Overview

On May 8, 2025, the Office of the Comptroller of the Currency (OCC) issued an interim final rule (the Interim Final Rule), rescinding its prior changes to the bank merger review process under the Bank Merger Act.1 The Interim Final Rule reinstates expedited review procedures and a streamlined application form for bank mergers that had previously been removed by a 2024 OCC rule (the 2024 Final Rule),2 and it also rescinds a policy statement issued by the OCC in 2024 that provided details on how the agency evaluates proposed bank mergers.

Background

The Bank Merger Act (12 U.S.C. § 1828(c)) requires federal banking agencies to assess specific statutory factors when reviewing proposed mergers involving insured depository institutions. In September 2024, the OCC eliminated its expedited review process, streamlined applications for certain low-risk transactions, and introduced a detailed policy statement describing how it interpreted Bank Merger Act factors and handled public input. Those changes took effect January 1, 2025.

Reinstatement of Expedited Review Procedures and the Streamlined Application Form

The Interim Final Rule reinstates an "expedited review" for two categories of transactions: "business reorganizations" and "streamlined applications." Under the expedited review provision, a filing is deemed approved on the 15th day after the close of the comment period, unless the filing is ineligible for expedited review (and the OCC has informed the filer of such) or the review period is extended pursuant to 12 CFR § 5.13(a)(2).3 By reintroducing faster review processes, the OCC intends to focus the OCC’s efforts on applications that are novel, complex, or could pose risks to the institutions involved.4

A business reorganization can be a combination of eligible banks, savings associations, or depository institutions that are controlled by the same holding company5 or a combination between an eligible bank or savings association and an interim institution in which investors exchange their shares of the eligible institution for those of a newly formed holding company.6

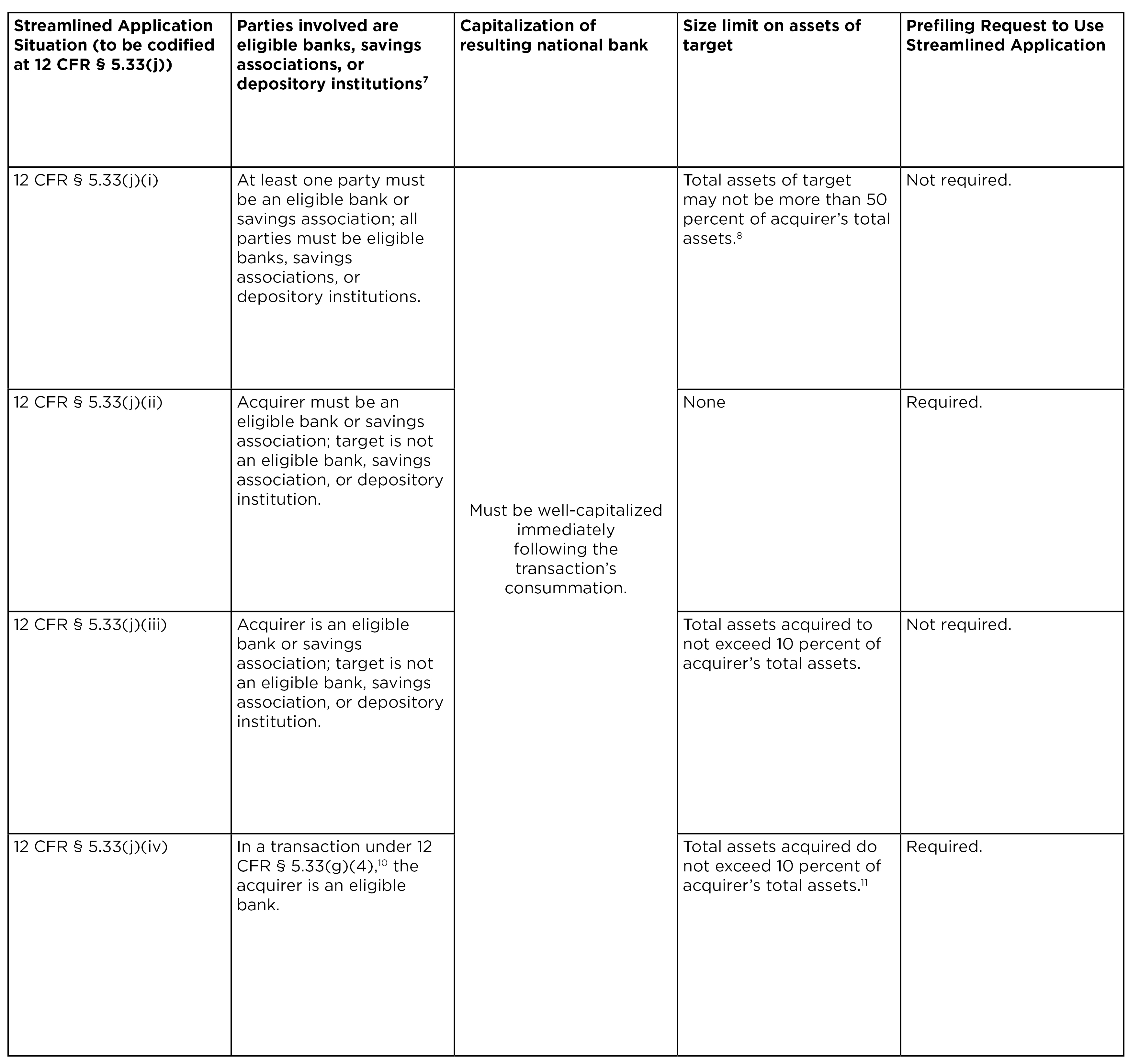

Transactions eligible for streamlined applications are those that meet one of the following categories:

Withdrawal of Policy Statement

The OCC also withdrew a policy statement included in the 2024 Final Rule in order to "provide insured depository institutions and the public with a better understanding of how the OCC considers certain statutory factors" under the Bank Merger Act.12 However, in its May 8 Interim Final Rule, the OCC wrote that the policy statement "generated confusion and generally did not succeed in providing additional clarity to banks or the public."13 Comments on the Interim Final Rule are due 30 days after its publication in the Federal Register, and the OCC will consider issuing a new policy statement after reviewing any comments submitted.

Takeaways

The OCC's rescission of the 2024 Final Rule is another example of the swift repudiation of Biden-era financial regulatory actions across the federal banking agencies that Steptoe has followed closely. The Interim Final Rule may substantially reduce regulatory friction for routine bank mergers and internal reorganizations. Financial institutions should consider the following:

- Renewed Opportunity for Strategic Combinations: Transactions previously deemed too burdensome may now proceed under the expedited framework. Institutions considering intra-holding company mergers or acquisitions of small institutions may benefit immediately.

- Prefiling Communications Remain Key: Institutions should continue engaging in prefiling discussions with the appropriate OCC licensing office to confirm eligibility for streamlined treatment, particularly in less conventional transactions.

- Reduced Public Scrutiny: By rescinding the policy statement, the OCC downplays the previously emphasized role of managerial assessment factors in routine mergers. This may decrease both internal documentation and public opposition risk.

On May 7, the Senate approved a joint resolution under the Congressional Review Act that would disapprove of the 2024 Final Rule. The measure is now pending consideration by the House of Representatives; it is unclear if the House will take up the measure or if Congress will take the view that the OCC's action settles the matter. Under the Congressional Review Act, a rule that is disapproved (by a joint resolution approved by the House and Senate and signed by the President) may not be reissued in "substantially the same form" unless doing so is authorized by a law enacted after the date of the joint resolution disapproving the rule.14 Thus, notwithstanding the OCC's current position, its ability to regulate this area of conduct may be constrained if the House and President Trump also approve the joint resolution.

1 Office of the Comptroller of the Currency, OCC Issues Interim Final Rule on Bank Mergers, News Release 2025-44 (May 8, 2025) https://www.occ.gov/news-issuances/news-releases/2025/nr-occ-2025-44.html.

2 The expedited review procedures and streamlined application rule provisions were located at 12 CFR §§ 5.33(i) and 5.33(j), respectively, and will be restored at those locations by the Interim Final Rule. The 2024 rule removing them was published at 89 Fed. Reg. 78,207 (Sep. 25, 2024).

3 Interim Final Rule at 17-18.

4 Id. at 7.

5An "eligible" institution is one that meets certain criteria (capitalization, CAMELS rating, etc.) described at 12 CFR § 5.3.

6 See Interim Final Rule at 17.

7 "Eligible" as defined at 12 CFR § 5.3.

8 As reported in each institution's Consolidated Report of Condition and Income filed for the quarter immediately prior to the filing of the application.

9 As reported in each institution's Consolidated Report of Condition and Income filed for the quarter immediately prior to the filing of the application.

10 A merger of a national bank with its nonbank affiliates resulting in a national bank. See 12 CFR § 5.33(g)(4).

11 As reported in each institution's Consolidated Report of Condition and Income filed for the quarter immediately prior to the filing of the application.

12 89 CFR 78,218 (Sep. 25, 2024).

13 Interim Final Rule at 9.

14 5 U.S.C. § 801(b)(2).