreed to pay nearly US$10 million to settle SEC FCPA charges. Between 2017 and 2020, employees at Deere’s subsidiary, Wirtgen Thailand, bribed government officials from the Royal Thai Air Force, the Department of Highways, and the Department of Rural Roads to secure multiple government contracts. They also bribed employees of a private company to boost sales. Deere inaccurately recorded these improper payments as legitimate expenses in its financial records.

Takeaway: Multinational corporations must integrate newly acquired subsidiaries into their existing internal control systems. Wirtgen became a wholly owned subsidiary of Deere in December 2017, but Deere had not fully integrated Wirtgen Thailand into its compliance program and overall control environment. Although Deere did not knowingly participate in the bribery scheme, the SEC charged the parent with FCPA’s books and records violations.

4. Moog Inc.

On October 11, 2024, Moog., a US-based global manufacturer of motion control systems, agreed to pay US$1.1 million to settle with the SEC for FCPA violations. From 2020 through 2022, employees of Moog’s Indian subsidiary bribed various Indian officials to secure business. They employed multiple schemes for these improper payments, including routing funds through third-party agents and distributors.

Takeaway: This case underscores the significance of corporate culture and leadership tone. SEC pointed out that the subsidiary’s employees openly discussed their misconduct, revealing a culture driven by the pursuit of business at any cost.

5. BIT Mining Ltd.

On November 18, 2024, BIT Mining, a cryptocurrency mining company, agreed to pay US$4 million to the SEC and US$10 million to the DOJ to settle FCPA violations. Between 2017 and 2019, the company bribed various foreign officials, including members of Japan’s parliament, in an ultimately unsuccessful attempt to establish a resort casino, which BIT Mining abandoned when it learned of the scheme.

Takeaway: The BIT Mining DPA, the indictment of its former CEO, and the SEC’s concurrent penalties illustrate the DOJ's and SEC's commitment to hold both corporations and individuals accountable.

6. Zhengming Pan

On June 18, 2024, the former CEO of BIT Mining was indicted for FCPA violations. Pan allegedly directed company consultants to pay nearly US$2 million to Japanese government officials to secure the casino resort bid. These payments were reportedly concealed through sham consulting contracts and included bribes in the form of cash, travel, entertainment, and gifts.

7. Ongoing Investigations

Cyril Cabanes, et al.: On October 24, 2024, the DOJ indicted Cyril Cabanes and three other individuals for their roles in a bribery scheme involving over US$250 million in payments to Indian officials. This scheme allegedly aimed to secure above-market energy purchase agreements, enabling two India-based companies to generate over US$2 billion in profits after tax over approximately 20 years. Additionally, on November 20, 2024, the SEC charged Cabanes with FCPA violations related to the same matter.

Roger Alejandro Pinate Martinez and Jorge Miguel Vasquez: On August 8, 2024, the DOJ charged two individuals for allegedly conspiring to bribe Juan Andres Donato Bautista, the former chairman of an independent agency overseeing election laws in the Philippines, with FCPA violations. Bautista, along with Elie Moreno, a Smartmatic executive based in the Philippines at the time, was also charged in the same indictment with violations of US anti-money laundering laws. Between May 2015 and February 2018, these two individuals allegedly conspired to pay around US$1 million in bribes to Bautista to obtain three US$182 million contracts to supply voting machines for the 2016 Philippine elections.

AAR Corp. (Nepal and South Africa)

Conduct: AAR Corp. (AAR), a publicly traded aviation services company headquartered in Illinois, resolved investigations by the DOJ and the SEC into its participation in corrupt schemes to pay bribes to government officials in Nepal and South Africa. Between 2015 and 2020, bribes were paid to obtain and retain business with state-owned airlines in Nepal and South Africa.[1]

Statutory Provisions: Conspiracy to violate the FCPA's anti-bribery provision (DOJ); FCPA anti-bribery, books and records and internal controls provisions (SEC).[2]

Payments: Millions of dollars in commissions, success fees, and advance payments to intermediary companies and to a JV partner, a portion of which was used to pay bribes.

Benefit: Profits from the sale of aircraft and aircraft-related support services of approximately US$23.9 million.[3]

Prosecuting Agencies: DOJ, SEC.

Resolution: AAR entered into an 18-month non-prosecution agreement with the DOJ and agreed to pay a US$26,363,029 criminal penalty and an administrative forfeiture of US$18,568,713. The criminal penalty reflects a 45% discount off the applicable sentence under the federal Sentencing Guidelines. The forfeiture amount will be credited against disgorgement of ill-gotten profits imposed on AAR under its concurrent resolution with the SEC.[4]

In the SEC resolution, AAR consented to the SEC's order finding violations and ordering payment of US$23,451,100 in disgorgement and US$5,785,524 in prejudgment interest.[5] The SEC did not impose a civil fine, stating in its order that the agency was declining to do so in light of AAR’s payment of a criminal penalty to DOJ.

Voluntary Disclosure: Although AAR self-reported to the department and received credit for its cooperation, its actions were not considered to be a "voluntary self-disclosure" as defined in DOJ guidance. Prior to AAR coming forward, media outlets in Nepal and South Africa had published articles in English describing potential contract irregularities, including an inquiry into an AAR subsidiary by a Nepalese agency investigating irregularities and corruption in connection with aircraft procurement. Further, shortly before AAR self-reported, an independent source informed the DOJ of similar allegations regarding AAR’s conduct in Nepal.[6] The DOJ nonetheless offered some cooperation credit in recognition that AAR self-disclosed before it knew that the unlawful conduct had already been reported to the government.

Related Individual Prosecutions: The DOJ charged and obtained guilty pleas from two individuals, a former AAR subsidiary executive, Deepak Sharma, for his role in the Nepal scheme, and AAR third-party agent Julian Aires, for his role in the South Africa scheme.[7]

BIT Mining, Ltd., formerly known as 500.com Ltd. (Japan)

Conduct: Online sports lottery service provider BIT Mining Ltd. (BIT Mining) (formerly known as 500.com Limited and headquartered in Shenzhen, China with shares traded on the New York Stock Exchange), allegedly engaged in a bribery scheme to influence numerous Japanese officials, including members of Japan’s parliament, in efforts to establish an integrated resort casino in Japan.[8] The scheme allegedly occurred from 2017 to 2019 and was directed by the then-CEO of 500.com Limited, Zhengming Pan.

Statutory Provisions: FCPA anti-bribery provision, books and records provisions (DOJ); FCPA anti-bribery, books and records and internal controls provisions (SEC).

Payments: Illicit payments of approximately US$2.5 million in the form of cash bribes, entertainment, and extravagant trips.[9]

Benefit: None. The company did not win an integrated resort bid in Japan.[10]

Prosecuting Agencies: DOJ, SEC.

Resolution: BIT Mining entered into a three-year deferred prosecution agreement and agreed to pay a criminal fine of US$10 million, which reflected DOJ's 10% reduction off the low end of the applicable Sentencing Guidelines range in recognition of Bit Mining’s timely remedial efforts.[11] Bit Mining's US$10 million fine also was a reduction from the appropriate and initially imposed fine of US$54 million based upon its poor financial conditions which, consistent with DOJ inability to pay guidance, prompted a fine reduction. DOJ also agreed to credit up to US$4 million against the civil penalty imposed in the parallel SEC matter.

Voluntary Disclosure: No.[12]

Related Individual Prosecutions: Pan was indicted for his participation in the scheme.

Noteworthy: Jurisdiction over Bit Mining for the anti-bribery charge was premised solely on Pan’s act of signing annual Sarbanes-Oxley certifications that falsely stated that he had disclosed to 500.com’s auditors and Board of Directors "any fraud, whether or not material, that involves management.” Those certifications failed to disclose the bribe payments, and the existence of false books, records, and accounts related to facilitating and concealing those payments. Notably, the certifications were filed electronically through SEC servers located in the District of New Jersey.

Bit Mining’s Board initiated an internal investigation after three consultants (including a former director of the company's subsidiary in Japan) were arrested by the Tokyo District Public Prosecutors Office.[13] The company later announced that it had closed its investigation without findings of misconduct under the FCPA. Both DOJ and SEC, however, initiated investigations that ultimately resulted in the noted settlements.[14]

Deere & Company (Thailand)

Conduct: Deere & Company (Deere), a publicly traded, Illinois-based global manufacturer of agricultural machinery and heavy equipment, resolved charges brought by the SEC related to conduct stemming from bribes paid by its wholly owned subsidiary, Wirtgen Thailand. In 2017, Deere acquired Wirtgen Group, an internationally operating construction company headquartered in Germany and operating in Thailand through Wirtgen Thailand.

The SEC's order found that, from at least late 2017 through 2020, Wirtgen Thailand employees bribed Thai government officials with the Royal Thai Air Force, the Department of Highways, and the Department of Rural Roads to win multiple government contracts.[15] The SEC also found that Wirtgen Thailand personnel bribed employees of a private company to win sales with that business.[16]

Statutory Provisions: FCPA books and records and internal controls provisions.

Payments: The SEC order finds that the bribes included cash payments, massage parlor visits, and international travel for government officials and private company employees.

Benefit: Approximately US$4.3 million in profits.

Prosecuting Agencies: SEC.

Resolution: Deere agreed to a Cease-and-Desist Order and agreed to pay US$4,343,401 in disgorgement, US$1,086,954 in prejudgment interest, and a civil penalty of US$4.5 million.[17]

Voluntary Disclosure: No.

Noteworthy: The internal controls charge was based on Deere’s alleged failure to fully integrate Wirtgen Thailand post-acquisition into its compliance program and internal control environment.[18]

Gunvor S.A. (Ecuador)

Conduct: Gunvor S.A. (Gunvor), a Swiss commodity trading company, allegedly conspired to pay bribes to Ecuadorean government officials between 2012 and 2020. The bribery scheme related to an oil-backed loans program of the Empresa Publica de Hidrocarburos del Ecuador (Petroecuador), through which state-owned entities provided loans to Petroecuador secured by oil products to be delivered over a period of years. In turn, private trading companies entered into separate but related agreements with the state-owned entities to market, sell and transport the oil products delivered pursuant to the state-owned entities’ contracts with Petroecuador. Gunvor entered into such agreements, allowing it to obtain and profit from oil products through a streamlined process otherwise unavailable to private entities.[19]

Statutory Provisions: Conspiracy to violate the FCPA’s anti-bribery provision.[20]

Payments: More than US$90 million in payments to intermediaries while knowing that a portion of the payments would be, or in fact were, directed to senior government officials in Ecuador.[21]

Benefit: The facts outlined in the criminal information would have resulted in profits for Gunvor totaling over US$384 million.[22]

Prosecuting Agencies: DOJ.

Resolution: Gunvor pleaded guilty to one count of conspiracy to violate the FCPA, agreeing to a criminal fine of US$374.5 million and forfeiture order of US$287.1 million. The criminal fine reflected a discount of 25% off the thirtieth percentile of the applicable Sentencing Guidelines fine range, and credits of up to one-quarter of the fine amounts imposed upon Gunvor to resolve investigations by each of the Swiss and Ecuadorean authorities.[23]

Voluntary Disclosure: No.[24]

Related Individual Prosecutions: Four individuals were previously convicted in connection with the scheme at issue for Gunvor, including former Gunvor consultants Antonio Pere Ycaza and Enrique Pere Ycaza, former Gunvor employee Raymond Kohut, and a former Petroecuador official, Nilsen Arias Sandoval.

Noteworthy: Jurisdiction under the anti-bribery provision was obtained over Guvnor, a privately held foreign company, based on meetings the attendance of its employees involved in the scheme at meetings held in Miami, Florida.

McKinsey and Company Africa (PTY) Ltd. (South Africa)

Conduct: McKinsey and Company Africa (Pty) Ltd (McKinsey Africa), a wholly owned and controlled subsidiary of U.S.-headquartered consulting firm McKinsey & Company Inc. (McKinsey), allegedly paid bribes to government officials in South Africa between 2012 and 2016. The bribes were directed to government officials at Transnet SOC Ltd. (Transnet), South Africa’s state-owned and state-controlled custodian of ports, rails, and pipelines, and at Eskom Holdings SOC Ltd. (Eskom), South Africa’s state-run energy company.

McKinsey Africa obtained sensitive confidential and non-public information regarding key contract awards from Transnet and Eskom. It then submitted proposals for multimillion-dollar consulting engagements with the knowledge that South African consulting firms with which McKinsey Africa had partnered would pay a portion of their fees to officials at Transnet and Eskom.[25]

Statutory Provisions: Conspiracy to violate the FCPA’s anti-bribery provision.

Payments: Portions of payments made to third-party consultants were intended to be passed on to government officials.

Benefit: Profits of approximately US$85 million.[26]

Prosecuting Agencies: DOJ.

Resolution: McKinsey Africa entered into a three-year deferred prosecution agreement and agreed to pay a criminal fine of US$122.8 million. The fine reflects a 35% discount off the fifth percentile of the Sentencing Guidelines range and includes a credit of up to US$61.4 million toward the amount the company pays to authorities in South Africa related to the same conduct.[27]

Voluntary Disclosure: No.[28]

Related Individual Prosecutions: Vikas Sagar, a former senior partner of McKinsey who worked in the South Africa office of McKinsey Africa, pleaded guilty to one count of conspiracy to violate the FCPA.

Moog Inc. (India)

Conduct: Moog Inc. (Moog), a publicly traded, New York-based manufacturer of motion controls systems for aerospace, defense, industrial, and medical markets, was alleged to have falsely recorded bribe payments made by its Indian subsidiary, Moog Motion Controls Private Limited (MMCPL). Moog not only falsely recorded the payments as legitimate business expenses in its books and records, but it also failed to detect these payments as a result of deficient internal accounting controls. From 2020 to 2022, MMPCL employees made and/or offered bribes to India officials to cause public tenders in India to favor Moog’s products and to exclude competitors.

Statutory Provisions: FCPA books and records and internal controls provisions.

Payments: Payments through third-party agents and distributors.

Benefit: According to the SEC order, Moog was unjustly enriched by approximately US$504,926.[29]

Prosecuting Agencies: SEC.

Resolution: Cease-and-Desist Order providing for a civil penalty of US$1.1 million and US$504,926 in disgorgement, as well as US$78,889 in prejudgment interest.

Voluntary Disclosure: The SEC did not characterize Moog as having made a voluntary self-disclosure, but stated that "Moog initially reported certain misconduct to DOJ and subsequently provided SEC staff with facts developed during its own internal investigation."[30]

Raytheon Company (Qatar)

Conduct: Raytheon Company (Raytheon), a subsidiary of Virginia-based defense contractor RTX, entered into a global settlement with multiple DOJ divisions and the SEC to resolve, among other matters charges brought under each of the FCPA, Arms Export Controls Act (AECA), and International Traffic in Arms Regulations (ITAR).

- FCPA. Employees of Raytheon working at a JV entity operating in Qatar allegedly were involved in a scheme between 2012 and 2016 to bribe a high-level official at the Qatar Emiri Air Force to obtain contract awards related to a Qatari program to update the country's air defense systems. In order to make the payments, sham local companies were engaged to perform services related to pursuing the Airforce contracts despite lacking the capability to do the work for which they were contracted; indeed, Raytheon personnel performed the work and then passed it off as having been done by the local companies. Further, the work for which the local companies ostensibly were engaged was added to Raytheon's scope of work at the direction of the Qatari official and one of the local entities was paid on a success fee basis yet characterized internally as merely a "service provider." The Qatari official also had founded and served as a board member and beneficial owner of one of the local companies, yet personnel working at the JV entity obscured those links when submitting due diligence materials for higher-up approval within Raytheon.

- Payments made to the Qatari local companies were not disclosed to the Department of State’s Directorate of Defense Trade Controls, as required under AECA and ITAR Part 130. Those provisions obligate companies selling defense articles and services subject to special U.S. export licensing requirements to disclose fees and commissions paid to intermediaries. The personnel involved at the JV entity level were well aware of the disclosure obligations and intentionally hid the relevant information from superiors and others within the company.

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision and the AECA (DOJ); FCPA anti-bribery, books and records and internal controls provisions (SEC).

Payments: Payments made to and through local companies that were intended to be shared with a Qatari official.[31]

Benefit: In connection with the FCPA violations, approximately US$36.7 million in profits from one contract, as well as anticipated profits of roughly US$72 million for a second contract that ultimately was not awarded,.[32] In addition, approximately US$13.6 million in profits in connection with the ITAR violations.[33]

Prosecuting Agencies: DOJ, SEC.

Resolution: Raytheon entered into separate agreements as follows:

- FCPA: Raytheon agreed to a three-year deferred prosecution agreement and a fine totaling US$230.4 million, as well as US$36,696,068 in forfeiture. The criminal fine reflects a 20% reduction off the twentieth percentile above the low end of the applicable guidelines' fine range. In the parallel SEC matter, the company agreed to pay a civil monetary penalty of US$75,000,000, disgorgement totaling US$37,400,090 and US$11,786,208 in prejudgment interest. The parties agreed that US$22.5 million of the civil penalty paid to the SEC would be credited against the DOJ’s criminal fine, and US$7.4 million of the disgorgement paid to the SEC offset against the criminal forfeiture. Raytheon agreed to appoint an independent compliance monitor to report to both the DOJ and SEC.

- ITAR: The resolution was a three-year DPA with a criminal fine of approximately US$21.9 million, which reflects a 20% reduction off the otherwise applicable penalty. Raytheon also agreed to appoint an independent compliance monitor in this resolution.

Voluntary Disclosure: No.

Noteworthy: The regulatory requirement to disclose fees and commissions paid to third parties in connection with exporting items subject to AECA and ITAR Part 130 is not limited to improper payments but instead applies to all such payments – as well as to political contributions and gifts to foreign officials.

The company did not receive full credit for cooperation because the DOJ took the view that the company’s early cooperation efforts were insufficient.

SAP SE, et al. (South Africa, Indonesia, Malawi, Kenya, Tanzania, Ghana, and Azerbaijan)

Conduct: From 2013 to 2018, SAP SE (SAP), a publicly traded global software company headquartered in Germany, allegedly bribed officials in South Africa, Indonesia, and several other countries in order to obtain contracts with various government departments, agencies, and instrumentalities.[34] SAP allegedly inaccurately recorded the bribes as legitimate business expenses in its books and records, despite the fact that certain of the third-party intermediaries could not show that they provided the services for which they had been contracted. SAP also failed to implement sufficient internal accounting controls over the third parties and lacked sufficient entity-level controls over its wholly owned subsidiaries. Although SAP had policies and procedures in place with respect to third-party due diligence, contracting, and payment, the company’s wholly-owned subsidiaries in multiple countries repeatedly violated these internal policies in order to use third parties to facilitate bribery schemes.

Statutory Provisions: Conspiracy to violate FCPA anti-bribery provision and books and records provision (DOJ); FCPA anti-bribery, books and records and internal accounting controls provisions (SEC).

Payments: Payments via third-party consultants, cash payments, political contributions, travel, and luxury goods.[35]

Benefit: Profits of more US$103.3 million.[36]

Prosecuting Agencies: DOJ and SEC.

Resolution: SAP entered into a three-year deferred prosecution agreement with the DOJ in connection with the corresponding criminal information and agreed to a criminal fine of approximately US$118.8 million and forfeiture totaling US$103,396,765. The fine reflects a discount of 40% off the tenth percentile of the Sentencing Guidelines fine and the DOJ agreed to credit up to US$55.1 million of the criminal penalty against amounts that SAP pays to resolve an investigation by law enforcement authorities in South Africa for related conduct. DOJ also agreed to credit up to the full forfeiture amount against disgorgement that SAP pays to the SEC or South African authorities. SAP received a credit of US$110,000 pursuant to the Criminal Division's Pilot Program Regarding Compensation Incentives and Clawbacks for withholding the bonuses of employees engaged in the misconduct.

SAP also entered into a Cease-and-Desist Order with the SEC, agreeing to pay disgorgement of US$85,046,035 and prejudgment interest of US$13,405,149. The SEC agreed to offset the disgorgement amount by up to US$59,455,779 for payments made to South African authorities for related conduct.

Voluntary Disclosure: No.[37]

Noteworthy: The SEC characterized SAP as a "recidivist" given it had entered into an FCPA settlement with the Commission in 2016; DOJ also noted this prior settlement in recounting SAP's prior history.

Telefónica Venezolana, C.A. (Venezuela)

Conduct: Telefónica Venezolana C.A. (Telefónica Venezolana), a Venezuela-based subsidiary of Telefónica S.A. (Telefónica), a publicly traded global telecommunications operator based in Spain, reportedly bribed Venezuelan government officials to receive preferential access to U.S. dollars in a government sponsored currency auction that took place in or around 2014. The auction and alleged bribes allowed Telefónica Venezolana to purchase equipment for its telecommunications network.[38]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision.

Payments: Payments to an intermediary while knowing that some of those funds would be paid as a "commission" to Venezuelan government officials.[39]

Benefit: Telefónica Venezolana was permitted to exchange and subsequently received over US$110 million through the currency auction, which it used to purchase equipment from the two suppliers it recruited to join the scheme. These funds represented over 65% of the funds that the Venezuelan government awarded in the 2014 currency auction.[40]

Prosecuting Agencies: DOJ.

Resolution: Telefónica Venezolana entered into a deferred prosecution agreement and agreed to pay a criminal fine of US$85.2 million. This fine reflects a 20% reduction off the fifth percentile of the applicable sentencing guidelines fine range.[41]

Voluntary Disclosure: No.[42]

Noteworthy: Jurisdiction under the FCPA's anti-bribery provision was asserted based on an allegation that relevant USD transactions went through correspondent bank accounts located in the United States, and an allegation that the company’s executive and another involved party "exchanged drafts of a consultancy agreement" "using their personal, US-based email accounts."[43]

Trafigura Beheer B.V. (Brazil)

Conduct: Trafigura Beheer B.V. (Trafigura), a Dutch-registered commodity trading company with its principal place of business in Switzerland, allegedly conspired to pay bribes to officials of Petróleo Brasileiro S.A. (Petrobras), a Brazilian state-owned and state-controlled oil company, between approximately 2003 and 2014, in order to obtain and retain business.[44] The bribe payments were up to 20 cents per barrel of oil products bought from or sold to Petrobras by Trafigura. They were made through the use of shell companies and by funneling payments through intermediaries who used offshore bank accounts to deliver cash to officials in Brazil.

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision.[45]

Payments: Commissions of US$19.7 million, portions of which were used to pay bribes to Brazilian officials.[46]

Benefit: Approximately $61 million in profits.[47]

Prosecuting Agencies: DOJ.

Resolution: Trafigura pleaded guilty and agreed to pay a criminal fine of US$80,488,040 and forfeiture totaling US$46,510,257.[48] The fine reflects a 10% reduction off the fifth percentile of the applicable guidelines fine range. DOJ also agreed to credit up to approximately US$26.8 million of the criminal fine against the amount Trafigura pays to Brazilian authorities for related conduct.[49]

Voluntary Disclosure: No.

FCPA Declinations (2024)

Boston Consulting Group

The Boston Consulting Group (BCG) obtained a formal declination in connection with an alleged scheme between 2011 and 2017 to bribe government officials in Angola in order to obtain contracts. The company paid an agent in Angola approximately US$4.3 million in commissions to help obtain business with the Angolan Ministry of Economy (MINEC) and the National Bank of Angola (BNA). Certain BCG employees in Portugal were aware that the agent had close ties to Angolan Government officials and members of the ruling political party, agreed to pay the agent 20 to 35 percent of the value of any government contracts procured, and sent the funds to the agent’s three different offshore entities.

BCG was credited by the DOJ with making a voluntary disclosure and engaging in full cooperation and remediation, resulting in a formal declination and a requirement to disgorge profits of approximately US$14.424 mill

[1] DOJ Press Release, AAR CORP to Pay Over $55M To Resolve Foreign Corrupt Practices Act Investigation (Dec. 19, 2024), https://www.justice.gov/opa/pr/aar-corp-pay-over-55m-resolve-foreign-corrupt-practices-act-investigation.

[2] SEC Press Release, Global Aerospace Company AAR and Former Executive of its Subsidiary Settle Charges for Bribing Nepalese and South African Officials (Dec. 19, 2024), https://www.sec.gov/newsroom/press-releases/2024-205.

[3] In re AAR Corp., Non-Prosecution Agreement, at 14-15 (D.C. Dec. 19, 2024), https://www.justice.gov/criminal/media/1384031/dl?inline.

[4] Id. at 3.

[5] SEC Press Release, Global Aerospace Company AAR and Former Executive of its Subsidiary Settle Charges for Bribing Nepalese and South African Officials (Dec. 19, 2024), https://www.sec.gov/newsroom/press-releases/2024-205.

[6] DOJ Press Release, AAR CORP to Pay Over $55M To Resolve Foreign Corrupt Practices Act Investigation (Dec. 19, 2024), https://www.justice.gov/opa/pr/aar-corp-pay-over-55m-resolve-foreign-corrupt-practices-act-investigation.

[7] Id.

[8] SEC Press Release, SEC Charges BIT Mining with FCPA Violations in Connection with Bribery Scheme to Influence Members of Japanese Parliament (Nov. 18, 2024), https://www.sec.gov/newsroom/press-releases/2024-180.

[9] Id.

[10] Id.

[11] DOJ Press Release, Former CEO Indicted for Role in Bribing Japanese Officials and BIT Mining Ltd. Resolves Foreign Bribery Investigation (Nov. 18, 2024), https://www.justice.gov/opa/pr/former-ceo-500com-now-bit-mining-ltd-indicted-role-bribing-japanese-officials-and-bit-mining.

[12] United States v. BIT Mining, Ltd., formerly known as 500.com Ltd., No. 24-cr-00744-EP, Deferred Prosecution Agreement, at 4 (District of New Jersey Nov. 18, 2024) https://www.justice.gov/opa/media/1377341/dl.

[13] Form 6-K filed by 500.com Limited (Dec. 31, 2019).

[14] Form 6-K filed by 500.com Limited (Oct. 7, 2020).

[15] SEC Order Instituting Cease-and-Desist Proceedings (Sept. 10, 2024) https://www.sec.gov/files/litigation/admin/2024/34-100984.pdf.

[16] Id.

[17] Id.

[18] Id.

[19] United States v. Gunvor S.A., No. 1:24-cr-00085-ENV, Criminal Information, at 5 (E.D.N.Y. March 1, 2024), https://www.justice.gov/criminal/media/1340971/dl?inline.

[20] Id. at 13.

[21] United States v. Gunvor S.A., No. 1:24-cr-00085-ENV, Plea Agreement, at 4 (E.D.N.Y March 1, 2024), https://www.justice.gov/criminal/media/1340966/dl?inline.

[22] Id. at 4.

[23] Id. at 7

[24] Id. at 4.

[25] DOJ Press Release, McKinsey & Company Africa to Pay Over $122M in Connection with Bribery of South African Government Officials (Dec. 5, 2024), https://www.justice.gov/opa/pr/mckinsey-company-africa-pay-over-122m-connection-bribery-south-african-government-officials.

[26] United States v. McKinsey and Company Africa (PTY) Ltd., No. 24-cr-00669-CM, Deferred Prosecution Agreement, at 31 (S.D.N.Y. Dec. 5, 2024), https://www.justice.gov/opa/media/1379421/dl.

[27] Id. at 10.

[28] Id. at 4.

[29] SEC Order Instituting Cease-and-Desist Proceedings (Oct. 11, 2024), https://www.sec.gov/files/litigation/admin/2024/34-101307.pdf.

[30] Id. at 7.

[31] United States v. Raytheon Company, No. 24-CR-399 (RER), Deferred Prosecution Agreement, at 38 (E.D.N.Y. Oct. 9, 2024), https://www.justice.gov/criminal/media/1373661/dl?inline.

[32] Id. at 50.

[33] Id. at 61.

[34] United States v. SAP SE, No. 1:23-cr-00202-RDA, Criminal Information, at 3 (E.D. Va. Jan. 10, 2024), https://www.justice.gov/criminal/media/1333311/dl?inline.

[35] United States v. SAP SE, No. 1:23-cr-00202-RDA, Plea Agreement, at 29 (E.D. Va. Jan. 10, 2024), https://www.justice.gov/criminal/media/1333316/dl?inline.

[36] Id. at 3.

[37] Id. at 4.

[38] United States v. Telefónica Venezolana, C.A., No. 24-CR-633 (DEH), Deferred Prosecution Agreement, at 30 (S.D.N.Y. Nov. 8, 2024), https://www.justice.gov/criminal/media/1376656/dl?inline.

[39] Id.

[40] Id. at 31.

[41] Id. at 6.

[42] Id. at 4.

[43] United States v. Telefónica Venezolana, C.A., No. 24-CR-633 (DEH), Information, at 9 (S.D.N.Y. Nov. 8, 2024), https://www.justice.gov/criminal/media/1376651/dl.

[44] United States v. Trafigura Beheer B.V., No. 1:23-cr-20476-KMW, Criminal Information, at 5 (S.D. Fla. Dec. 13, 2023), https://www.justice.gov/criminal/media/1345971/dl?inline.

[45] Id. at 5.

[46] United States v. Trafigura Beheer B.V., No. 1:23-cr-20476-KMW, Plea Agreement, at 31 (S.D. Fla. March 28, 2024), https://www.justice.gov/criminal/media/1345976/dl?inline

[47] Id. at 4.

[48] Id. at 7.

[49] Id. at 19.

Julian Aires (South Africa)

Conduct: Julian Aires, a citizen of the United States and former third-party agent of AAR Corp. (AAR), allegedly conspired from January 2016 to at least January 2020, to bribe South African officials to obtain and retain business for AAR with South African Airways Technical, a subsidiary of the state-owned flag carrier airline South African Airways.[1]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision.

Payments: Millions of dollars in commissions, success fees, and advance payments to intermediary companies to use to pay bribes.

Benefit: Profits for AAR of approximately US$17.9 million.[2]

Prosecuting Agencies: DOJ.

Resolution: In July 2024, Aires entered into a plea agreement in connection with the criminal information filed in the United States District Court for the District of Columbia.[3] The case is pending sentencing.

Noteworthy: Both the DOJ and SEC charged AAR with FCPA violations, and it entered into an 18-month non-prosecution agreement with the DOJ and a settlement with the SEC.

Mauricio Gomez Baez (Mexico, Brazil, and Argentina)

Conduct: Mauricio Baez, a Mexican citizen and former Senior Vice President of Stericycle LATAM, allegedly conspired from at least 2011 to 2016, to bribe Mexican, Brazilian and Argentinian officials to obtain and retain contracts and other business advantages.[4]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision.

Payments: Bribes totaling roughly US$10.5 million.

Benefit: Profits for Stericycle of US$21.5 million.

Prosecuting Agencies: DOJ.

Resolution: In February 2024, Baez entered into a plea agreement. In June 2024, Baez was sentenced to 7 months of imprisonment followed by 3 years of supervised release, and further ordered to pay a fine of US$250,000.[5]

Noteworthy: Both the DOJ and SEC charged Stericycle with FCPA violations, which resulted in it entering into a three-year deferred prosecution agreement with the DOJ and a settlement with the SEC.[6]

Rojer Alejandro Pinate Martinez, Jorge Miguel Vasquez (Philippines)

Conduct: Rojer Alejandro Pinate Martinez and Jorge Miguel Vasquez, citizens of Venezuela and the United States, respectively, were alleged to have conspired with others between 2015 and 2018 to cause bribes to be paid to Juan Andres Donato Bautista, the former Chairman of the Commission on Elections (COMELEC) of the Republic of the Philippines. Pinate was the co-founder and an executive at Smartmatic, a UK-headquartered voting machine and services provider company, and Vasquez was an executive at a Florida subsidiary of Smartmatic.

Bautista, as well as Elie Moreno, a Philippines-based Smartmatic executive at the time, were charged in the same indictment with violations of US anti-money laundering laws.

The objective of the bribes was to obtain and retain business for Smartmatic related to providing voting machines and election services for the 2016 Philippine elections and to secure payments on awarded contracts, including the release of value-added tax payments. By over-invoicing for the provided voting machines, co-conspirators to the scheme generated a slush fund to make the payments and then allegedly concealed the bribes through a series of fraudulent and sham contracts and loan agreements. They then laundered funds related to the bribery scheme through bank accounts located in Asia, Europe, and the United States, including in the Southern District of Florida.[7]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision; FCPA anti-bribery provision; conspiracy to commit money laundering; international laundering of monetary instruments.

Payments: At least US$1 million.

Benefit: Contracts worth approximately US$182 million in total.

Prosecuting Agencies: DOJ.

Resolution: The indictment was filed in August 2024, and the case is ongoing.

Cyril Cabanes, et al. (India)

Conduct: Former Board members and executives associated with Azure Power Global Ltd. (Azure) or its Canadian corporate investor, allegedly participated in a scheme to bribe state government officials in India to secure multibillion-dollar energy projects for Azure and another company, Adani Green Energy Limited (Adani Green Energy). Azure, a renewable energy company in India, is a subsidiary of a then-U.S. issuer corporation whose majority shareholder was a Canadian institutional investor. Adani Green is a renewable energy business in India that is a portfolio company of a large Indian conglomerate.

Allegedly, Azure and Adani Green Energy, as well as executives and agents of the companies, engaged in a scheme between 2021 and 2023 in which Adani Green Energy paid or promised approximately US$250 million in bribes to Indian state officials to secure contracts.

Cyril Cabanes, a citizen of Australia and France and a former Board member of Azure and the then-U.S. issuer corporation, was charged by both the DOJ and SEC for violations of the FCPA. DOJ also charged three former executives and/or Board members associated with Azure under the FCPA. Each of Gautam Adani, Sagar Adani, and Vneet Jain, all associated with Adani Green Energy, were criminally charged in the same matter under securities and wire fraud statutes but not under the FCPA.[8]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision (DOJ); FCPA anti-bribery, books and records and internal controls provisions (SEC).

Payments: Over US$250 million in bribes.

Benefit: Solar energy supply contracts projected to generate more than US$2 billion in profits after tax over an approximately 20-year period.

Prosecuting Agencies: DOJ, SEC.

Resolution: The indictment was filed in October 2024; the SEC charges against Cabanes were filed in November 2024. Both cases are ongoing.

Abraham Cigarroa Cervantes (Mexico, Brazil, and Argentina)

Conduct: From around December 2011 until at least April 2016, Abraham Cigarroa Cervantes, a Mexican citizen who served as Finance Director at Stericycle LATAM, allegedly conspired to bribe Mexican, Brazilian, and Argentinian officials, to obtain and retain contracts and secure other business advantages for Stericycle.[9] Cigarroa also allegedly maintained false books and records, including falsified Sarbanes-Oxley certifications, to conceal the corrupt payments.

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision; conspiracy to violate the FCPA books and records and internal controls provisions.[10]

Payments: Approximately US$10 million in bribes.[11]

Benefit: Profits for Stericycle of US$21.5 million.

Prosecuting Agencies: DOJ.

Resolution: The indictment was filed in March 2024, and the case is ongoing.

Noteworthy: Both the DOJ and SEC charged Stericycle, and it entered into a three-year deferred prosecution agreement with DOJ and a settlement with the SEC.[12]

Zhengming Pan (Japan)

Conduct: Zhengming Pan, a Chinese citizen and former CEO of 500.com (at the time an online sports lottery service provider headquartered in Shenzhen, China, which is now BIT Mining Ltd.), allegedly engaged in a bribery scheme from 2017 to 2019 to influence numerous Japanese officials, including members of Japan’s parliament, to favor 500.com in efforts to establish an integrated resort casino in Japan.

Pan and others allegedly covered up the payment of these bribes by, among other things, entering into sham contracts with the consultants and falsely recording the payments as legitimate expenses, including as management advisory fees.[13]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision; conspiracy to violate the FCPA books and records and internal controls provisions; FCPA anti-bribery provision; FCPA books and records and internal controls provisions.

Payments: Nearly US$2 million in bribes.

Benefit: None. The company did not win an integrated resort bid.

Prosecuting Agencies: DOJ.

Resolution: The indictment was filed in June 2024, and the case is ongoing.

Noteworthy: Both the DOJ and SEC charged BIT Mining with violations of the FCPA, and it entered into a three-year deferred prosecution agreement with DOJ and a settlement with the SEC.

Deepak Sharma (Nepal)

Conduct: Deepak Sharma, a United Kingdom citizen and former executive of a subsidiary of AAR Corp., allegedly conspired to bribe Nepali government officials from 2015 through 2018 to win a bid to sell two Airbus A330-200 aircraft to Nepal Airlines Corporation, a state-owned flag carrier airline of Nepal. Further, Sharma was involved in a bribery scheme involving a contract for AAR to provide aviation services to a subsidiary of government-owned South African Airways.[14]

Sharma also allegedly signed false SOX sub-certifications during the relevant years on behalf of an AAR subsidiary, attesting to his compliance with AAR policies and internal accounting controls and sufficiency of documentation to substantiate those procedures operated effectively, thereby causing AAR to violate the FCPA books and records provision. He allegedly knowingly circumvented AAR’s internal accounting controls by concealing arrangements to pay bribes and failing to report them to AAR’s chief financial officer or general counsel and participated in schemes to falsify the company’s books and records with respect to bribe payments.

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision (DOJ); committing or causing violations of the FCPA books and records and internal controls provisions (SEC).

Payments: Millions of dollars in commissions, success fees, and advance payments to intermediary companies to use for bribes.[15]

Benefit: Profits for AAR of approximately US$23.9 million.[16]

Prosecuting Agencies: DOJ, SEC.

Resolution: In July 2024, Sharma entered into a plea agreement in the criminal case providing for the payment of forfeiture totaling US$130,835, which amount he agreed constituted or was derived from proceeds traceable to such offense.[17] The case is pending sentencing.

In the SEC resolution, Sharma admitted to the Commission’s findings and agreed to pay US$130,835 in disgorgement and US$53,762 in prejudgment interest. The disgorgement amount was deemed satisfied by his agreement to forfeit the same amount in his plea agreement with the DOJ.[18]

Noteworthy: Both the DOJ and SEC charged AAR with violations of the FCPA, and it entered into an 18-month non-prosecution agreement with the DOJ and a settlement with the SEC.

Individual FCPA Cases – Significant Developments

Javier Aguilar (Ecuador and Mexico)

Conduct: Javier Aguilar, a citizen of Mexico and former manager and oil trader at Vitol Inc. (Vitol), the US affiliate of the largest independent energy trading firm in the world, reportedly paid bribes to officials of Empresa Publica de Hidrocarburos del Ecuador (Petroecuador), the Ecuadorean state-owned oil and gas company, and PEMEX Procurement International (PPI), a subsidiary of PEMEX, the Mexican state-owned oil and gas company. The objective of the bribes was to obtain lucrative contracts for Vitol. Furthermore, Aguilar would have needed to use a series of fake contracts, shell documents, and offshore accounts to conceal the scheme.[19]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision; FCPA anti-bribery provision; Travel Act violation; conspiracy to commit money laundering.

Payments: More than US$1 million in bribes.

Benefit: The scheme reportedly netted Vitol hundreds of millions of dollars in contracts.

Prosecuting Agencies: DOJ.

Resolution: In February 2024, a federal jury in Brooklyn convicted Aguilar. The case is pending sentencing.

Following the conviction at trial, Aguilar consented to the disposition of a separate case, pending in the Southern District of Texas (SDTX) and the Eastern District of New York (EDNY). He pleaded guilty to conspiring to violate the FCPA, as well as to engaging in interstate and foreign commerce to promote and distribute the proceeds of commercial bribery payments made to officials at PPI.[20] The case is also pending sentencing.

Noteworthy: The FCPA conspiracy charge was initially filed in December 2022 in the EDNY as part of a superseding indictment. In May 2023, the government consented to dismiss that charge on venue grounds, but in August 2023, along with other related charges, refiled the charge in SDTX. As part of his guilty plea, Aguilar consented to transfer the SDTX case back to the EDNY, resulting in a reconsolidation of the cases.

Vitol entered into a deferred prosecution agreement with the DOJ, resolved a parallel investigation in Brazil, and settled with the Commodity Futures Trading Commission (CFTC).[21]

Paulo J.D.C. Casqueiro-Murta (Venezuela)

Conduct: Paulo J.D.C. Casqueiro-Murta, a citizen of Portugal and Switzerland, allegedly conspired from 2012 through at least 2013 to direct bribes to officials of Petróleos de Venezuela S.A. (PDVSA) in order to assist others in obtaining and retaining lucrative contracts with PDVSA through corrupt and fraudulent means.[22]

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision.

Benefit: Casqueiro-Murta obtained at least US$105,000 from the criminal offense.[23]

Prosecuting Agencies: DOJ.

Resolution: In May 2024, Casqueiro-Murta plead guilty to count one (conspiracy) of the criminal information filed by the DOJ.[24] As a result of the plea, DOJ agreed not to seek a decision from the court on whether the dismissal of the superseding indictment should have been without prejudice. Casqueiro-Murta was sentenced to time served and ordered to pay a forfeiture of US$105,000.[25]

Noteworthy: The trial court initially found DOJ lacked jurisdiction over Casqueiro-Murta, but the dismissal was later reversed by the Fifth Circuit. Subsequently, Casqueiro-Murta moved to dismiss for violation of his right to a speedy trial and again succeeded in obtaining a dismissal. However, the Fifth Circuit again reversed the dismissal and remanded for further decision by the district judge. Casqueiro-Murta then pleaded guilty.

Glenn Oztemel, Gary Oztemel, and Eduardo Innecco (Brazil)

Conduct: From 2010 through 2018, Gary Oztemel and his brother Glenn Oztemel, both United States citizens, and Eduardo Innecco, a Brazilian and Italian citizen, along with others, allegedly paid bribes to government officials for their assistance in helping Arcadia Fuels Ltd. (Arcadia), Freepoint Commodities LLC (Freepoint), and Oil Trade & Transport S.A. (OTT), to obtain and retain business with Petróleo Brasileiro S.A. (Petrobras).[26]

As part of the scheme, a Petrobras official provided confidential information regarding Petrobras’ fuel oil business to each of the aforementioned individuals. Gary Oztemel also used his company Petro Trade to conceal the proceeds of the scheme.

Statutory Provisions: Conspiracy to violate the FCPA anti-bribery provision; conspiracy to commit money laundering; money laundering.

Payments: Over US$1 million in bribes.[27]

Benefit: Entities obtained confidential information and retained lucrative fuel oil contracts with Petrobras.

Prosecuting Agencies: DOJ.

Resolution: In June 2024, Gary Oztemel entered into a guilty plea with the DOJ.[28] In October 2024, Gary Oztemel was sentenced to two years of probation, 100 hours of community service, and ordered to pay forfeiture totaling approximately US$301,575 and a fine of US$8,774.

In September 2024, a federal jury in Bridgeport, Connecticut, convicted Glenn Oztemel. [29] The case is pending sentencing.

Eduardo Innecco is awaiting extradition from France to the United States.[30]

Noteworthy: In December 2023, Freepoint entered into a deferred prosecution agreement with the DOJ and agreed to pay more than US$98 million in criminal penalties and forfeiture.[31]

Alain Riedo (China)

Conduct: In October 2013, Alan Riedo, a Swiss citizen who held top executive positions at Maxwell Technologies S.A., a wholly owned Swiss subsidiary of Maxwell Technologies Inc. (Maxwell), was indicted by a grand jury in the Southern District of California for his reported role in the payment of bribes to Chinese government officials.[32]